On October 3 2017 two individuals form Gray Corporation unde

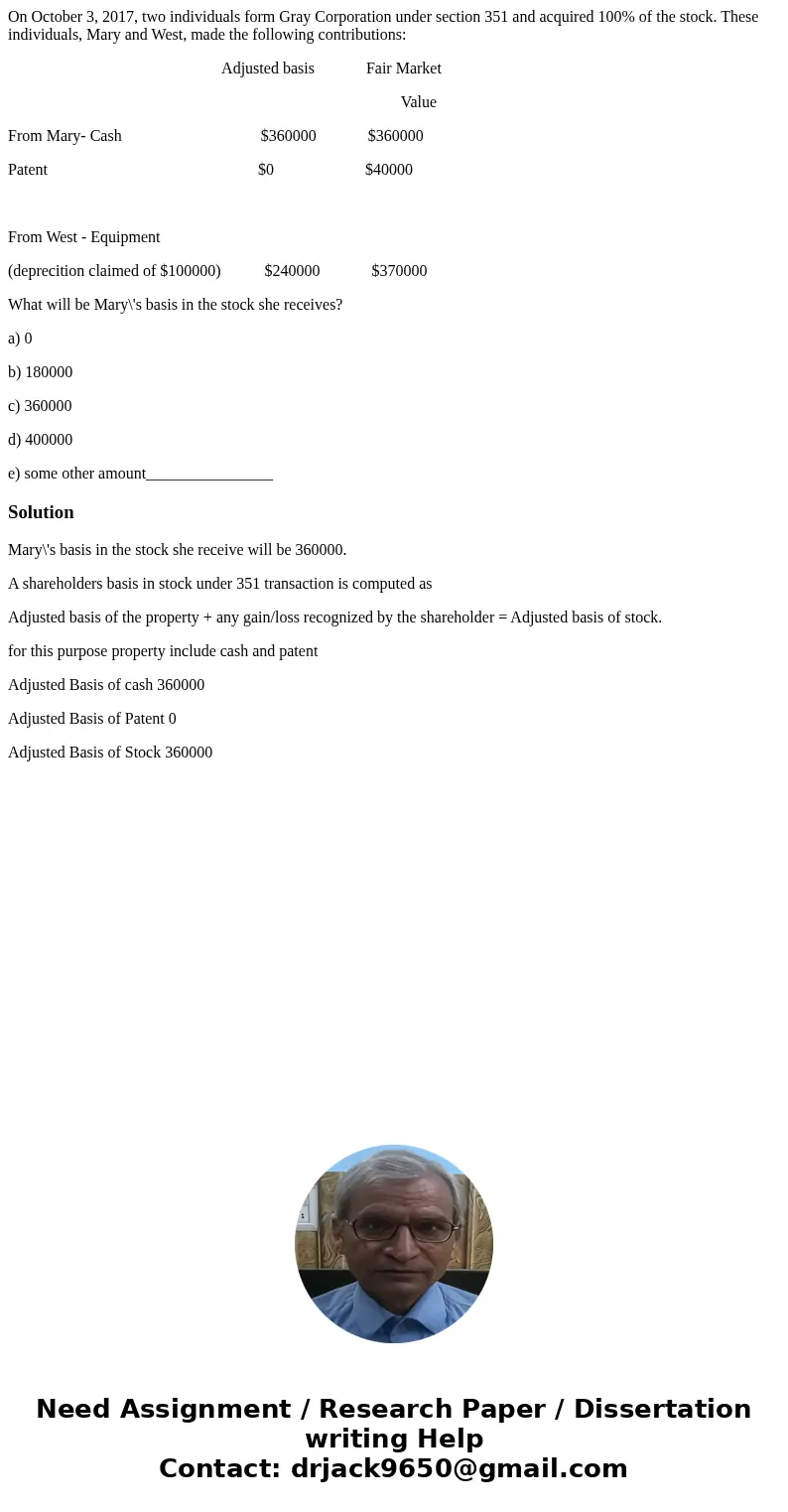

On October 3, 2017, two individuals form Gray Corporation under section 351 and acquired 100% of the stock. These individuals, Mary and West, made the following contributions:

Adjusted basis Fair Market

Value

From Mary- Cash $360000 $360000

Patent $0 $40000

From West - Equipment

(deprecition claimed of $100000) $240000 $370000

What will be Mary\'s basis in the stock she receives?

a) 0

b) 180000

c) 360000

d) 400000

e) some other amount________________

Solution

Mary\'s basis in the stock she receive will be 360000.

A shareholders basis in stock under 351 transaction is computed as

Adjusted basis of the property + any gain/loss recognized by the shareholder = Adjusted basis of stock.

for this purpose property include cash and patent

Adjusted Basis of cash 360000

Adjusted Basis of Patent 0

Adjusted Basis of Stock 360000

Homework Sourse

Homework Sourse