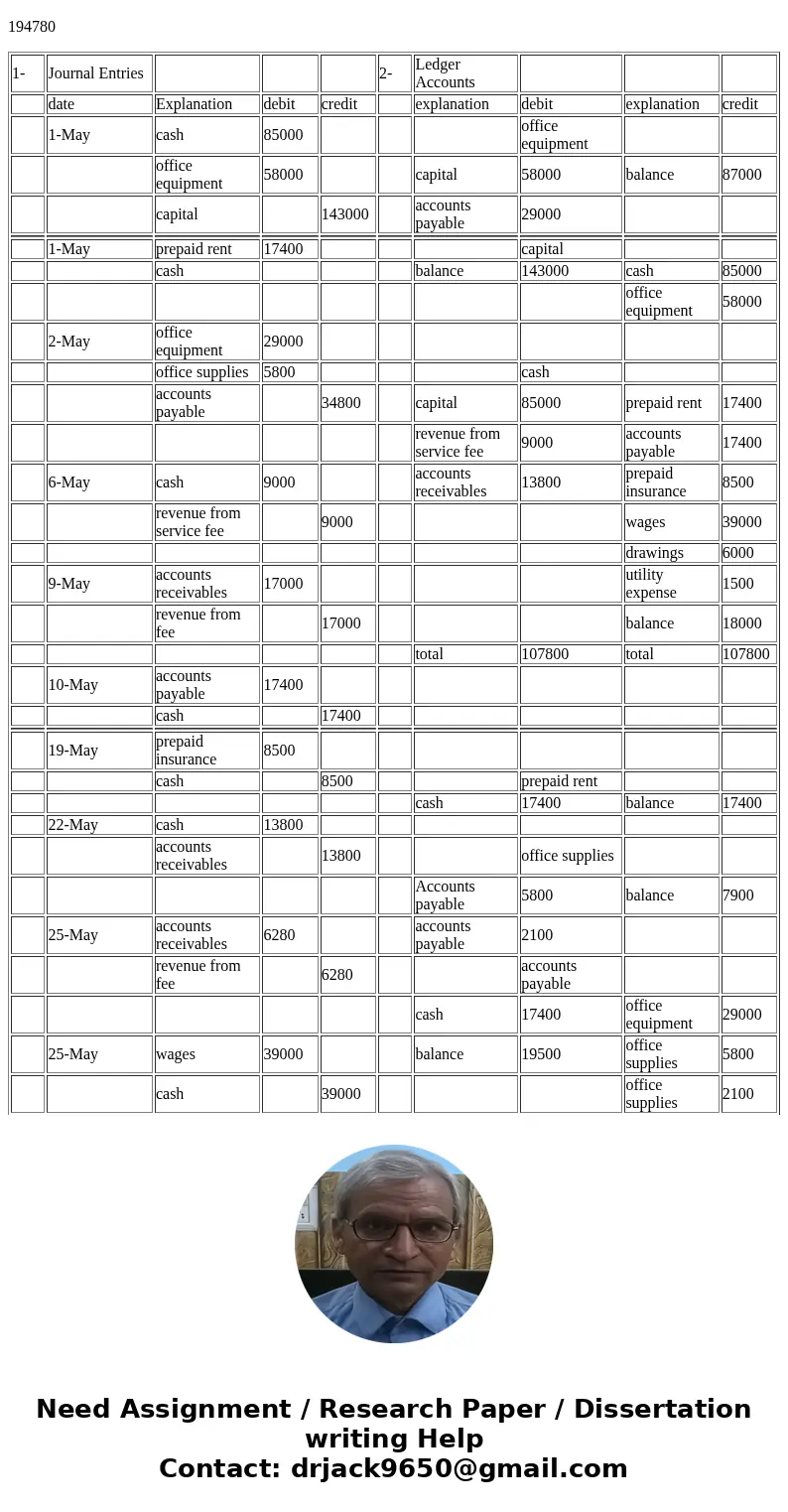

Jill Wahpoosywan invested 85000 in cash and office equipment

Jill Wahpoosywan invested $85,000 in cash and office equipment that had a fair value of $58,000 in the business.

Prepare General Journal entries to record the transactions. (If no entry is required for a transaction/event, select \"No journal entry required\" in the first account field).

| May | 1 | Jill Wahpoosywan invested $85,000 in cash and office equipment that had a fair value of $58,000 in the business. |

| 1 | Prepaid $17,400 cash for three months’ rent for an office. | |

| 2 | Made credit purchases of office equipment for $29,000 and office supplies for $5,800. | |

| 6 | Completed services for a client and immediately received $9,000 cash. | |

| 9 | Completed a $17,000 project for the Chicago Blackhawks who will pay within 30 days. | |

| 10 | Paid half of the account payable created on May 2. | |

| 19 | Paid $8,500 cash for the annual premium on an insurance policy. | |

| 22 | Received $13,800 as partial payment for the work completed on May 9. | |

| 25 | Completed work for the Washington Redskins for $6,280 on credit. | |

| 25 | Paid wages for May totalling $39,000. | |

| 31 | Wahpoosywan withdrew $6,000 cash from the business for personal use. | |

| 31 | Purchased $2,100 of additional office supplies on credit. | |

| 31 | Paid $1,500 for the month’s utility bill. |

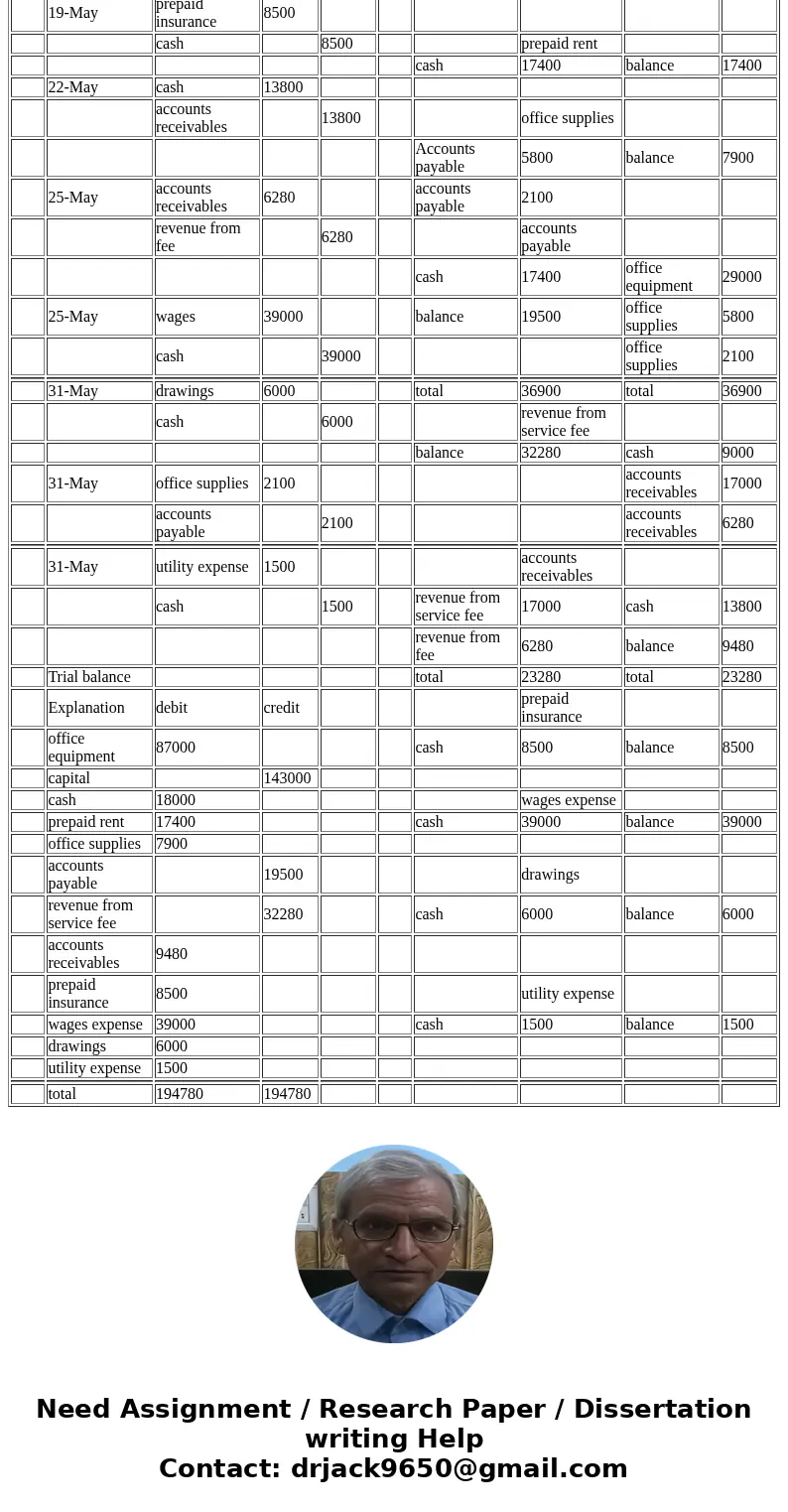

Solution

1-

Journal Entries

2-

Ledger Accounts

date

Explanation

debit

credit

explanation

debit

explanation

credit

1-May

cash

85000

office equipment

office equipment

58000

capital

58000

balance

87000

capital

143000

accounts payable

29000

1-May

prepaid rent

17400

capital

cash

balance

143000

cash

85000

office equipment

58000

2-May

office equipment

29000

office supplies

5800

cash

accounts payable

34800

capital

85000

prepaid rent

17400

revenue from service fee

9000

accounts payable

17400

6-May

cash

9000

accounts receivables

13800

prepaid insurance

8500

revenue from service fee

9000

wages

39000

drawings

6000

9-May

accounts receivables

17000

utility expense

1500

revenue from fee

17000

balance

18000

total

107800

total

107800

10-May

accounts payable

17400

cash

17400

19-May

prepaid insurance

8500

cash

8500

prepaid rent

cash

17400

balance

17400

22-May

cash

13800

accounts receivables

13800

office supplies

Accounts payable

5800

balance

7900

25-May

accounts receivables

6280

accounts payable

2100

revenue from fee

6280

accounts payable

cash

17400

office equipment

29000

25-May

wages

39000

balance

19500

office supplies

5800

cash

39000

office supplies

2100

31-May

drawings

6000

total

36900

total

36900

cash

6000

revenue from service fee

balance

32280

cash

9000

31-May

office supplies

2100

accounts receivables

17000

accounts payable

2100

accounts receivables

6280

31-May

utility expense

1500

accounts receivables

cash

1500

revenue from service fee

17000

cash

13800

revenue from fee

6280

balance

9480

Trial balance

total

23280

total

23280

Explanation

debit

credit

prepaid insurance

office equipment

87000

cash

8500

balance

8500

capital

143000

cash

18000

wages expense

prepaid rent

17400

cash

39000

balance

39000

office supplies

7900

accounts payable

19500

drawings

revenue from service fee

32280

cash

6000

balance

6000

accounts receivables

9480

prepaid insurance

8500

utility expense

wages expense

39000

cash

1500

balance

1500

drawings

6000

utility expense

1500

total

194780

194780

| 1- | Journal Entries | 2- | Ledger Accounts | ||||||

| date | Explanation | debit | credit | explanation | debit | explanation | credit | ||

| 1-May | cash | 85000 | office equipment | ||||||

| office equipment | 58000 | capital | 58000 | balance | 87000 | ||||

| capital | 143000 | accounts payable | 29000 | ||||||

| 1-May | prepaid rent | 17400 | capital | ||||||

| cash | balance | 143000 | cash | 85000 | |||||

| office equipment | 58000 | ||||||||

| 2-May | office equipment | 29000 | |||||||

| office supplies | 5800 | cash | |||||||

| accounts payable | 34800 | capital | 85000 | prepaid rent | 17400 | ||||

| revenue from service fee | 9000 | accounts payable | 17400 | ||||||

| 6-May | cash | 9000 | accounts receivables | 13800 | prepaid insurance | 8500 | |||

| revenue from service fee | 9000 | wages | 39000 | ||||||

| drawings | 6000 | ||||||||

| 9-May | accounts receivables | 17000 | utility expense | 1500 | |||||

| revenue from fee | 17000 | balance | 18000 | ||||||

| total | 107800 | total | 107800 | ||||||

| 10-May | accounts payable | 17400 | |||||||

| cash | 17400 | ||||||||

| 19-May | prepaid insurance | 8500 | |||||||

| cash | 8500 | prepaid rent | |||||||

| cash | 17400 | balance | 17400 | ||||||

| 22-May | cash | 13800 | |||||||

| accounts receivables | 13800 | office supplies | |||||||

| Accounts payable | 5800 | balance | 7900 | ||||||

| 25-May | accounts receivables | 6280 | accounts payable | 2100 | |||||

| revenue from fee | 6280 | accounts payable | |||||||

| cash | 17400 | office equipment | 29000 | ||||||

| 25-May | wages | 39000 | balance | 19500 | office supplies | 5800 | |||

| cash | 39000 | office supplies | 2100 | ||||||

| 31-May | drawings | 6000 | total | 36900 | total | 36900 | |||

| cash | 6000 | revenue from service fee | |||||||

| balance | 32280 | cash | 9000 | ||||||

| 31-May | office supplies | 2100 | accounts receivables | 17000 | |||||

| accounts payable | 2100 | accounts receivables | 6280 | ||||||

| 31-May | utility expense | 1500 | accounts receivables | ||||||

| cash | 1500 | revenue from service fee | 17000 | cash | 13800 | ||||

| revenue from fee | 6280 | balance | 9480 | ||||||

| Trial balance | total | 23280 | total | 23280 | |||||

| Explanation | debit | credit | prepaid insurance | ||||||

| office equipment | 87000 | cash | 8500 | balance | 8500 | ||||

| capital | 143000 | ||||||||

| cash | 18000 | wages expense | |||||||

| prepaid rent | 17400 | cash | 39000 | balance | 39000 | ||||

| office supplies | 7900 | ||||||||

| accounts payable | 19500 | drawings | |||||||

| revenue from service fee | 32280 | cash | 6000 | balance | 6000 | ||||

| accounts receivables | 9480 | ||||||||

| prepaid insurance | 8500 | utility expense | |||||||

| wages expense | 39000 | cash | 1500 | balance | 1500 | ||||

| drawings | 6000 | ||||||||

| utility expense | 1500 | ||||||||

| total | 194780 | 194780 |

Homework Sourse

Homework Sourse