You are the number one free agent in the National HackeySack

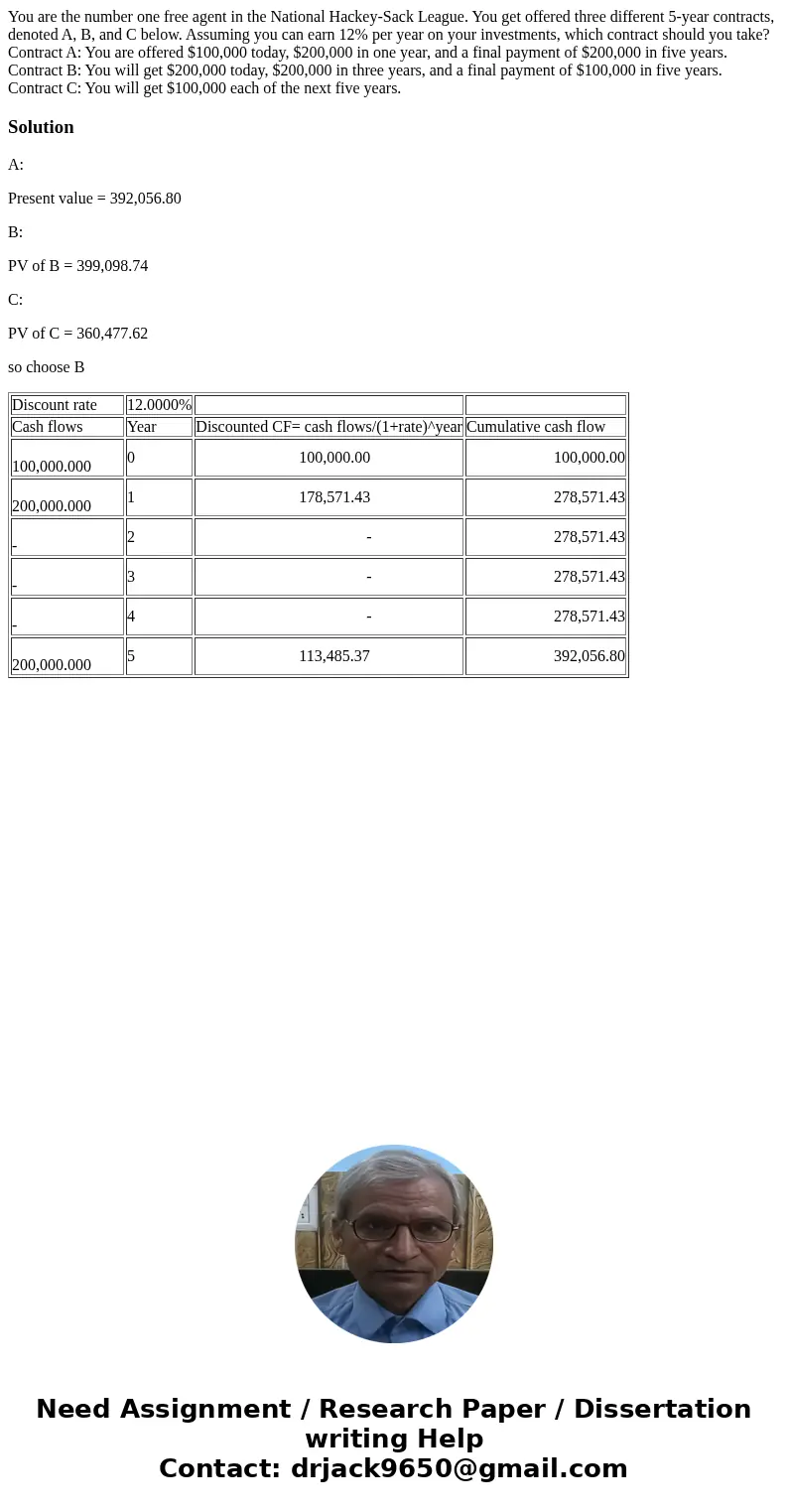

You are the number one free agent in the National Hackey-Sack League. You get offered three different 5-year contracts, denoted A, B, and C below. Assuming you can earn 12% per year on your investments, which contract should you take? Contract A: You are offered $100,000 today, $200,000 in one year, and a final payment of $200,000 in five years. Contract B: You will get $200,000 today, $200,000 in three years, and a final payment of $100,000 in five years. Contract C: You will get $100,000 each of the next five years.

Solution

A:

Present value = 392,056.80

B:

PV of B = 399,098.74

C:

PV of C = 360,477.62

so choose B

| Discount rate | 12.0000% | ||

| Cash flows | Year | Discounted CF= cash flows/(1+rate)^year | Cumulative cash flow |

| 100,000.000 | 0 | 100,000.00 | 100,000.00 |

| 200,000.000 | 1 | 178,571.43 | 278,571.43 |

| - | 2 | - | 278,571.43 |

| - | 3 | - | 278,571.43 |

| - | 4 | - | 278,571.43 |

| 200,000.000 | 5 | 113,485.37 | 392,056.80 |

Homework Sourse

Homework Sourse