chapter 10 1. Prepare·depreciation schedule for each depreciation meth nd, showing asset ow, 2. Speedy prepares financial statements using the depreciation method that reports depreciation expense, accumulated depreciation, and asset book value. the highest net income in the early years of asset use. Consider the first year that Speedy uses the truck. Identify the depreclation method that meets the company objectives Learning Objectives 1, 2. 3 P10-38B Recording lump-sum asset parchases, depreciation, and disposals Whiney Plumb Associates surveys American eating habies The company\'s accounts inclade Land, Buildings Office Equipament, and Communication Equipment, with a separate Accumulated Depreciation account for each asset During 2018, Whieney Plumb completed the following transactions Sep. 1 Gain $163,250 Jan. 1 Purchased office equipment, $117,000. Paid $77,000 cash and financed the remainder with a note payable Acquired land and communikation equipment in a lump-sum purchase. Total cost was $350,000 paid in cash. An independent Apr. 1 appraisal vailued the land at $275,625 and the communication equipment at $91,875 Sep. 1 Sold a building that cost $520,000 (accumulated depreciation of $285,000 through December 31 of the preceding year). Whitney Plumb received $390,000 cash from the sale of the building. Depreciation is computed on ·straight-line basis. The building has a 40-year useful life and a residual value of $25,000. Recorded depreciation as follows Communication equipment is depreciated by the straight-line method over a five-year life with zero residual value. Office equipment is depreciated using the double-declining-balance method over five years with a $2.000 residual value Dec. 31 Record the transactions in the journal of Whitney Plumb Associates Learning Objective 4 P10-39B Accounting for natural resources Donahue Oil Company has an account tided Oial and Gas Properties. Donahue paid $6,400,000 for oil reserves holding an estimated 400,000 barrels of oil. Assume the company paid $510,000 for additional geological tests of the property and $470,000 o prepare for drilling During the first year, Donahue removed and sold 75,000 barrels of oil Record all of Donabue\'s transactions, including depletion for the first year. Depl. Exp $1,383,750 Learning Objective 5 P10-40B Accounting for intangibles Core Telecom provides communication services in Town, Nebraska, the Dakotas, and Montana. Core purchased goodwill as part of the acquisition of Surety Wireless Com- pany, which had the following figures: . Goodwill $210,000 Book value of assets Market value of assets Market value of liabilities 700,000 1,000,000 510,000

2.

Sr. No.

Particulars

Debit

Credit

1.

Oil and Gas Properties

$6400000

To Cash & Bank a/c

$6400000

(Being oil reserves asset purchased)

2

Oil and Gas properties

$980000

To Cash & Bank a/c

$980000

(To cost of testing & drilling capitalized)($510000+$470000)

3.

Depletion of oil & Gas properties

$2434250

To accumulated Depletion of Oil & gas Properties

$2434250

(being depletion exp. of asset recorded)

Working notes:

1. The expense incurred to make the asset put to use is capitalize in the cost of the asset. So testing exp. & preparation for drilling exp. are added to the cost of Oil & Gas Properties

2. Depletion exp. = Cost of Oil & Gas properties/Total Estimated Barrels of oils to be extracted * Barrels actually extracted during the year

= 7380000/200000 Barrels * 75000

= $2,767,500

3. question not given fully.

let me know in comments also please do not provide negative feedback.. please do comment brfore negative feedback i will provide you more information.

Thanks

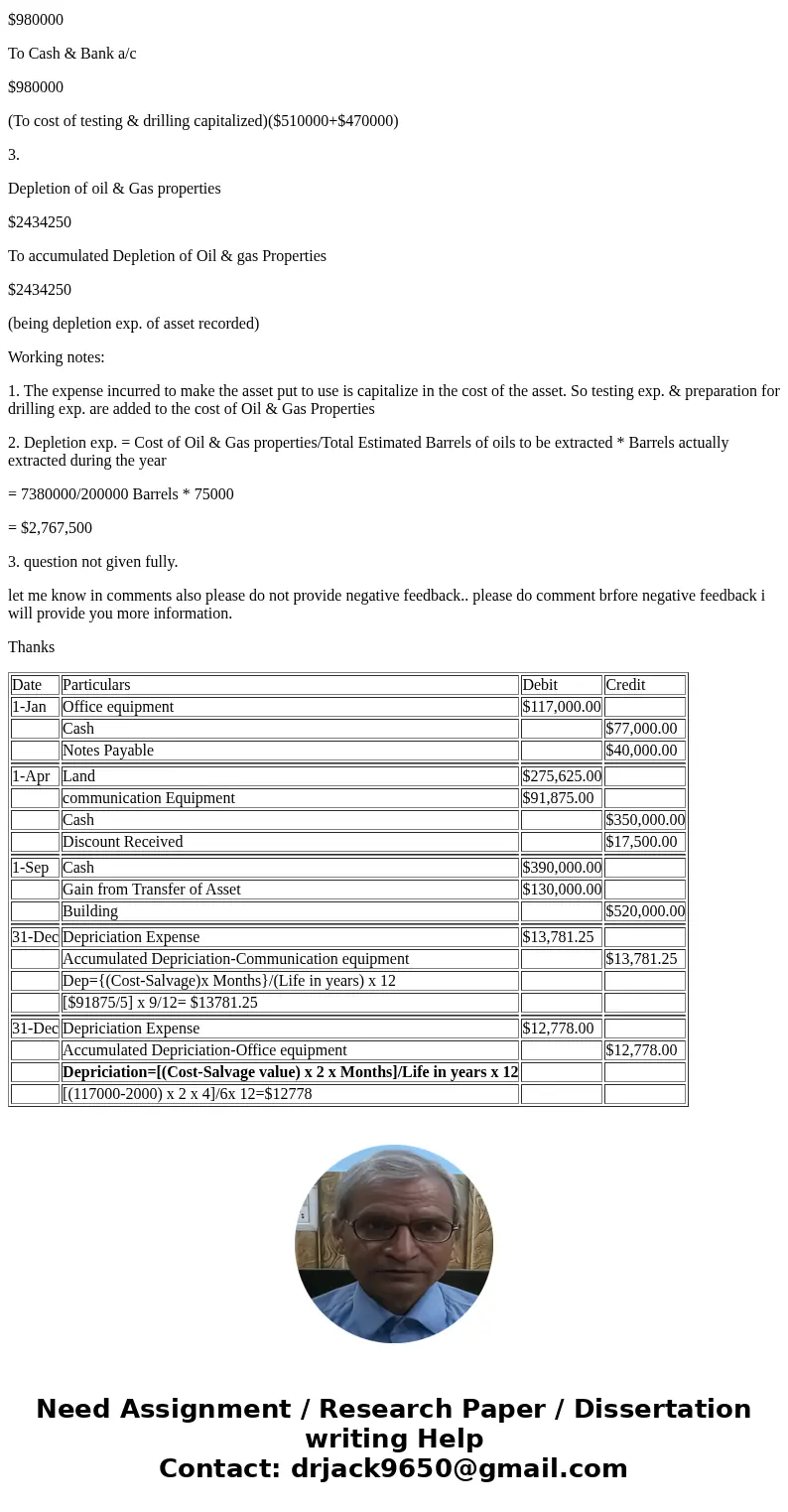

| Date | Particulars | Debit | Credit |

| 1-Jan | Office equipment | $117,000.00 | |

| Cash | | $77,000.00 |

| Notes Payable | | $40,000.00 |

| | | |

| 1-Apr | Land | $275,625.00 | |

| communication Equipment | $91,875.00 | |

| Cash | | $350,000.00 |

| Discount Received | | $17,500.00 |

| | | |

| 1-Sep | Cash | $390,000.00 | |

| Gain from Transfer of Asset | $130,000.00 | |

| Building | | $520,000.00 |

| | | |

| 31-Dec | Depriciation Expense | $13,781.25 | |

| Accumulated Depriciation-Communication equipment | | $13,781.25 |

| Dep={(Cost-Salvage)x Months}/(Life in years) x 12 | | |

| [$91875/5] x 9/12= $13781.25 | | |

| | | |

| 31-Dec | Depriciation Expense | $12,778.00 | |

| Accumulated Depriciation-Office equipment | | $12,778.00 |

| Depriciation=[(Cost-Salvage value) x 2 x Months]/Life in years x 12 | | |

| [(117000-2000) x 2 x 4]/6x 12=$12778 | | |

Homework Sourse

Homework Sourse