You are a manger of the Lowell Fund and manage a portfolio o

You are a manger of the Lowell Fund and manage a portfolio of $21 million. Your portfolio has a beta of 1.2 and required return of 12 percent. You receive $4 million additional to invest in the portfolio, and you invest it in a stock with a beta of 1.6. The risk-free rate is 5 percent. What is the required return on the new portfolio? (Hint: Calculate weighted average beta after new capital investment.)

Solution

E(R) = RF + (RM - RF) Beta

where,

E(R) = Expected return from a portfolio

RM = Market rate of return

RF = Risk free return

E(R) = RF + (RM - RF) Beta

12% = 5% + (RM - 5%) x 1.2

12% - 5% = (RM - 5%) x 1.2

RM - 5% = 7%/1.2

RM = 5.83% + 5%

RM = 10.83%

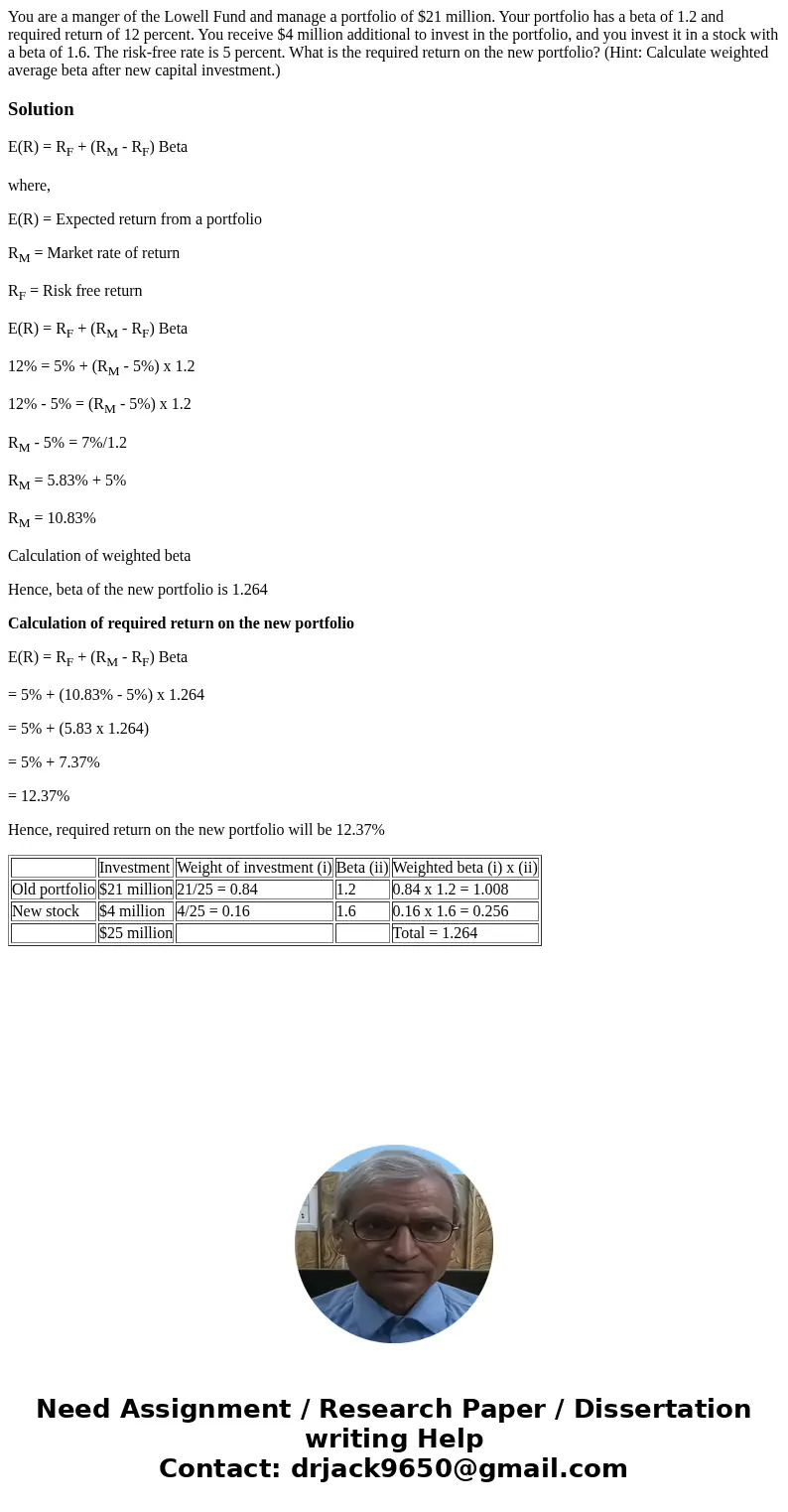

Calculation of weighted beta

Hence, beta of the new portfolio is 1.264

Calculation of required return on the new portfolio

E(R) = RF + (RM - RF) Beta

= 5% + (10.83% - 5%) x 1.264

= 5% + (5.83 x 1.264)

= 5% + 7.37%

= 12.37%

Hence, required return on the new portfolio will be 12.37%

| Investment | Weight of investment (i) | Beta (ii) | Weighted beta (i) x (ii) | |

| Old portfolio | $21 million | 21/25 = 0.84 | 1.2 | 0.84 x 1.2 = 1.008 |

| New stock | $4 million | 4/25 = 0.16 | 1.6 | 0.16 x 1.6 = 0.256 |

| $25 million | Total = 1.264 |

Homework Sourse

Homework Sourse