27 ter 6 7 6 Hall macOS High Sierra A company uses t

???? ?? ?? ?? 27% ?? ter 6 &7) 6 Hall macOS High Sierra ???? ?? ???? A company uses the percent of sales method to determine its bad debts expense. At the end of the current year, the company\'s unadjusted trial balance reported the following selected amounts: Accounts receivable Allowance for uncollectible accounts Net Sales $375,000 debit 500 debit 800,000 eredit All sales are made on credit. Based on past experience, the company estimates 06% of net credit sales to be unco entry should the company make at the end of the current year to record its estimated bad debts expense? llectible, what adjusting Multiple Choice Debit Bad Debts Expense $4,800: credit Allowance for Doubtful Accounts $4,800 Debit Bad Debts Expense $4.300; credit Allowance for Doubtful Accounts $4,300. Debit Bed Debts Expense $5,300; credit Allowance for Doubtful Accounts $5.300

Solution

Estimated bad debts= Net sales * Percentage of net sales which are uncollectible

Estimated bad debts= $800000* .6%

Estimated bad debts=$4800

Hence the adjustment entry will be:

Date

Particulars

Debit

credit

Bad debts expense

$4800

Allowance for doubtful accounts

$4800

Hence, the correct option is first option.

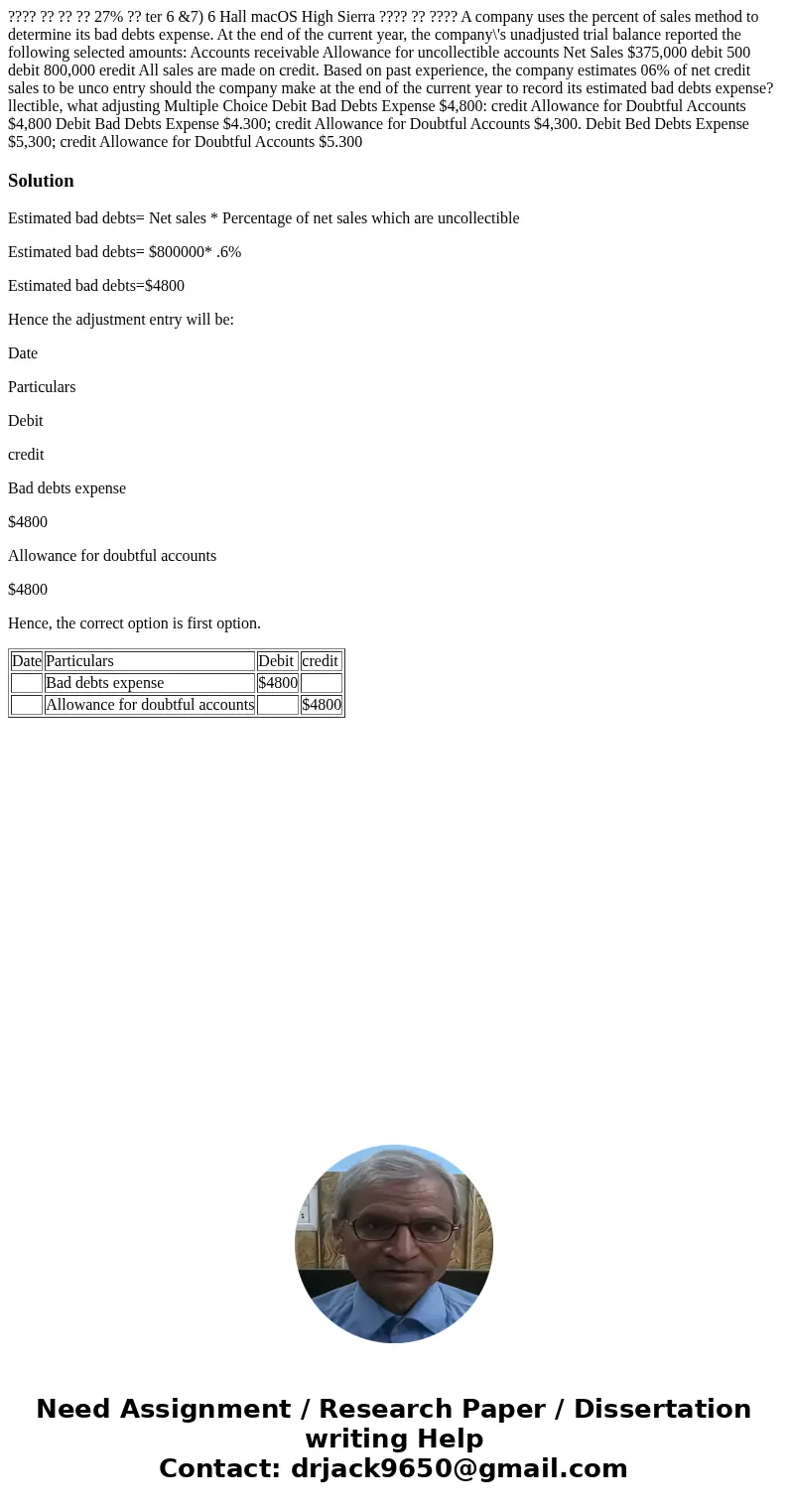

| Date | Particulars | Debit | credit |

| Bad debts expense | $4800 | ||

| Allowance for doubtful accounts | $4800 |

Homework Sourse

Homework Sourse