Problem 225A Schedule of Cost of Goods Manufactured Overhead

Solution

1. a.

Predetermined overhead rate = $800000 / $500000 = 160%

b. Before the underapplied or overapplied overhead can be computed, we must determine the amount of direct materials used in production for the year.

Raw materials inventory, beginning

$20000

Add: Purchases of raw materials

510000

Raw materials available

530000

Less: Raw materials inventory, ending

80000

Raw materials used in production

450000

Actual manufacturing overhead costs:

Indirect labor

170000

Property taxes

48000

Depreciation of equipment

260000

Maintenance

95000

Insurance

7000

Rent, building

180000

Total actual costs

760000

Applied manufacturing overhead costs: $450,000 × 160%

720000

Underapplied overhead

$40000

2.

Gitano Products

Schedule of Cost of Goods Manufactured

Direct materials:

Raw materials inventory, beginning

$20000

Add: purchases of raw materials

510000

Total raw materials available

530000

Less: raw materials inventory, ending

80000

Raw materials used in production

$450000

Direct labor

90000

Manufacturing overhead applied to work in process

720000

Total manufacturing costs

1260000

Add: Work in process, beginning

150000

1410000

Less: Work in process, ending

70000

Cost of goods manufactured

$1340000

3.

Cost of goods sold:

Finished goods inventory, beginning

$260000

Add: Cost of goods manufactured

1340000

Goods available for sale

1600000

Less: Finished goods inventory, ending

400000

Cost of goods sold

$1200000

The underapplied overhead can either be closed out to Cost of Goods Sold or allocated between Work in Process, Finished Goods, and Cost of Goods Sold based on the overhead applied during the year in the ending balance in each of these accounts.

4.

Direct materials

$8500

Direct labor

2700

Overhead applied ($8,500 × 160%)

13600

Total manufacturing cost

$24800

$24,800 × 125% = $31,000 price to the customer

5.

The amount of overhead cost in Work in Process was:

$24,000 direct materials cost × 160% = $38,400

The amount of direct labor cost in Work in Process is:

Total ending work in process

$70000

Deduct: Direct materials

24000

Manufacturing overhead

38400

$62400

Direct labor cost

$7600

The completed schedule of costs in Work in Process was:

Direct materials .................................$24,000

Direct labor .......................................7,600

Manufacturing overhead.....................38,400

Work in process inventory................... $70,00

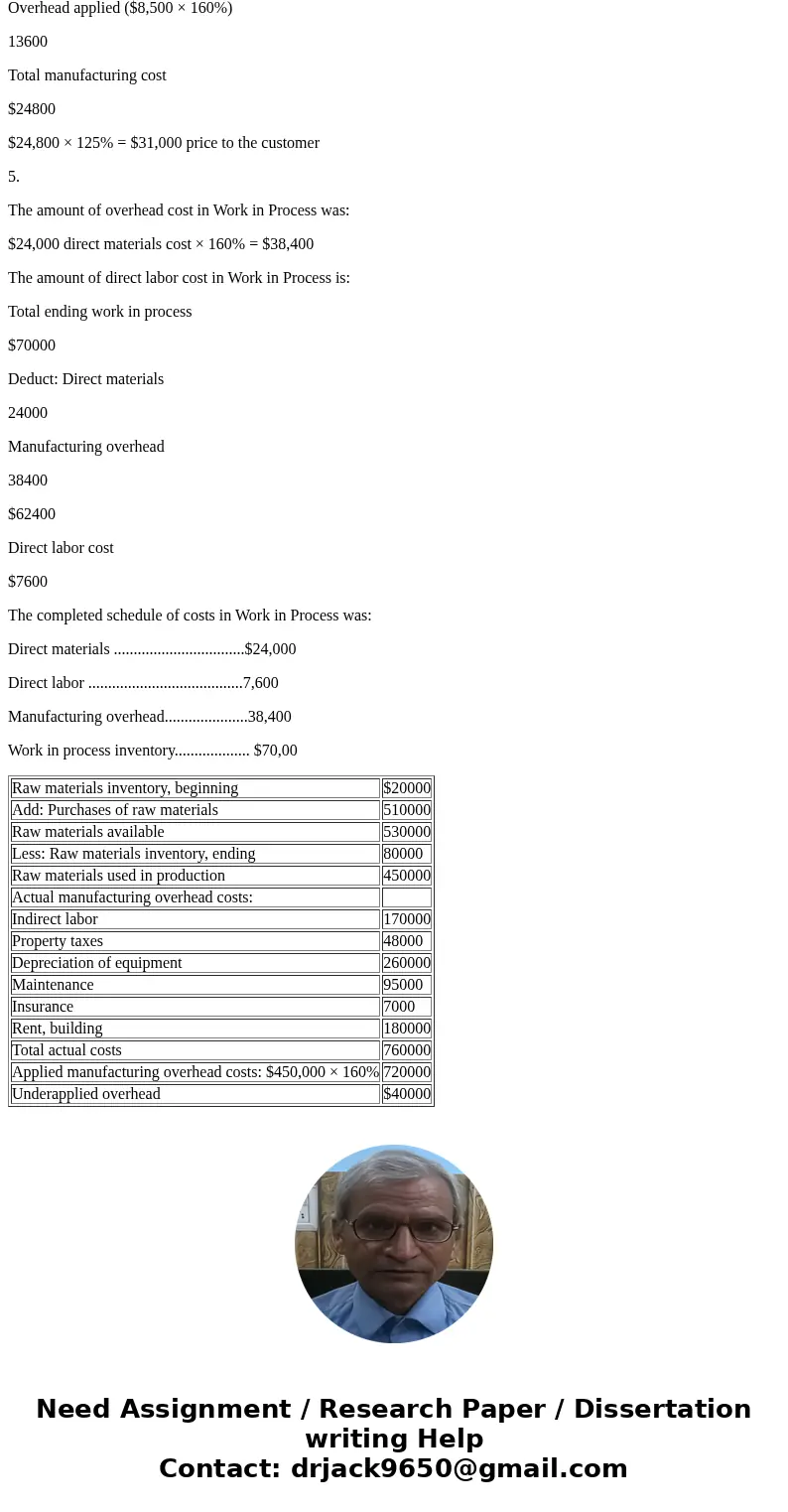

| Raw materials inventory, beginning | $20000 |

| Add: Purchases of raw materials | 510000 |

| Raw materials available | 530000 |

| Less: Raw materials inventory, ending | 80000 |

| Raw materials used in production | 450000 |

| Actual manufacturing overhead costs: | |

| Indirect labor | 170000 |

| Property taxes | 48000 |

| Depreciation of equipment | 260000 |

| Maintenance | 95000 |

| Insurance | 7000 |

| Rent, building | 180000 |

| Total actual costs | 760000 |

| Applied manufacturing overhead costs: $450,000 × 160% | 720000 |

| Underapplied overhead | $40000 |

Homework Sourse

Homework Sourse