a project produces a cash flow of 5750 a year for 4 years Th

a project produces a cash flow of $5750 a year for 4 years. The PI is 0.88 at a discount rate of 9.5%. what is the initial cost of the project? ($20938.37) should you accept the project? Explain what does PI:0.88 mean.

Solution

PI stands for Profitability Index. It is an investment appraisal technique calculated by dividing the present value of future cash flow of a project by initial investment in project

Formula: Profitability Index: Present Value of Future Cash Flows / Initial Investment in project

A project can be accepted if profitability index is greater than 1 as the project generates value but if profitability index is less than 1 then project cannot be accepted as project destroys the value.

Let’s check below steps on order to understand how the initial cost of the project can be derived.

Step 1: First calculate present value of cash flows with the discount rate which is given @ 9.5% or 0.095 by formula ---

Formula: Cash Flow / (1+discount rate)^Number of years

Put in the figures in formula:

5750 / (1+0.095)^0.....5750 / (1+0.095)^1....5750 / (1+0.095)^2.....5750 / (1+0.095)^3.....5750 / (1+0.095)^4

Below is discounting of cash flows:

18425.76645 is present value of Cash flows.

Step2: We are given PI i.e. Profitability Index as 0.88

And we need to calculate Initial Investment:

Therefore,

Formula:

Profitability Index: Present Value of Future Cash Flows / Initial Investment in project

Formula:

0.88: 18425.76645 / Initial Investment in project

Therefore,

Initial Investment in project is 18425.76645 / 0.88

Initial Investment in project is $20938.37 and since PI is 0.88 i.e. less than 1 project cannot be accepted.

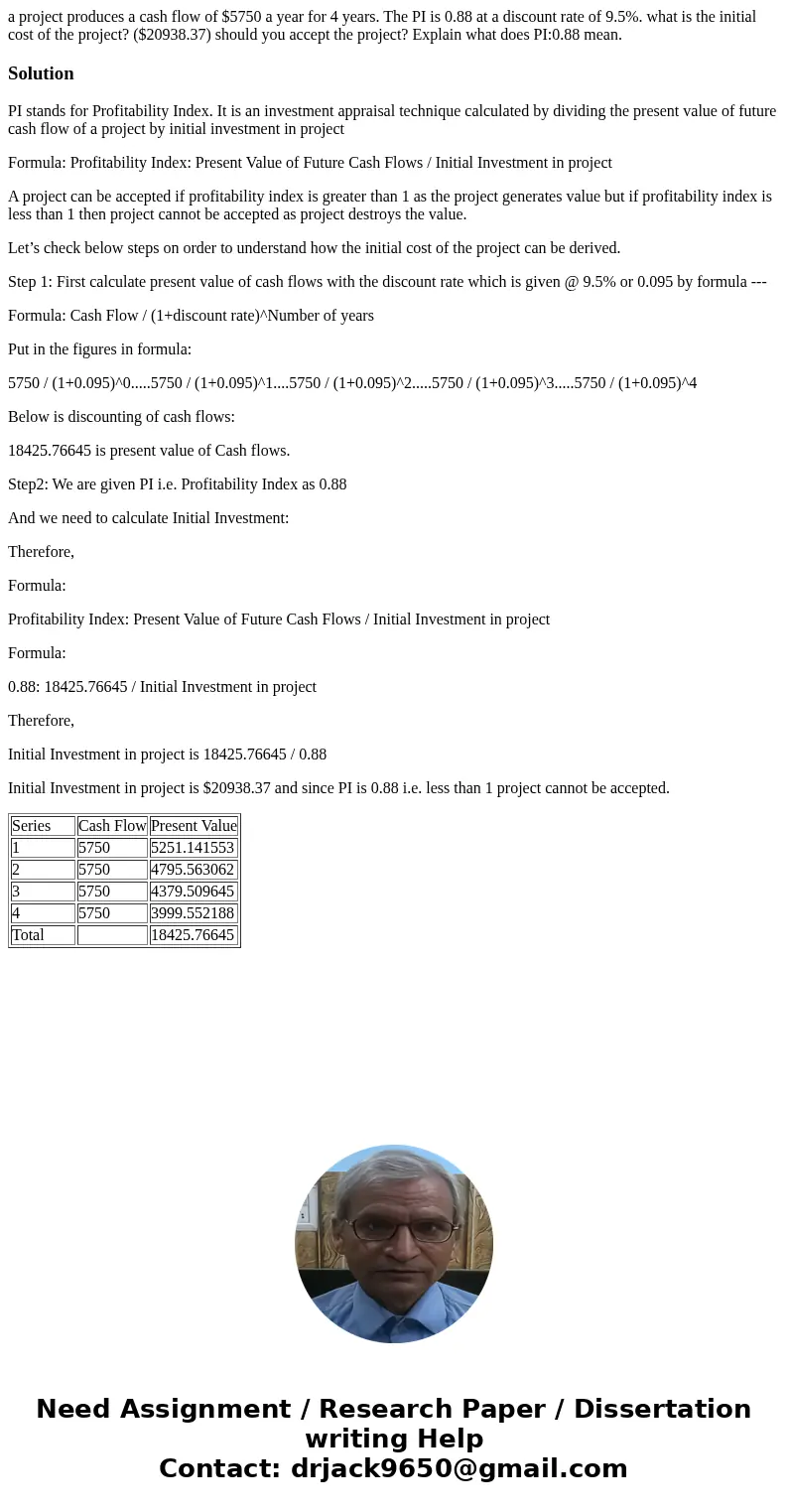

| Series | Cash Flow | Present Value |

| 1 | 5750 | 5251.141553 |

| 2 | 5750 | 4795.563062 |

| 3 | 5750 | 4379.509645 |

| 4 | 5750 | 3999.552188 |

| Total | 18425.76645 |

Homework Sourse

Homework Sourse