A certain companys cash flows are expected to grow at a rate

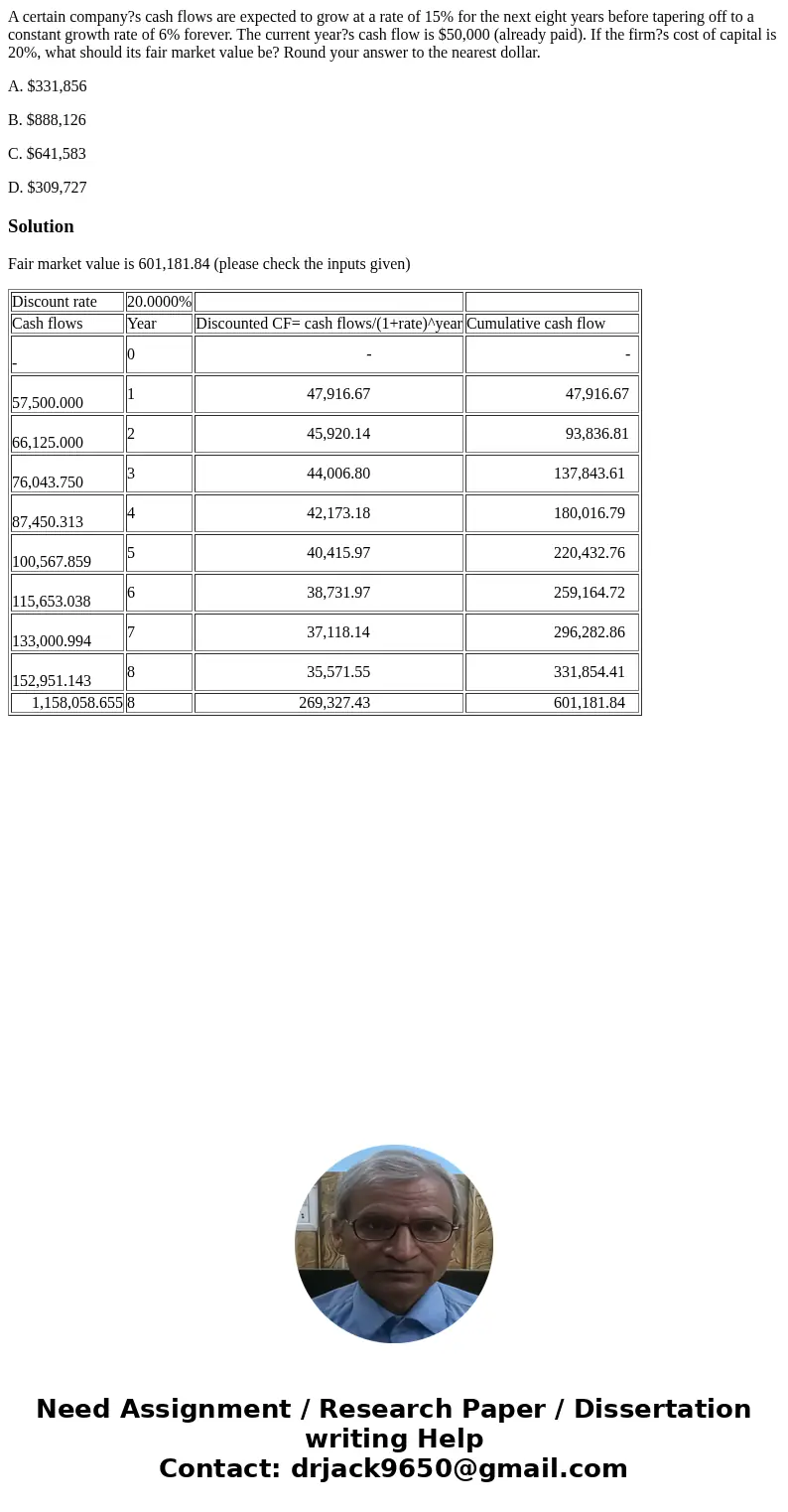

A certain company?s cash flows are expected to grow at a rate of 15% for the next eight years before tapering off to a constant growth rate of 6% forever. The current year?s cash flow is $50,000 (already paid). If the firm?s cost of capital is 20%, what should its fair market value be? Round your answer to the nearest dollar.

A. $331,856

B. $888,126

C. $641,583

D. $309,727

Solution

Fair market value is 601,181.84 (please check the inputs given)

| Discount rate | 20.0000% | ||

| Cash flows | Year | Discounted CF= cash flows/(1+rate)^year | Cumulative cash flow |

| - | 0 | - | - |

| 57,500.000 | 1 | 47,916.67 | 47,916.67 |

| 66,125.000 | 2 | 45,920.14 | 93,836.81 |

| 76,043.750 | 3 | 44,006.80 | 137,843.61 |

| 87,450.313 | 4 | 42,173.18 | 180,016.79 |

| 100,567.859 | 5 | 40,415.97 | 220,432.76 |

| 115,653.038 | 6 | 38,731.97 | 259,164.72 |

| 133,000.994 | 7 | 37,118.14 | 296,282.86 |

| 152,951.143 | 8 | 35,571.55 | 331,854.41 |

| 1,158,058.655 | 8 | 269,327.43 | 601,181.84 |

Homework Sourse

Homework Sourse