This Question 1 pt 20 of 31 0 complete This Test 31 pts pos

Solution

Project 1

Calculation of NPV of project 1

NPV (at 10%) = Present value of cash inflows - Present value of cash outflows

= 568.91 - 410

= $158.91

P.I. of project 1 = Present value of cash inflows/Present value of cash outflows

= 568.91/410

= 1.39

Calculation of IRR of project 1

To find out IRR, two discount rates are needed. Let us discount cash flows at 22%

NPV(at 22%) = 427.41 - 410

= $17.41

At IRR, NPV is zero. Since even at 22% discount rate, NPV is positive, hence IRR must be above 22%. Let us take another discount rate 23%

NPV(at 23%) = 418.19 - 410

= $8.19

Since NPV is still positive at 23%, hence IRR must be slight above 23%. Exact IRR can be calculated as under:

IRR = lower rate + [NPV at lower rate/(NPV at lower rate - NPV at higher rate)] x (Higher rate - lower rate)

= 22% + [17.41/(17.41-8.19)] x (23 - 22)

= 22% + (17.41/9.22) x 1

= 22% + 1.89%

= 23.89%

Project 2

Calculation of NPV of project 2

NPV (at 10%) = Present value of cash inflows - Present value of cash outflows

= 563.96 - 400

= $163.96

P.I. of project 2 = Present value of cash inflows/Present value of cash outflows

= 563.96/400

= 1.41

Calculation of IRR of project 2

To find out IRR, two discount rates are needed. Let us discount cash flows at 22%

NPV(at 22%) = 426.61 - 400

= $26.61

At IRR, NPV is zero. Since even at 22% discount rate, NPV is positive, hence IRR must be above 22%. Let us take another discount rate 23%

NPV(at 23%) = 417.66 - 400

= $17.66

Since NPV is still positive at 23%, hence IRR must be slight above 23%. Exact IRR can be calculated as under:

IRR = lower rate + [NPV at lower rate/(NPV at lower rate - NPV at higher rate)] x (Higher rate - lower rate)

= 22% + [26.61/(26.61-17.66)] x (23 - 22)

= 22% + (26.61/8.95) x 1

= 22% + 2.97%

= 24.97%

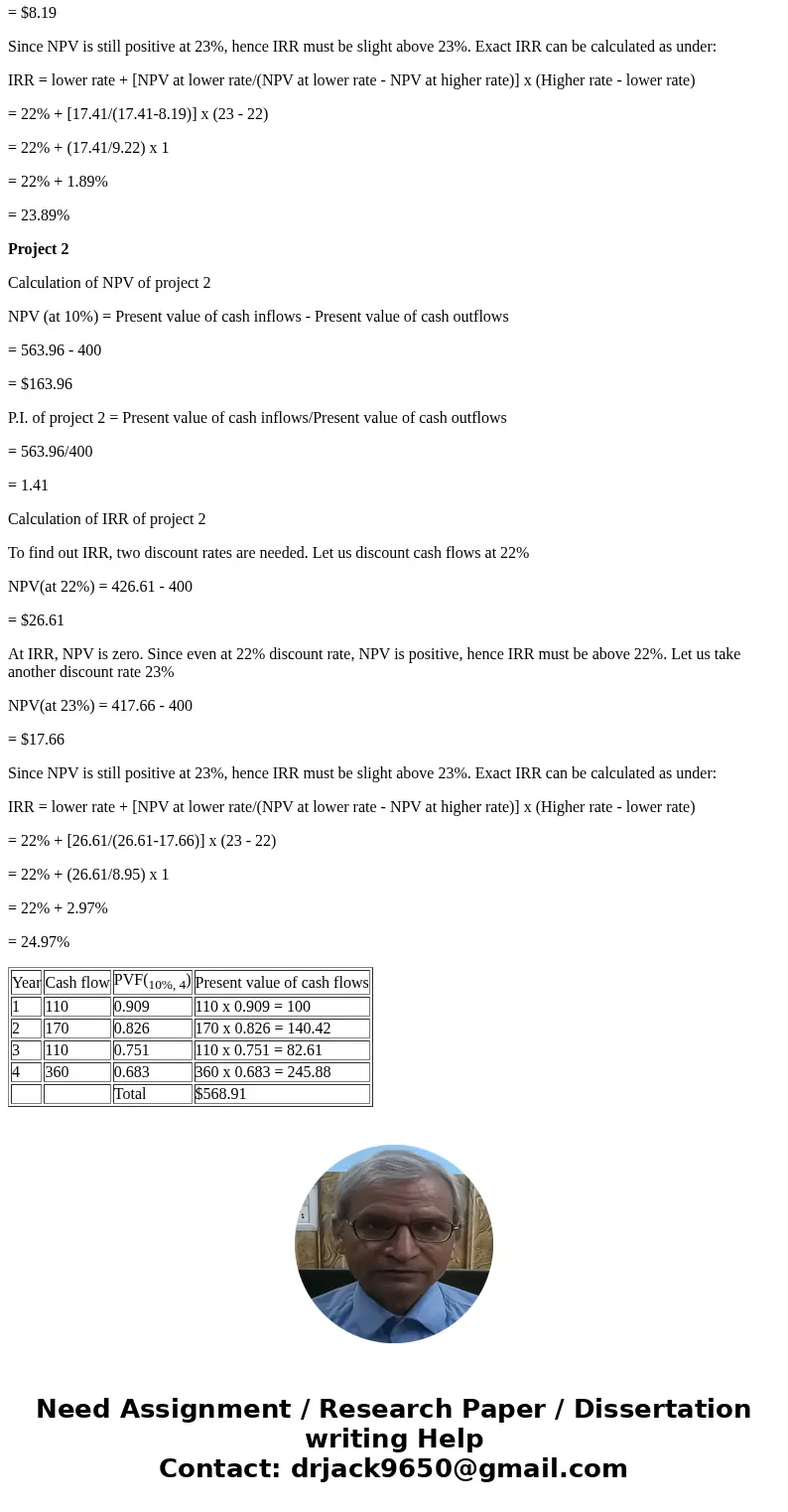

| Year | Cash flow | PVF(10%, 4) | Present value of cash flows |

| 1 | 110 | 0.909 | 110 x 0.909 = 100 |

| 2 | 170 | 0.826 | 170 x 0.826 = 140.42 |

| 3 | 110 | 0.751 | 110 x 0.751 = 82.61 |

| 4 | 360 | 0.683 | 360 x 0.683 = 245.88 |

| Total | $568.91 |

Homework Sourse

Homework Sourse