The specifics of the opportunity are as follows Assume 100 o

The specifics of the opportunity are as follows:

Assume 100% occupancy

Property purchase price $2,250,000. Loan to Value Ratio (LTV) 80%

Loan Terms: fully amortized over 30 years at 4.25% APR paid monthly

The property offers six recently updated “luxury” apartments. Each apartment has 3 bedrooms and 2.5 baths in 1,800 square feet of living space. Rents are $1,690 per month per apartment. All six units are leased but one of the units only receives half rent because the tenants in that unit are responsible for year round cosmetic maintenance of the walkways and greenspaces and also minor emergency repairs. You plan to invest an additional $150,000 in paid in capital for cosmetic updates on the property and closing fees. The tax rate on the property is 1.75% of the purchase price. For the sake of simplicity will assume that taxes and rents are constant.

5.If you hold the property for exactly 10 years then sell it for $3,500,000 what rate of return did you get if you consider the cost of a loan that you took to purchase the property given these loan conditions: $3,500 origination fee and $5,875 closing costs and 2.0 points paid at closing. Assume the loan was carried from purchase to close of sale then repaid exactly ten years after purchase. For simplicity we will assume that taxes and rents are held constant.

Instructions: Set up a spreadsheet for valuing this opportunity using Excel functions to answer the questions given

Solution

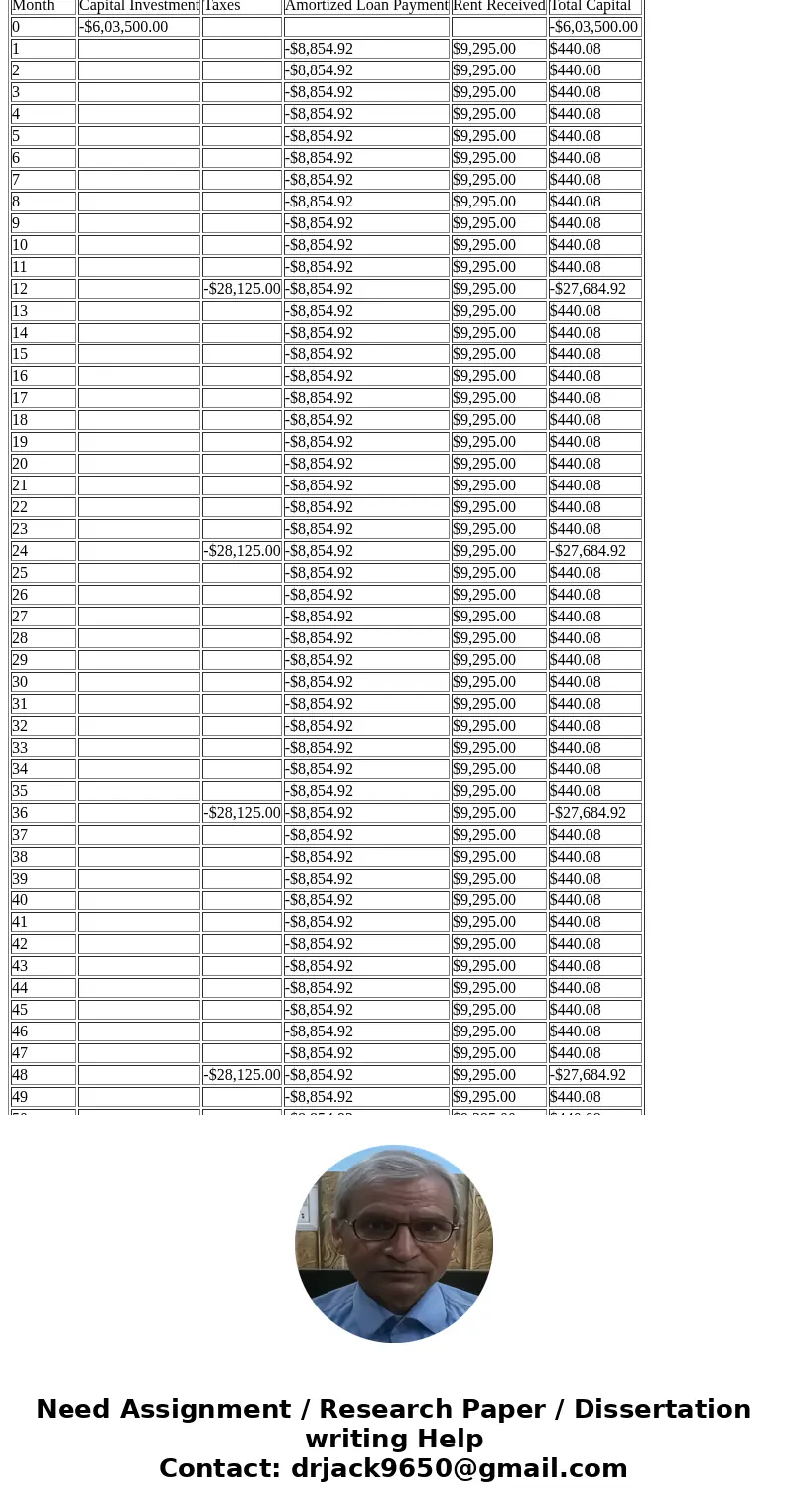

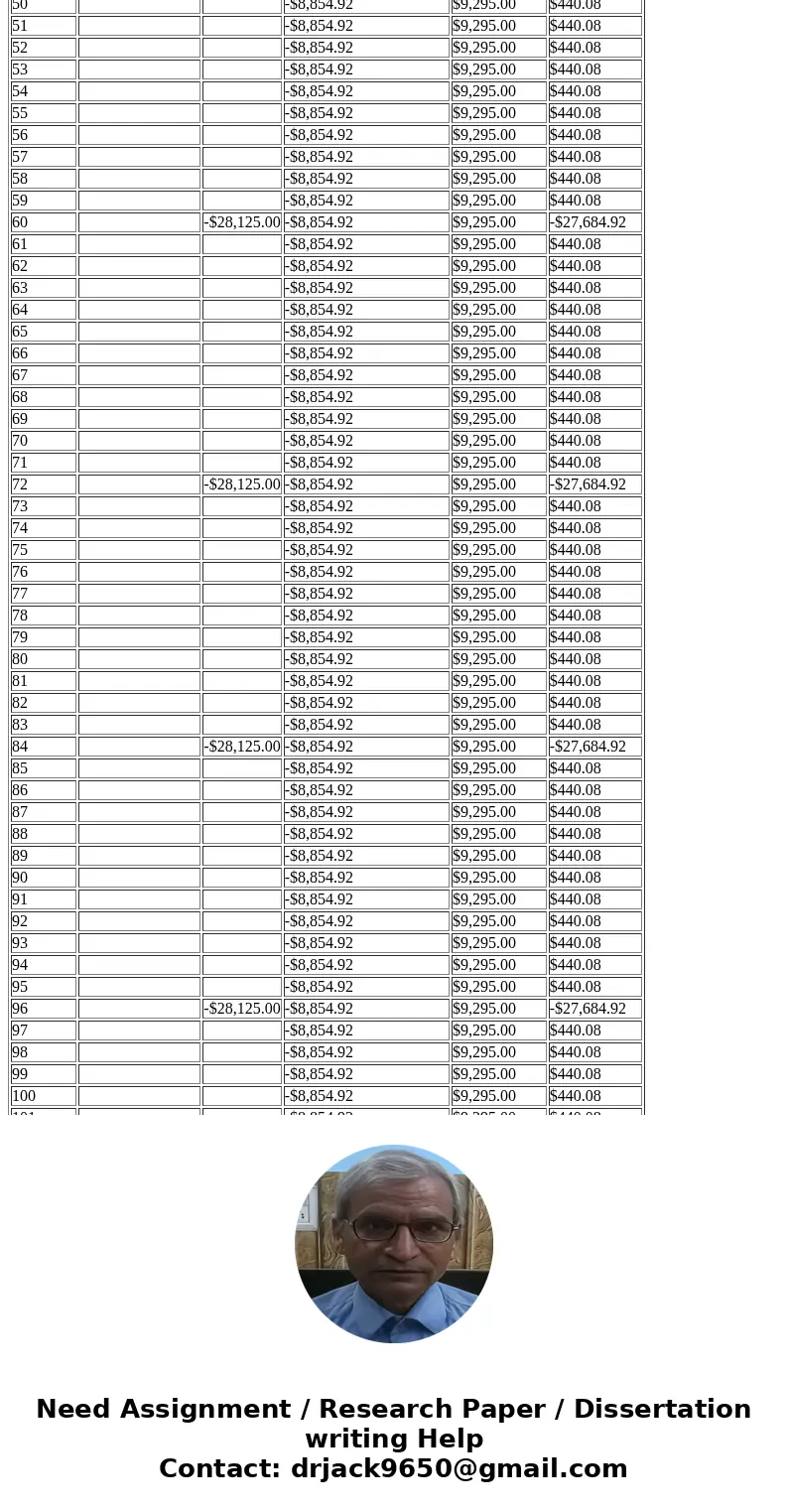

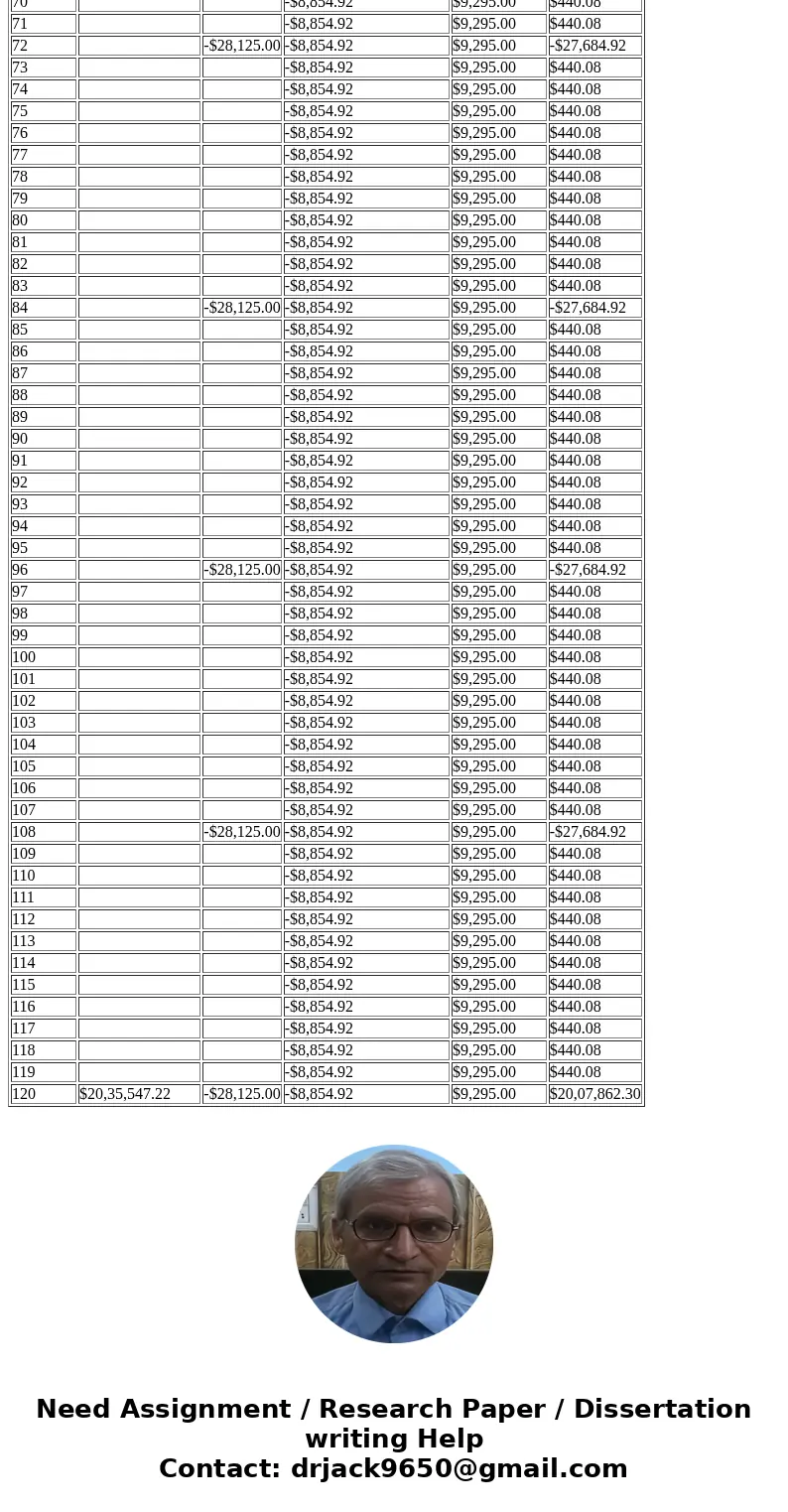

Please refer below spread sheet:-

In above spread sheet we can see that in second column of capital investment we have initial outflow of $603500 as below =

= 20% of Purchase Price + $150000 + $3500 (Origination Fees)

and in the same column at last we have selling price - Remaining loan price - $5875 (closing fees) - 2% of remaining loaned price

= $3500000 - FV formula in excel explained below - $5875 - 0.02 * FV formula

FV (0.0425/12,120,1800000, PMT, End of period i.e.0) = $1429978.22

PMT (0.0425 / 12 , 12*30 , 1800000, 0 , 0) = $8854.92

In third column we have taxes paid

As per question taxes are 1.75 % of Purchase price so 0.0175 * 2250000 = $28125 paid at end of each year.

In fourth column we have amortized loan payment calculated with PMT formula in excel

PMT (0.0425 / 12 , 12*30 , 1800000, 0 , 0) = $8854.92

Rent received = 5.5 * 1690 = $9295

Total capital columnn is sum of all other columns.

Now for calcuating return we can use Internal Rate of Return formula in excel as below:-

IRR (Select all 120 cells of Total value complete column)

= 0.85% monthly

so yearly it will be = 0.85*12 = 10.1835%

Please let me know if you need any further help.

Thank You!!

| Month | Capital Investment | Taxes | Amortized Loan Payment | Rent Received | Total Capital |

| 0 | -$6,03,500.00 | -$6,03,500.00 | |||

| 1 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 2 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 3 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 4 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 5 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 6 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 7 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 8 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 9 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 10 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 11 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 12 | -$28,125.00 | -$8,854.92 | $9,295.00 | -$27,684.92 | |

| 13 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 14 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 15 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 16 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 17 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 18 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 19 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 20 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 21 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 22 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 23 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 24 | -$28,125.00 | -$8,854.92 | $9,295.00 | -$27,684.92 | |

| 25 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 26 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 27 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 28 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 29 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 30 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 31 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 32 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 33 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 34 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 35 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 36 | -$28,125.00 | -$8,854.92 | $9,295.00 | -$27,684.92 | |

| 37 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 38 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 39 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 40 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 41 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 42 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 43 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 44 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 45 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 46 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 47 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 48 | -$28,125.00 | -$8,854.92 | $9,295.00 | -$27,684.92 | |

| 49 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 50 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 51 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 52 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 53 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 54 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 55 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 56 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 57 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 58 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 59 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 60 | -$28,125.00 | -$8,854.92 | $9,295.00 | -$27,684.92 | |

| 61 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 62 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 63 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 64 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 65 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 66 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 67 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 68 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 69 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 70 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 71 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 72 | -$28,125.00 | -$8,854.92 | $9,295.00 | -$27,684.92 | |

| 73 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 74 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 75 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 76 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 77 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 78 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 79 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 80 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 81 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 82 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 83 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 84 | -$28,125.00 | -$8,854.92 | $9,295.00 | -$27,684.92 | |

| 85 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 86 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 87 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 88 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 89 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 90 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 91 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 92 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 93 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 94 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 95 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 96 | -$28,125.00 | -$8,854.92 | $9,295.00 | -$27,684.92 | |

| 97 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 98 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 99 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 100 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 101 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 102 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 103 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 104 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 105 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 106 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 107 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 108 | -$28,125.00 | -$8,854.92 | $9,295.00 | -$27,684.92 | |

| 109 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 110 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 111 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 112 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 113 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 114 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 115 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 116 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 117 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 118 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 119 | -$8,854.92 | $9,295.00 | $440.08 | ||

| 120 | $20,35,547.22 | -$28,125.00 | -$8,854.92 | $9,295.00 | $20,07,862.30 |

Homework Sourse

Homework Sourse