WD Pty Ltd bought a motor vehicle Ford Falcon Ute Registrati

WD Pty Ltd bought a motor vehicle (Ford Falcon Ute, Registration Number: WDP 345) for $30,000 from Brighton Cheap Motor Vehicles Pty Ltd on 1st July 2013. The residual value for the Ute is $8,000. WD Pty Ltd decided to use the diminishing value method (reducing value method) to depreciate the Ute. After referring to the tax ruling (TR 2013/4 – Income tax: effective life of depreciating assets), WD Pty Ltd decided to depreciate the Ute by 25% per annum.

Please ignore GST in all parts of this question.

Please calculate the depreciation, accumulated depreciation and reduced balance amounts for the life of this vehicle by filling in the table below: Hint: please note that for the diminishing value method, the residual value is not deducted before the calculation of depreciation is made; however, the asset is depreciated down to the residual value.

Year Calculation Depreciation Accumulated Reduced balance Depreciation 1 30,000 X 25% 7,500 7,500 30,000-7,500 22,500 AdjustmentSolution

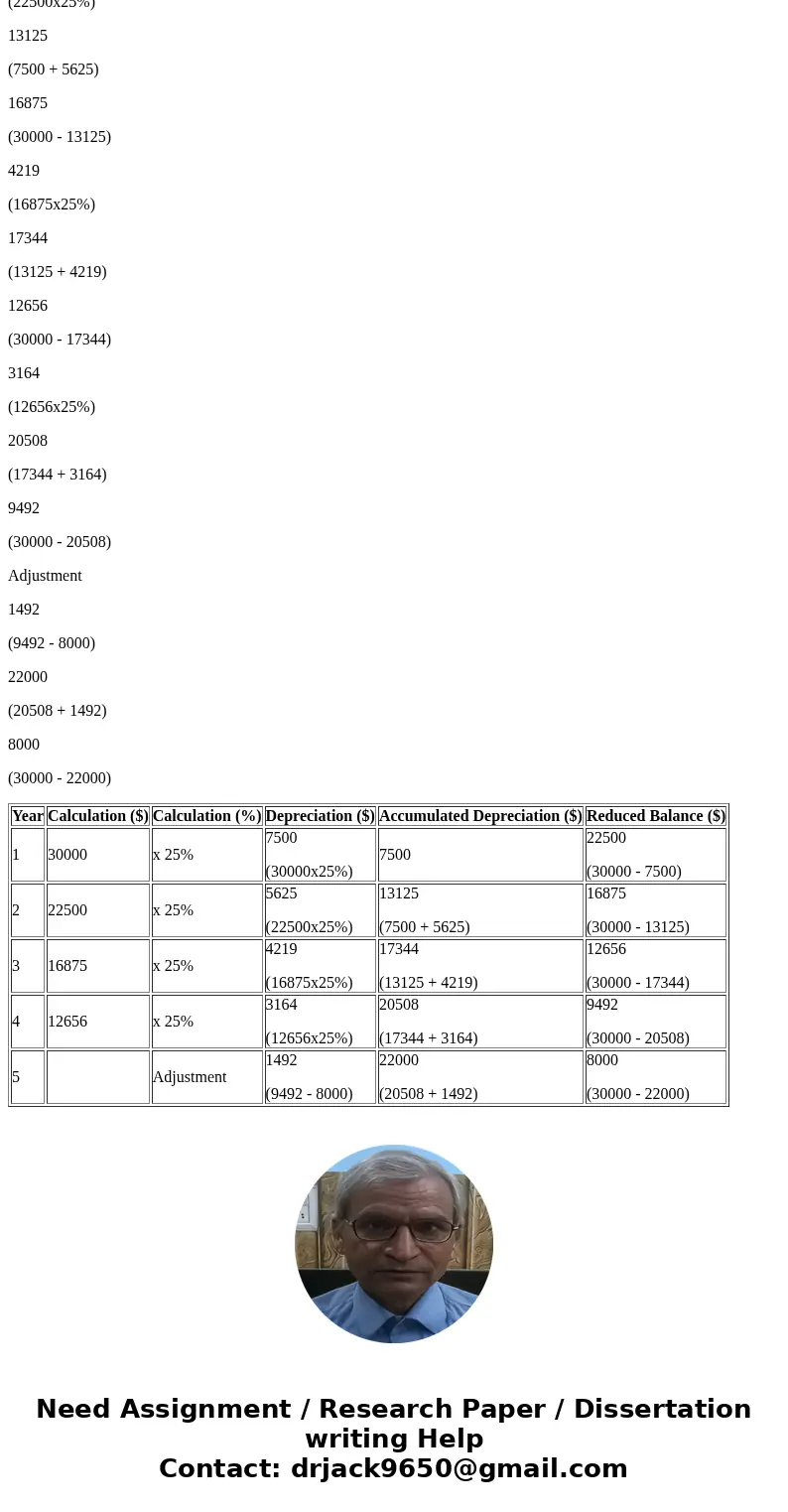

Table showing the depreciation calculation on motor vehicle

Method of Depreciation = Declining Balance method

Cost of Asset = $30000

Rate of depreciation = 25%

Residual Method - The methos in which depreciation is calculated at the end of every year on residual value of asset which is (asset cost - Depreciation)

7500

(30000x25%)

22500

(30000 - 7500)

5625

(22500x25%)

13125

(7500 + 5625)

16875

(30000 - 13125)

4219

(16875x25%)

17344

(13125 + 4219)

12656

(30000 - 17344)

3164

(12656x25%)

20508

(17344 + 3164)

9492

(30000 - 20508)

Adjustment

1492

(9492 - 8000)

22000

(20508 + 1492)

8000

(30000 - 22000)

| Year | Calculation ($) | Calculation (%) | Depreciation ($) | Accumulated Depreciation ($) | Reduced Balance ($) |

| 1 | 30000 | x 25% | 7500 (30000x25%) | 7500 | 22500 (30000 - 7500) |

| 2 | 22500 | x 25% | 5625 (22500x25%) | 13125 (7500 + 5625) | 16875 (30000 - 13125) |

| 3 | 16875 | x 25% | 4219 (16875x25%) | 17344 (13125 + 4219) | 12656 (30000 - 17344) |

| 4 | 12656 | x 25% | 3164 (12656x25%) | 20508 (17344 + 3164) | 9492 (30000 - 20508) |

| 5 | Adjustment | 1492 (9492 - 8000) | 22000 (20508 + 1492) | 8000 (30000 - 22000) |

Homework Sourse

Homework Sourse