2 On Jan 1 2015 equipment was acquired at a cost of 105000 h

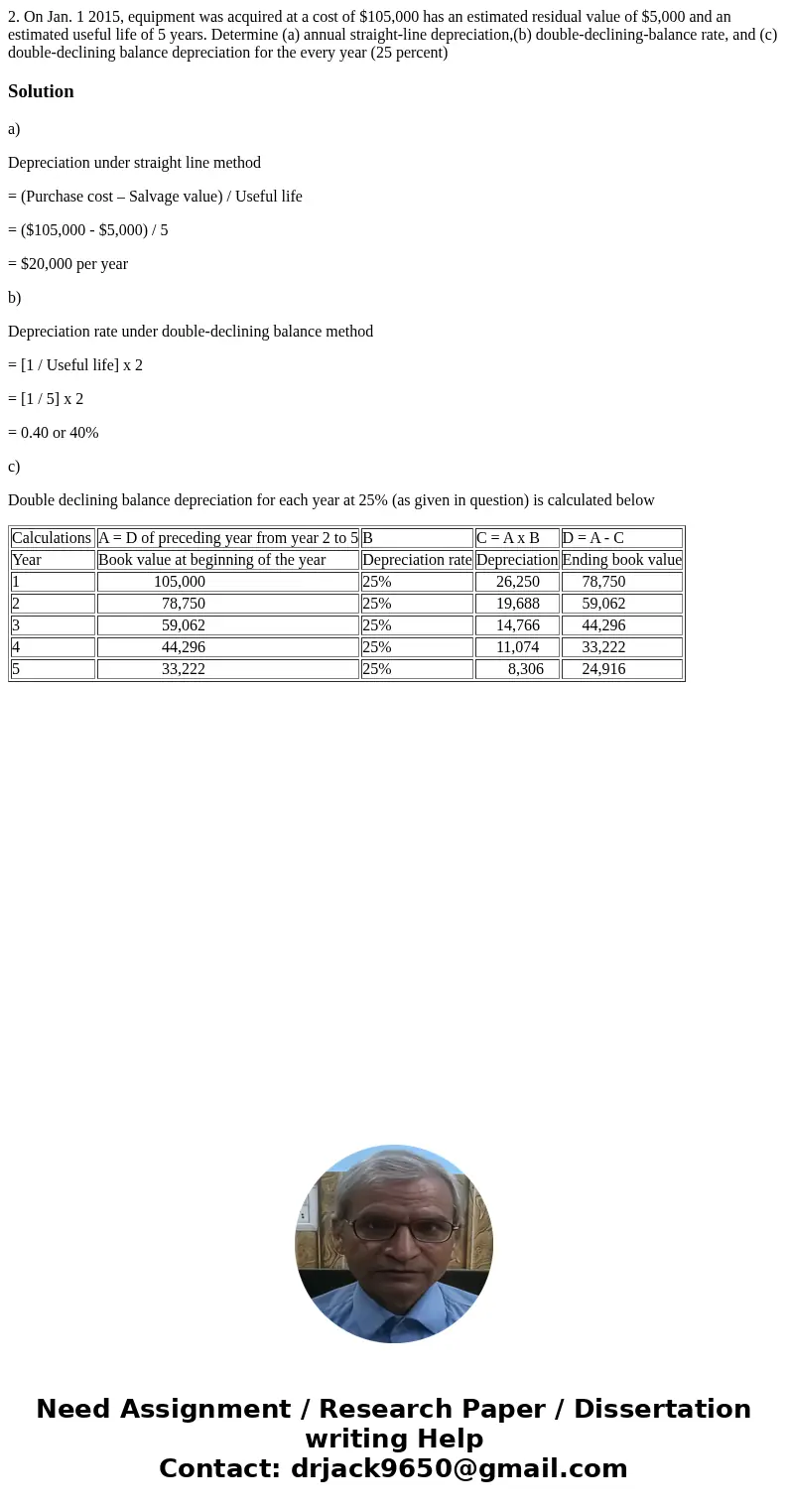

2. On Jan. 1 2015, equipment was acquired at a cost of $105,000 has an estimated residual value of $5,000 and an estimated useful life of 5 years. Determine (a) annual straight-line depreciation,(b) double-declining-balance rate, and (c) double-declining balance depreciation for the every year (25 percent)

Solution

a)

Depreciation under straight line method

= (Purchase cost – Salvage value) / Useful life

= ($105,000 - $5,000) / 5

= $20,000 per year

b)

Depreciation rate under double-declining balance method

= [1 / Useful life] x 2

= [1 / 5] x 2

= 0.40 or 40%

c)

Double declining balance depreciation for each year at 25% (as given in question) is calculated below

| Calculations | A = D of preceding year from year 2 to 5 | B | C = A x B | D = A - C |

| Year | Book value at beginning of the year | Depreciation rate | Depreciation | Ending book value |

| 1 | 105,000 | 25% | 26,250 | 78,750 |

| 2 | 78,750 | 25% | 19,688 | 59,062 |

| 3 | 59,062 | 25% | 14,766 | 44,296 |

| 4 | 44,296 | 25% | 11,074 | 33,222 |

| 5 | 33,222 | 25% | 8,306 | 24,916 |

Homework Sourse

Homework Sourse