A On September 1 2012 Ramsey Company purchased the follow fo

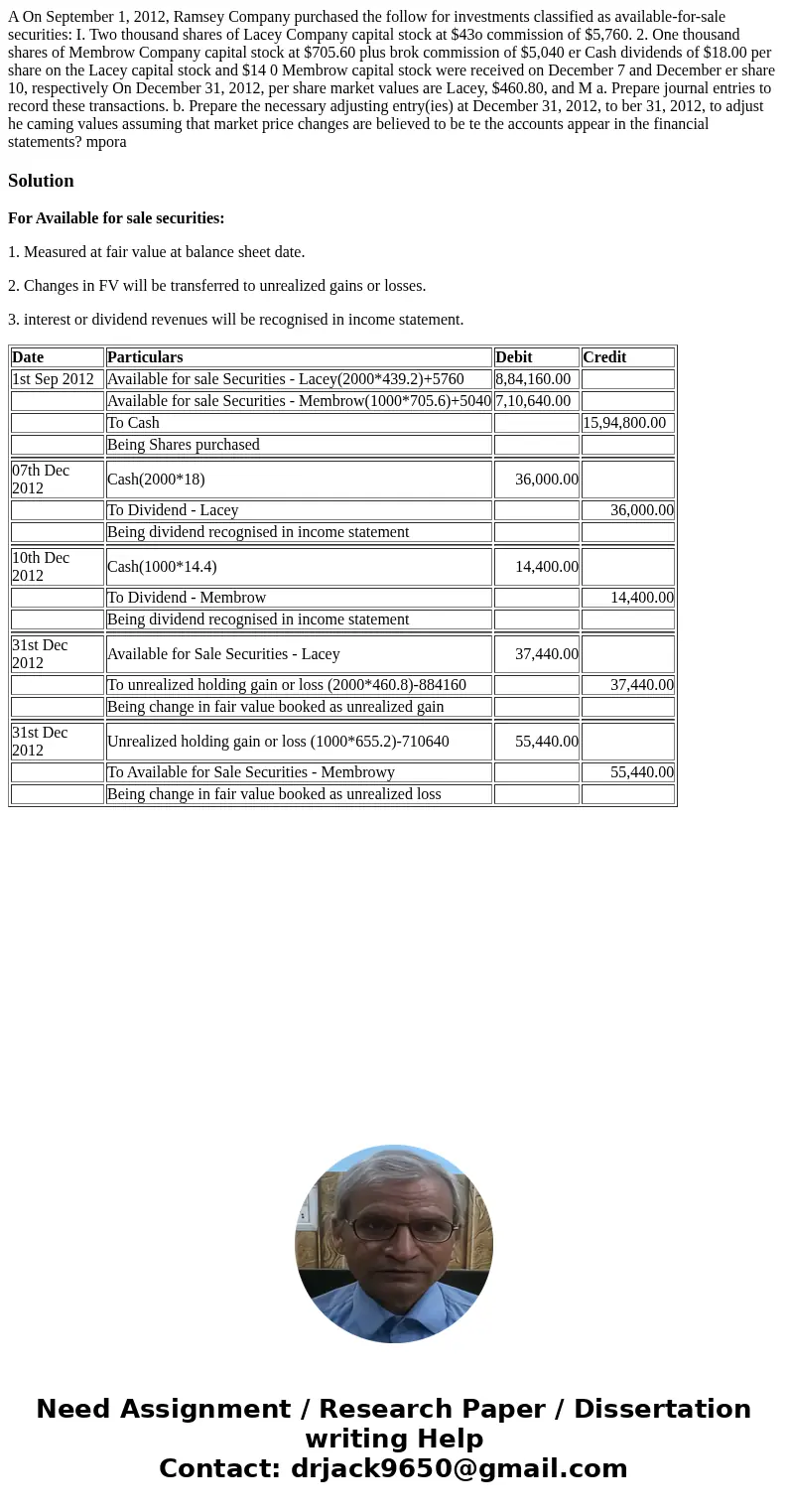

A On September 1, 2012, Ramsey Company purchased the follow for investments classified as available-for-sale securities: I. Two thousand shares of Lacey Company capital stock at $43o commission of $5,760. 2. One thousand shares of Membrow Company capital stock at $705.60 plus brok commission of $5,040 er Cash dividends of $18.00 per share on the Lacey capital stock and $14 0 Membrow capital stock were received on December 7 and December er share 10, respectively On December 31, 2012, per share market values are Lacey, $460.80, and M a. Prepare journal entries to record these transactions. b. Prepare the necessary adjusting entry(ies) at December 31, 2012, to ber 31, 2012, to adjust he caming values assuming that market price changes are believed to be te the accounts appear in the financial statements? mpora

Solution

For Available for sale securities:

1. Measured at fair value at balance sheet date.

2. Changes in FV will be transferred to unrealized gains or losses.

3. interest or dividend revenues will be recognised in income statement.

| Date | Particulars | Debit | Credit |

| 1st Sep 2012 | Available for sale Securities - Lacey(2000*439.2)+5760 | 8,84,160.00 | |

| Available for sale Securities - Membrow(1000*705.6)+5040 | 7,10,640.00 | ||

| To Cash | 15,94,800.00 | ||

| Being Shares purchased | |||

| 07th Dec 2012 | Cash(2000*18) | 36,000.00 | |

| To Dividend - Lacey | 36,000.00 | ||

| Being dividend recognised in income statement | |||

| 10th Dec 2012 | Cash(1000*14.4) | 14,400.00 | |

| To Dividend - Membrow | 14,400.00 | ||

| Being dividend recognised in income statement | |||

| 31st Dec 2012 | Available for Sale Securities - Lacey | 37,440.00 | |

| To unrealized holding gain or loss (2000*460.8)-884160 | 37,440.00 | ||

| Being change in fair value booked as unrealized gain | |||

| 31st Dec 2012 | Unrealized holding gain or loss (1000*655.2)-710640 | 55,440.00 | |

| To Available for Sale Securities - Membrowy | 55,440.00 | ||

| Being change in fair value booked as unrealized loss |

Homework Sourse

Homework Sourse