Mustang Enterprises Inc has been considering the purchase of

Mustang Enterprises, Inc., has been considering the purchase of a new manufacturing facility for $283,000. The facility is to be fully depreciated on a straight-line basis over seven years. It is expected to have no resale value after the seven years. Operating revenues from the facility are expected to be $118,000, in nominal terms, at the end of the first year. The revenues are expected to increase at the inflation rate of 4 percent. Production costs at the end of the first year will be $43,000, in nominal terms, and they are expected to increase at 5 percent per year. The real discount rate is 7 percent. The corporate tax rate is 34 percent. Calculate the NPV of the project. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV $

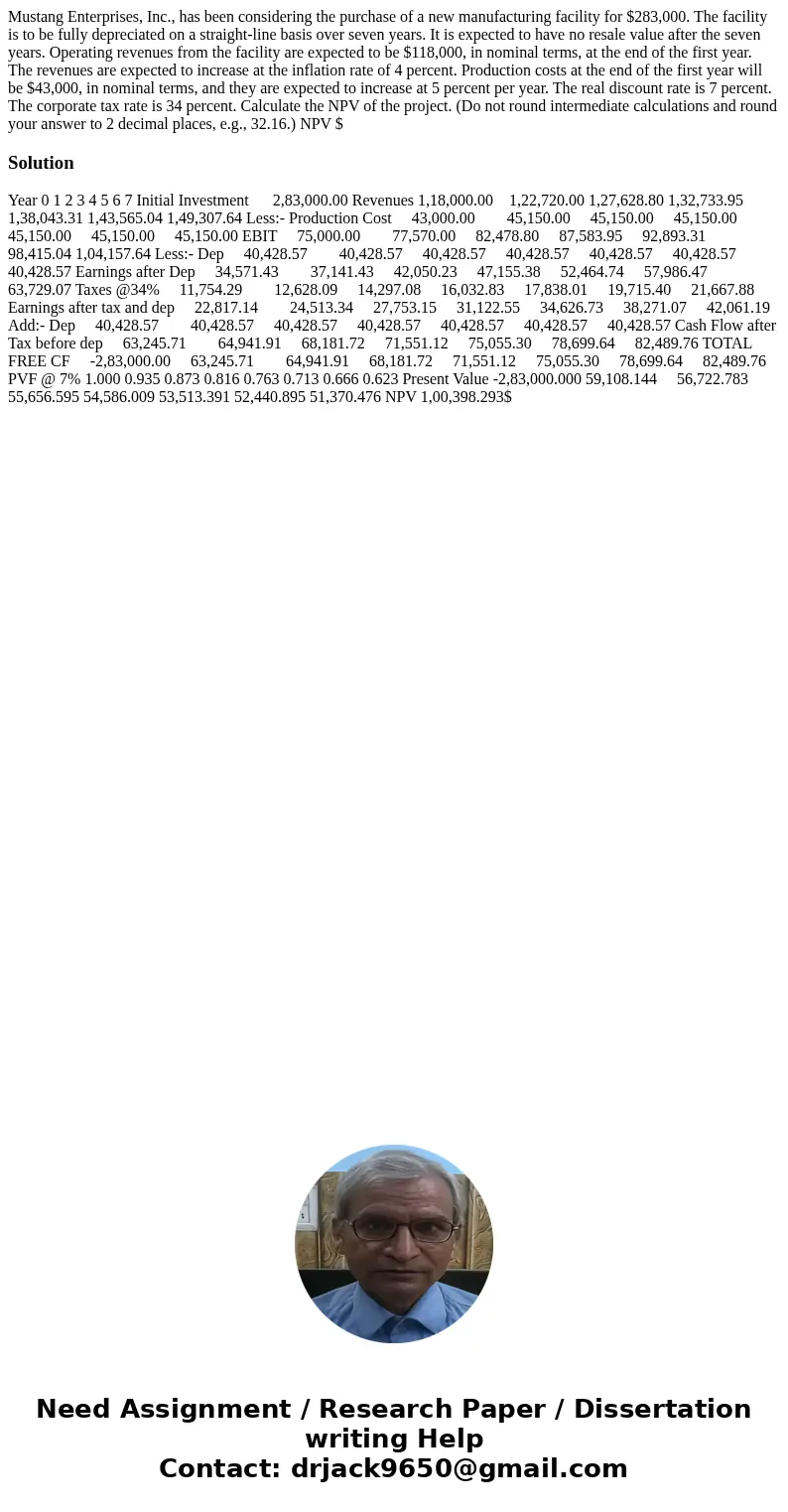

Solution

Year 0 1 2 3 4 5 6 7 Initial Investment 2,83,000.00 Revenues 1,18,000.00 1,22,720.00 1,27,628.80 1,32,733.95 1,38,043.31 1,43,565.04 1,49,307.64 Less:- Production Cost 43,000.00 45,150.00 45,150.00 45,150.00 45,150.00 45,150.00 45,150.00 EBIT 75,000.00 77,570.00 82,478.80 87,583.95 92,893.31 98,415.04 1,04,157.64 Less:- Dep 40,428.57 40,428.57 40,428.57 40,428.57 40,428.57 40,428.57 40,428.57 Earnings after Dep 34,571.43 37,141.43 42,050.23 47,155.38 52,464.74 57,986.47 63,729.07 Taxes @34% 11,754.29 12,628.09 14,297.08 16,032.83 17,838.01 19,715.40 21,667.88 Earnings after tax and dep 22,817.14 24,513.34 27,753.15 31,122.55 34,626.73 38,271.07 42,061.19 Add:- Dep 40,428.57 40,428.57 40,428.57 40,428.57 40,428.57 40,428.57 40,428.57 Cash Flow after Tax before dep 63,245.71 64,941.91 68,181.72 71,551.12 75,055.30 78,699.64 82,489.76 TOTAL FREE CF -2,83,000.00 63,245.71 64,941.91 68,181.72 71,551.12 75,055.30 78,699.64 82,489.76 PVF @ 7% 1.000 0.935 0.873 0.816 0.763 0.713 0.666 0.623 Present Value -2,83,000.000 59,108.144 56,722.783 55,656.595 54,586.009 53,513.391 52,440.895 51,370.476 NPV 1,00,398.293$

Homework Sourse

Homework Sourse