Suppose you observe the following effective annual zerocoupo

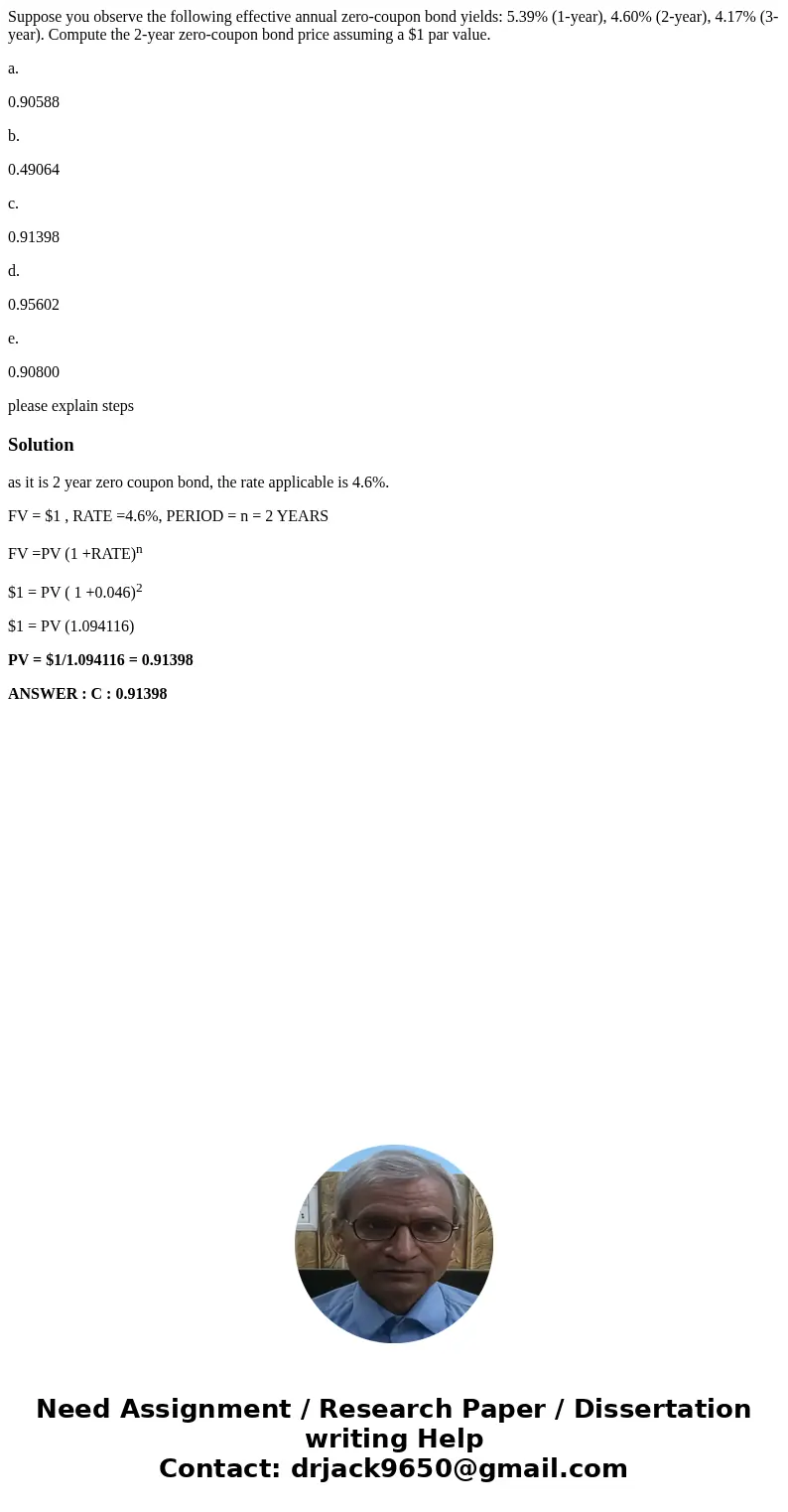

Suppose you observe the following effective annual zero-coupon bond yields: 5.39% (1-year), 4.60% (2-year), 4.17% (3-year). Compute the 2-year zero-coupon bond price assuming a $1 par value.

a.

0.90588

b.

0.49064

c.

0.91398

d.

0.95602

e.

0.90800

please explain steps

Solution

as it is 2 year zero coupon bond, the rate applicable is 4.6%.

FV = $1 , RATE =4.6%, PERIOD = n = 2 YEARS

FV =PV (1 +RATE)n

$1 = PV ( 1 +0.046)2

$1 = PV (1.094116)

PV = $1/1.094116 = 0.91398

ANSWER : C : 0.91398

Homework Sourse

Homework Sourse