core 0 of 1 pt 6 of 11 8 complete HW Score 4924 542 of 11 pt

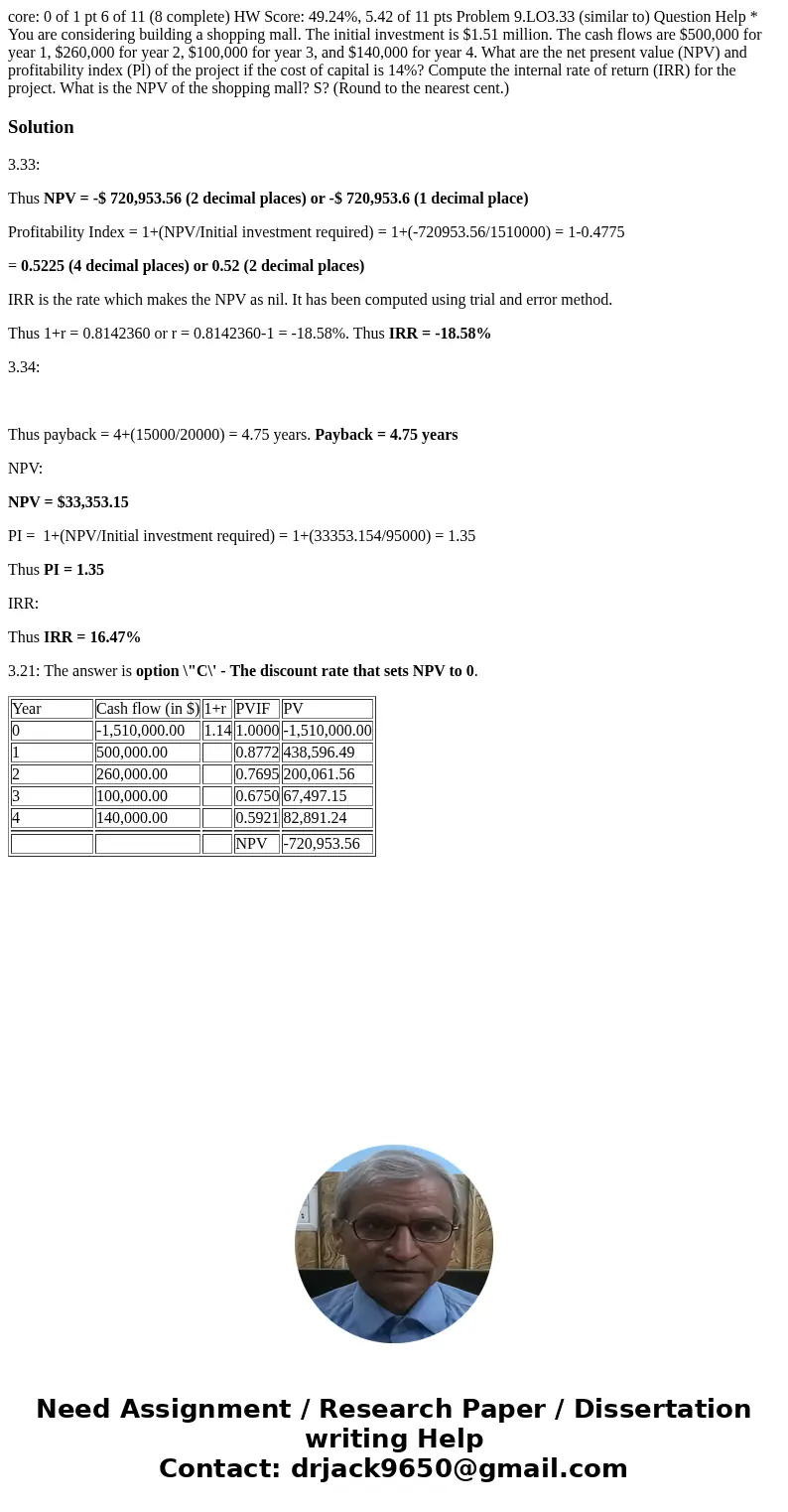

core: 0 of 1 pt 6 of 11 (8 complete) HW Score: 49.24%, 5.42 of 11 pts Problem 9.LO3.33 (similar to) Question Help * You are considering building a shopping mall. The initial investment is $1.51 million. The cash flows are $500,000 for year 1, $260,000 for year 2, $100,000 for year 3, and $140,000 for year 4. What are the net present value (NPV) and profitability index (Pl) of the project if the cost of capital is 14%? Compute the internal rate of return (IRR) for the project. What is the NPV of the shopping mall? S? (Round to the nearest cent.)

Solution

3.33:

Thus NPV = -$ 720,953.56 (2 decimal places) or -$ 720,953.6 (1 decimal place)

Profitability Index = 1+(NPV/Initial investment required) = 1+(-720953.56/1510000) = 1-0.4775

= 0.5225 (4 decimal places) or 0.52 (2 decimal places)

IRR is the rate which makes the NPV as nil. It has been computed using trial and error method.

Thus 1+r = 0.8142360 or r = 0.8142360-1 = -18.58%. Thus IRR = -18.58%

3.34:

Thus payback = 4+(15000/20000) = 4.75 years. Payback = 4.75 years

NPV:

NPV = $33,353.15

PI = 1+(NPV/Initial investment required) = 1+(33353.154/95000) = 1.35

Thus PI = 1.35

IRR:

Thus IRR = 16.47%

3.21: The answer is option \"C\' - The discount rate that sets NPV to 0.

| Year | Cash flow (in $) | 1+r | PVIF | PV |

| 0 | -1,510,000.00 | 1.14 | 1.0000 | -1,510,000.00 |

| 1 | 500,000.00 | 0.8772 | 438,596.49 | |

| 2 | 260,000.00 | 0.7695 | 200,061.56 | |

| 3 | 100,000.00 | 0.6750 | 67,497.15 | |

| 4 | 140,000.00 | 0.5921 | 82,891.24 | |

| NPV | -720,953.56 |

Homework Sourse

Homework Sourse