Problem 223A Tanek Corps sales slumped badly in 2017 For the

Solution

Answer

Working

Units

Amount

Per unit

A

Sales

585500

2927500

5

(less) Variable Costs

B

Cost of Goods Sold

585500

1861890

3.18

C

Selling Expenses

585500

107732

0.184

D

Administrative expenses

585500

79628

0.136

E=B+C+D

Total Var Cost

585500

2049250

3.5

F=A-E

Contribution Margin

585500

878250

1.5

(less) Fixed expenses

G

Cost of Goods Sold

644050

H

Selling Expenses

185018

I

Administrative expenses

166282

J=G+H+I

Total Fixed expenses

995350

K=F-J

Net Income(Loss)

(117100)

A

Total Fixed expenses (from above)

995350.00

B

Contribution Margin per unit (from above)

1.50

C=A/B

Break Even point in units

663566.67

D

Sale Price per unit (from above)

5.00

E=C x D

Break Even point in dollars

$ 3317833

Working

Units (A)

Amount (A x B)

Per unit (B)

A

Sales at new Sales price

585500

3542275

6.05 [5 + (5 x 21%)]

(less) Variable Costs

B

Cost of Goods Sold

585500

1861890

3.18

C

Selling Expenses

585500

107732

0.184

D

Administrative expenses

585500

79628

0.136

E=B+C+D

Total Var Cost

585500

2049250

3.5

F=A-E

Contribution Margin

585500

1493025

2.55

(less) Fixed expenses

G

Cost of Goods Sold

644050

H

Selling Expenses

185018

I

Administrative expenses

166282

J=G+H+I

Total Fixed expenses

995350

K=F-J

Net Income(Loss)

497675

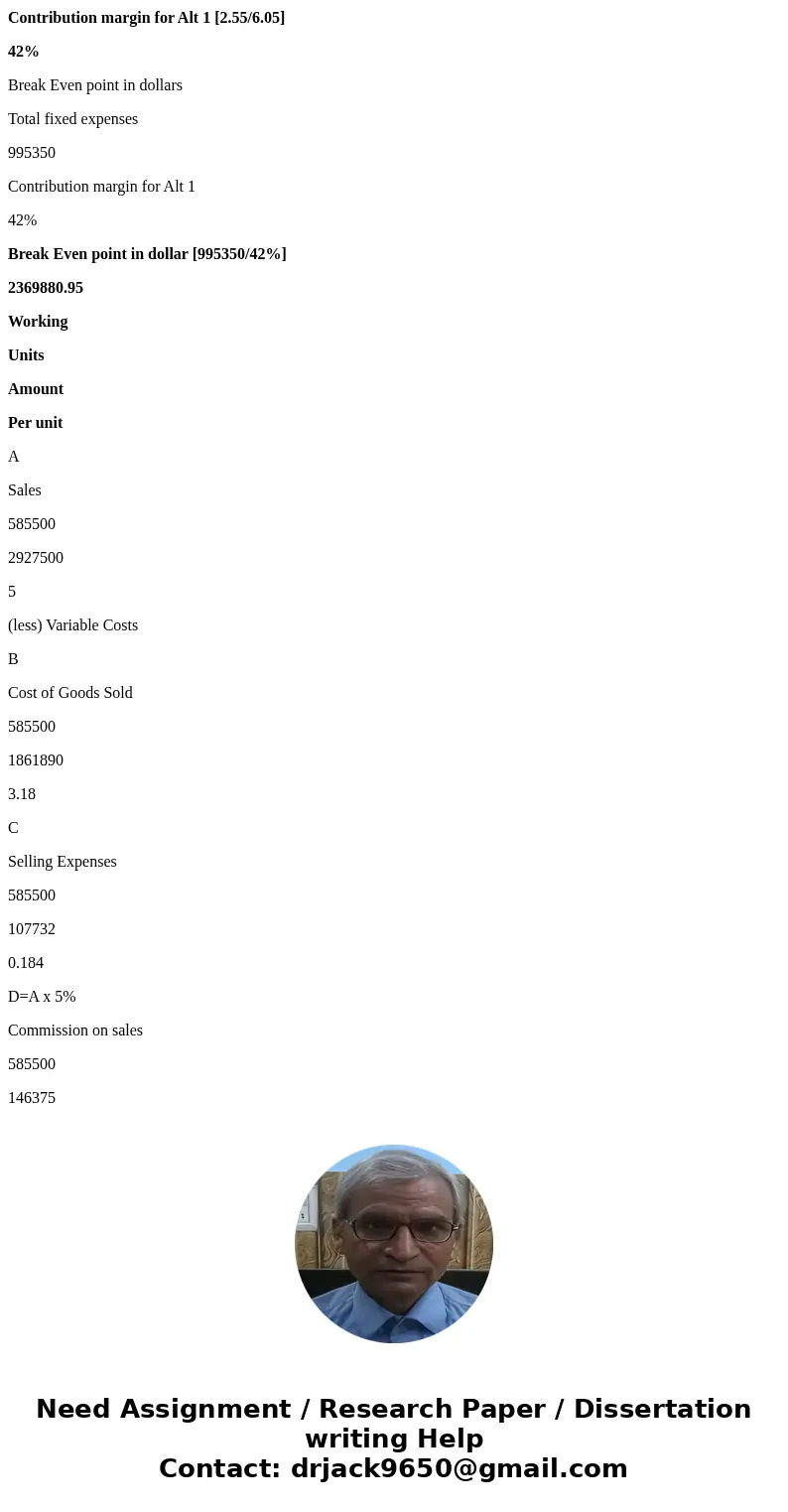

Contribution margin for alternative 1

Contribution per unit

2.55

Sale Price

6.05

Contribution margin for Alt 1 [2.55/6.05]

42%

Break Even point in dollars

Total fixed expenses

995350

Contribution margin for Alt 1

42%

Break Even point in dollar [995350/42%]

2369880.95

Working

Units

Amount

Per unit

A

Sales

585500

2927500

5

(less) Variable Costs

B

Cost of Goods Sold

585500

1861890

3.18

C

Selling Expenses

585500

107732

0.184

D=A x 5%

Commission on sales

585500

146375

0.25

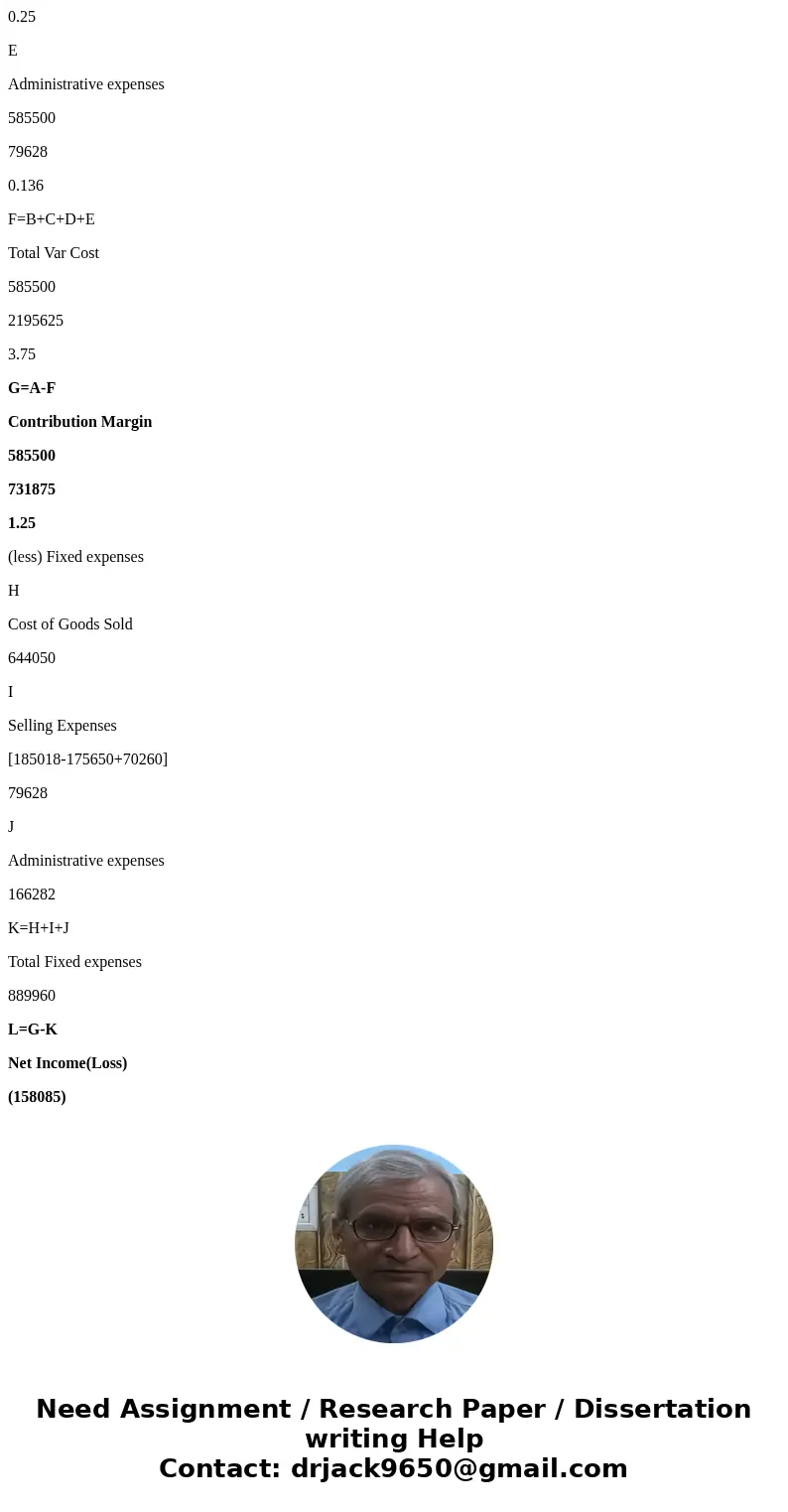

E

Administrative expenses

585500

79628

0.136

F=B+C+D+E

Total Var Cost

585500

2195625

3.75

G=A-F

Contribution Margin

585500

731875

1.25

(less) Fixed expenses

H

Cost of Goods Sold

644050

I

Selling Expenses

[185018-175650+70260]

79628

J

Administrative expenses

166282

K=H+I+J

Total Fixed expenses

889960

L=G-K

Net Income(Loss)

(158085)

Contribution margin for alternative 2

Contribution per unit

1.25

Sale Price

5

Contribution margin for Alt 2 [1.25/5]

25%

Break Even point in dollars

Total fixed expenses

889960

Contribution margin for Alt 1

25%

Break Even point in dollar [889960/25%]

3559840.00

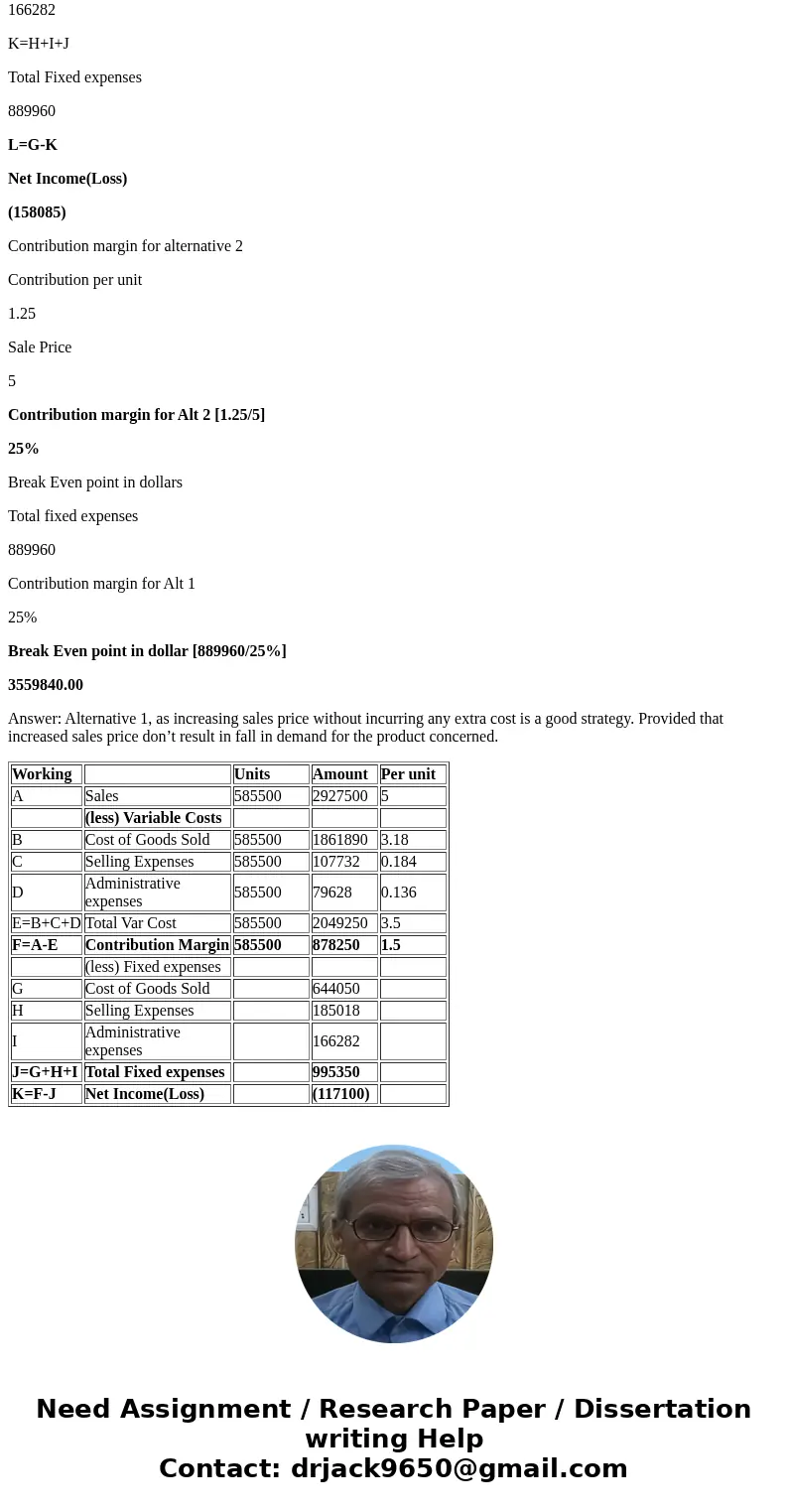

Answer: Alternative 1, as increasing sales price without incurring any extra cost is a good strategy. Provided that increased sales price don’t result in fall in demand for the product concerned.

| Working | Units | Amount | Per unit | |

| A | Sales | 585500 | 2927500 | 5 |

| (less) Variable Costs | ||||

| B | Cost of Goods Sold | 585500 | 1861890 | 3.18 |

| C | Selling Expenses | 585500 | 107732 | 0.184 |

| D | Administrative expenses | 585500 | 79628 | 0.136 |

| E=B+C+D | Total Var Cost | 585500 | 2049250 | 3.5 |

| F=A-E | Contribution Margin | 585500 | 878250 | 1.5 |

| (less) Fixed expenses | ||||

| G | Cost of Goods Sold | 644050 | ||

| H | Selling Expenses | 185018 | ||

| I | Administrative expenses | 166282 | ||

| J=G+H+I | Total Fixed expenses | 995350 | ||

| K=F-J | Net Income(Loss) | (117100) |

Homework Sourse

Homework Sourse