The IRS was interested in the number of individual tax forms

The IRS was interested in the number of individual tax forms prepared by small accounting firms. The IRS randomly sampled 52 public accounting firms with 10 or fewer employees in the Dallas-Fort Worth area. The following frequency table reports the results of the study.

Number of Clients

Frequency

20 up to 25

4

25 up to 30

15

30 up to 35

21

35 up to 40

8

40 up to 45

4

| The IRS was interested in the number of individual tax forms prepared by small accounting firms. The IRS randomly sampled 52 public accounting firms with 10 or fewer employees in the Dallas-Fort Worth area. The following frequency table reports the results of the study. |

Solution

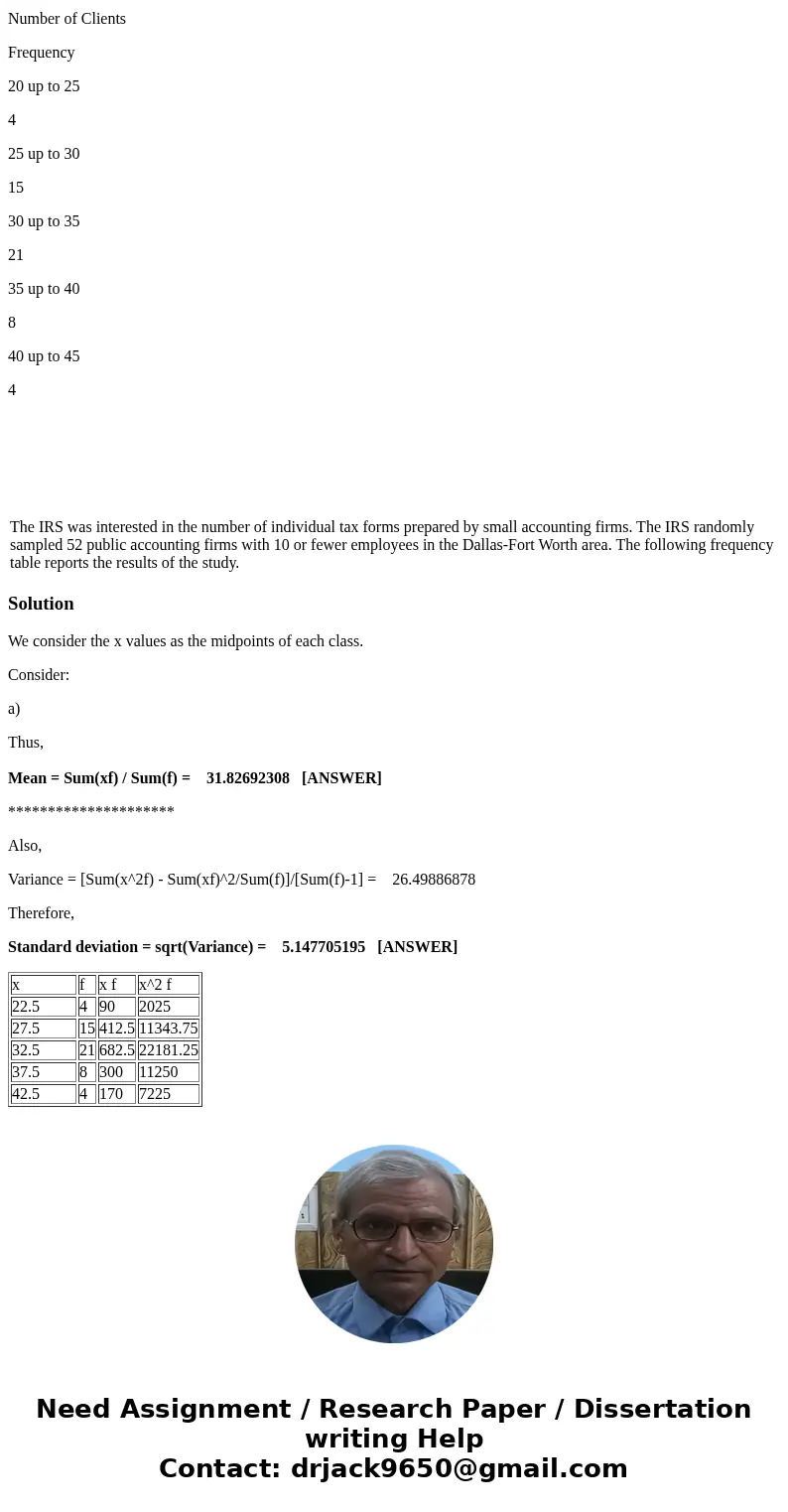

We consider the x values as the midpoints of each class.

Consider:

a)

Thus,

Mean = Sum(xf) / Sum(f) = 31.82692308 [ANSWER]

*********************

Also,

Variance = [Sum(x^2f) - Sum(xf)^2/Sum(f)]/[Sum(f)-1] = 26.49886878

Therefore,

Standard deviation = sqrt(Variance) = 5.147705195 [ANSWER]

| x | f | x f | x^2 f |

| 22.5 | 4 | 90 | 2025 |

| 27.5 | 15 | 412.5 | 11343.75 |

| 32.5 | 21 | 682.5 | 22181.25 |

| 37.5 | 8 | 300 | 11250 |

| 42.5 | 4 | 170 | 7225 |

Homework Sourse

Homework Sourse