Inventory at the beginning of the year consisted of materia

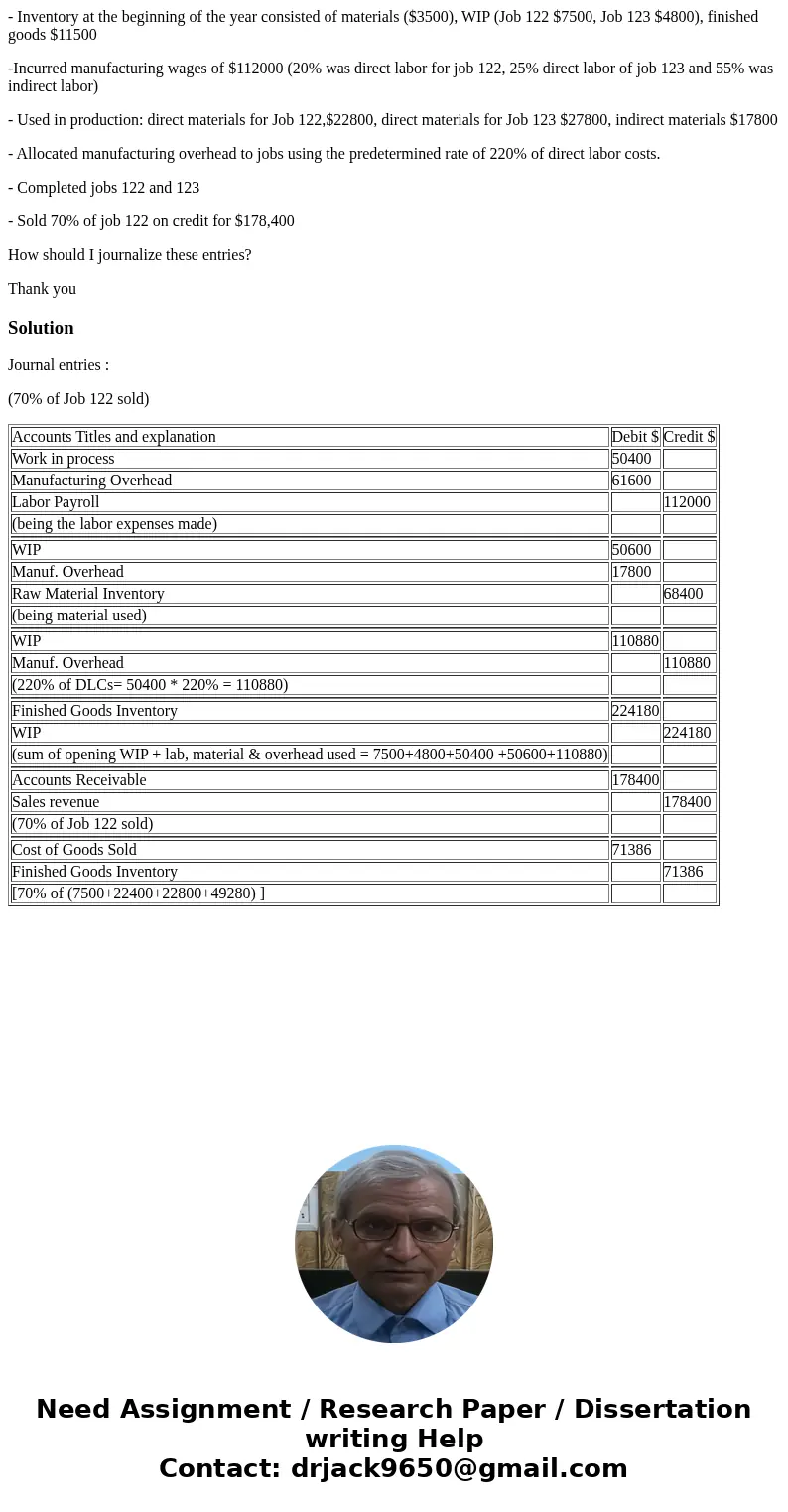

- Inventory at the beginning of the year consisted of materials ($3500), WIP (Job 122 $7500, Job 123 $4800), finished goods $11500

-Incurred manufacturing wages of $112000 (20% was direct labor for job 122, 25% direct labor of job 123 and 55% was indirect labor)

- Used in production: direct materials for Job 122,$22800, direct materials for Job 123 $27800, indirect materials $17800

- Allocated manufacturing overhead to jobs using the predetermined rate of 220% of direct labor costs.

- Completed jobs 122 and 123

- Sold 70% of job 122 on credit for $178,400

How should I journalize these entries?

Thank you

Solution

Journal entries :

(70% of Job 122 sold)

| Accounts Titles and explanation | Debit $ | Credit $ |

| Work in process | 50400 | |

| Manufacturing Overhead | 61600 | |

| Labor Payroll | 112000 | |

| (being the labor expenses made) | ||

| WIP | 50600 | |

| Manuf. Overhead | 17800 | |

| Raw Material Inventory | 68400 | |

| (being material used) | ||

| WIP | 110880 | |

| Manuf. Overhead | 110880 | |

| (220% of DLCs= 50400 * 220% = 110880) | ||

| Finished Goods Inventory | 224180 | |

| WIP | 224180 | |

| (sum of opening WIP + lab, material & overhead used = 7500+4800+50400 +50600+110880) | ||

| Accounts Receivable | 178400 | |

| Sales revenue | 178400 | |

| (70% of Job 122 sold) | ||

| Cost of Goods Sold | 71386 | |

| Finished Goods Inventory | 71386 | |

| [70% of (7500+22400+22800+49280) ] |

Homework Sourse

Homework Sourse