During 2017 Grant Industries Inc was in the process of const

During 2017, Grant Industries, Inc. was in the process of constructing a new manufacturing facility. The project began on January 1,2017 and ended on December 31,2017. There were two expenditures as follow: January 1, 2017 for $2,500,000 April 30, 2017 for $1,500,000 The company had the following debt outstanding during the entire construction project: (a) 8 percent, five-year note to finance construction of the manufacturing facility, dated (b) 12 percent, 20-year bonds issued at par on January 1,2010, $8,000,000. (c) 8 percent, six-year note payable, dated March 1, 2015, S2,000,000. Instructions: Determine the amount of interest to be capitalized by Grant Industries for 2017. Show your work by fo January 1, 2017, S3,600,000. (construction-specific loan)

Solution

Calculation of Weighted average rate of interest

Note - Calculation of wieghted average amount of accumulated expenditure

$2500000

($2500000*12/12)

$100000

($1500000*8/12)

1. SPECIFIC BORROWING RATE

Specific borrowing = Note Payable @8% interest yearly

Hence weighted average rate will be 8% since it the only specific loan for the project

2. GENERAL BORROWING RATE

Weighted average Rate

(Total general interest/Total loan)*100

$1120000

($960000 + $160000)

Weighted average accumulated expenditure = $3500000

($3500000 * 8%)

$280000

Calculation of Actual Interest

Analysis

Since potential/avoidable Interest is less than actual Interest

Hence avoidable Interest (to be capitalised) = $280000

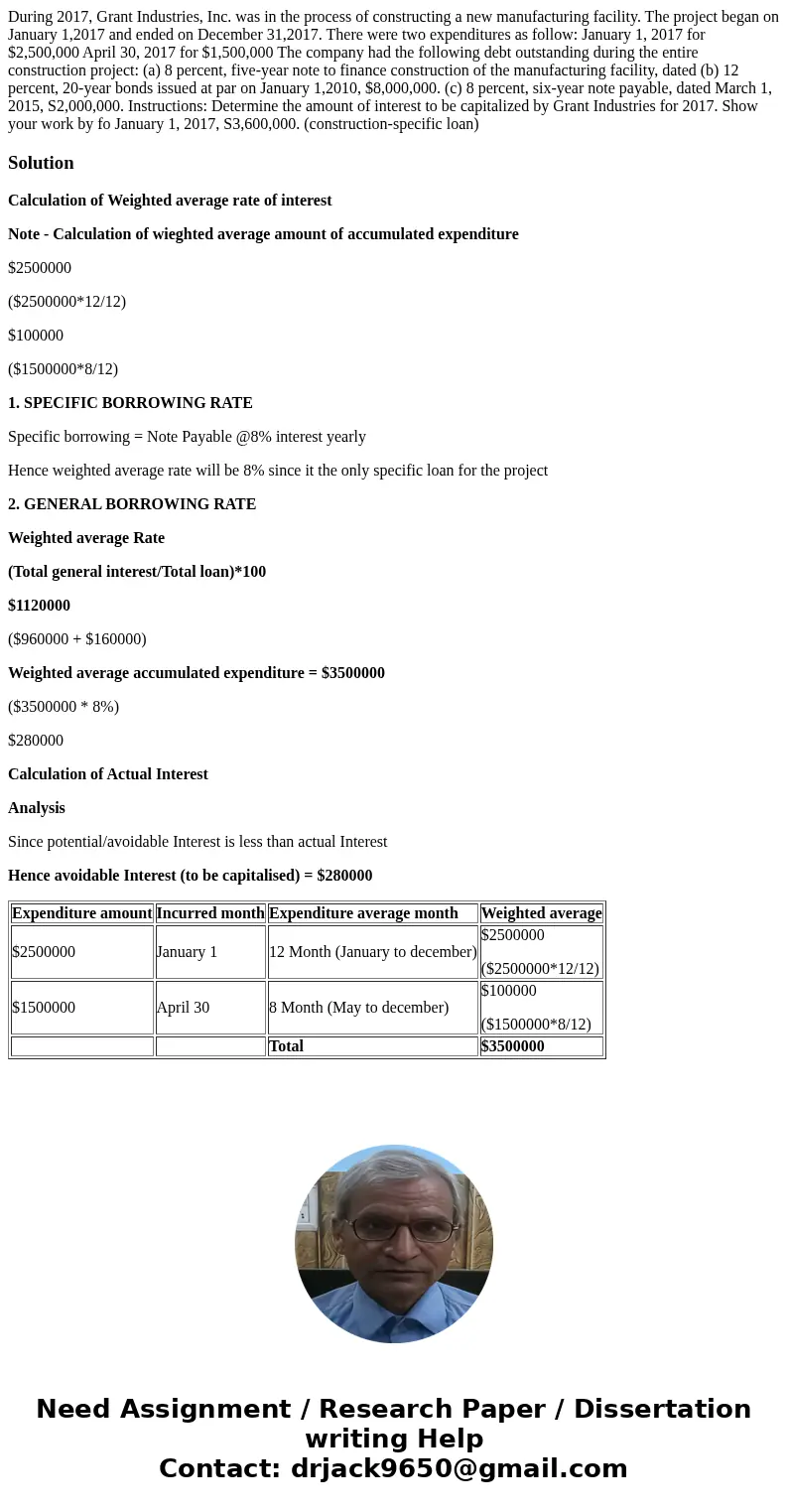

| Expenditure amount | Incurred month | Expenditure average month | Weighted average |

| $2500000 | January 1 | 12 Month (January to december) | $2500000 ($2500000*12/12) |

| $1500000 | April 30 | 8 Month (May to december) | $100000 ($1500000*8/12) |

| Total | $3500000 |

Homework Sourse

Homework Sourse