Explain the value of separating cash flows into operating ac

Explain the value of separating cash flows into operating activities, investing activities, and financing activities to financial statement users in analyzing cash flows and the company\'s financial performance and condition.

Solution

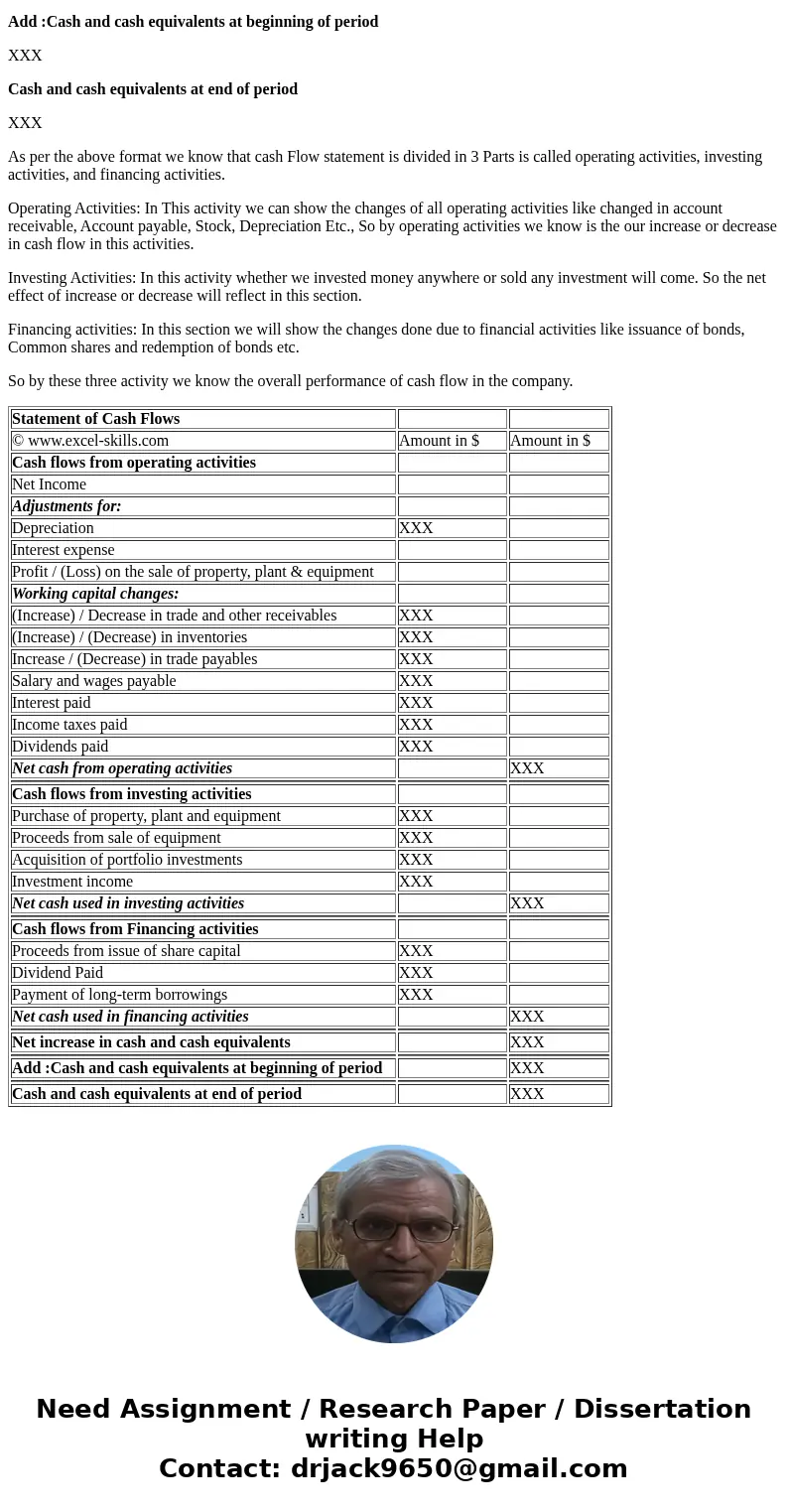

Answer: Format

Statement of Cash Flows

© www.excel-skills.com

Amount in $

Amount in $

Cash flows from operating activities

Net Income

Adjustments for:

Depreciation

XXX

Interest expense

Profit / (Loss) on the sale of property, plant & equipment

Working capital changes:

(Increase) / Decrease in trade and other receivables

XXX

(Increase) / (Decrease) in inventories

XXX

Increase / (Decrease) in trade payables

XXX

Salary and wages payable

XXX

Interest paid

XXX

Income taxes paid

XXX

Dividends paid

XXX

Net cash from operating activities

XXX

Cash flows from investing activities

Purchase of property, plant and equipment

XXX

Proceeds from sale of equipment

XXX

Acquisition of portfolio investments

XXX

Investment income

XXX

Net cash used in investing activities

XXX

Cash flows from Financing activities

Proceeds from issue of share capital

XXX

Dividend Paid

XXX

Payment of long-term borrowings

XXX

Net cash used in financing activities

XXX

Net increase in cash and cash equivalents

XXX

Add :Cash and cash equivalents at beginning of period

XXX

Cash and cash equivalents at end of period

XXX

As per the above format we know that cash Flow statement is divided in 3 Parts is called operating activities, investing activities, and financing activities.

Operating Activities: In This activity we can show the changes of all operating activities like changed in account receivable, Account payable, Stock, Depreciation Etc., So by operating activities we know is the our increase or decrease in cash flow in this activities.

Investing Activities: In this activity whether we invested money anywhere or sold any investment will come. So the net effect of increase or decrease will reflect in this section.

Financing activities: In this section we will show the changes done due to financial activities like issuance of bonds, Common shares and redemption of bonds etc.

So by these three activity we know the overall performance of cash flow in the company.

| Statement of Cash Flows | ||

| © www.excel-skills.com | Amount in $ | Amount in $ |

| Cash flows from operating activities | ||

| Net Income | ||

| Adjustments for: | ||

| Depreciation | XXX | |

| Interest expense | ||

| Profit / (Loss) on the sale of property, plant & equipment | ||

| Working capital changes: | ||

| (Increase) / Decrease in trade and other receivables | XXX | |

| (Increase) / (Decrease) in inventories | XXX | |

| Increase / (Decrease) in trade payables | XXX | |

| Salary and wages payable | XXX | |

| Interest paid | XXX | |

| Income taxes paid | XXX | |

| Dividends paid | XXX | |

| Net cash from operating activities | XXX | |

| Cash flows from investing activities | ||

| Purchase of property, plant and equipment | XXX | |

| Proceeds from sale of equipment | XXX | |

| Acquisition of portfolio investments | XXX | |

| Investment income | XXX | |

| Net cash used in investing activities | XXX | |

| Cash flows from Financing activities | ||

| Proceeds from issue of share capital | XXX | |

| Dividend Paid | XXX | |

| Payment of long-term borrowings | XXX | |

| Net cash used in financing activities | XXX | |

| Net increase in cash and cash equivalents | XXX | |

| Add :Cash and cash equivalents at beginning of period | XXX | |

| Cash and cash equivalents at end of period | XXX |

Homework Sourse

Homework Sourse