Determine the NPV of the project described below and whether

Determine the NPV of the project described below and whether the local and US owners will be interested in investing in it.

Proposed Project:

A joint venture located in Catalonia is to be owned in equal shares by a US company and a local owner. The JV produces a product under license from the US owner. The US owner provides administrative, accounting and marketing services. The local owner provides labor pursuant to a contract with the joint venture.

Initial investment (half contributed by each)

Land: Pt 12 million

Equipment ($): $2 million

Equipment (Pt): Pt 4 million equipment

Other (Pt) Pt 12 million

Cash flows

Revenues:

Pt 82.5 million in first year

Costs:

Raw materials and services from unrelated third parties - Pt 30 million in year one

Labor and services from local owner - Pt 25.5 million in year one. (The local owner’s net profit from this contract is 10%).

License and services from US owner - $2.0 million in year one. (The US owner’s net profit from this contract is 50%.)

Project lasts 10 years with no terminal cash flow.

All revenues and costs are expected to increase with inflation.

Catalonia income taxes:

On project: 25%.

On local owner’s profit from labor and services: 25%

US income taxes:

On US owners profit from license and services: 22%

Current exchange rate is Pt 8.5 = $1.0

Inflation rate:

Catalonia: 7.5%

US: 2.5%

Discount rate that accounts for risk (but not inflation): 25%

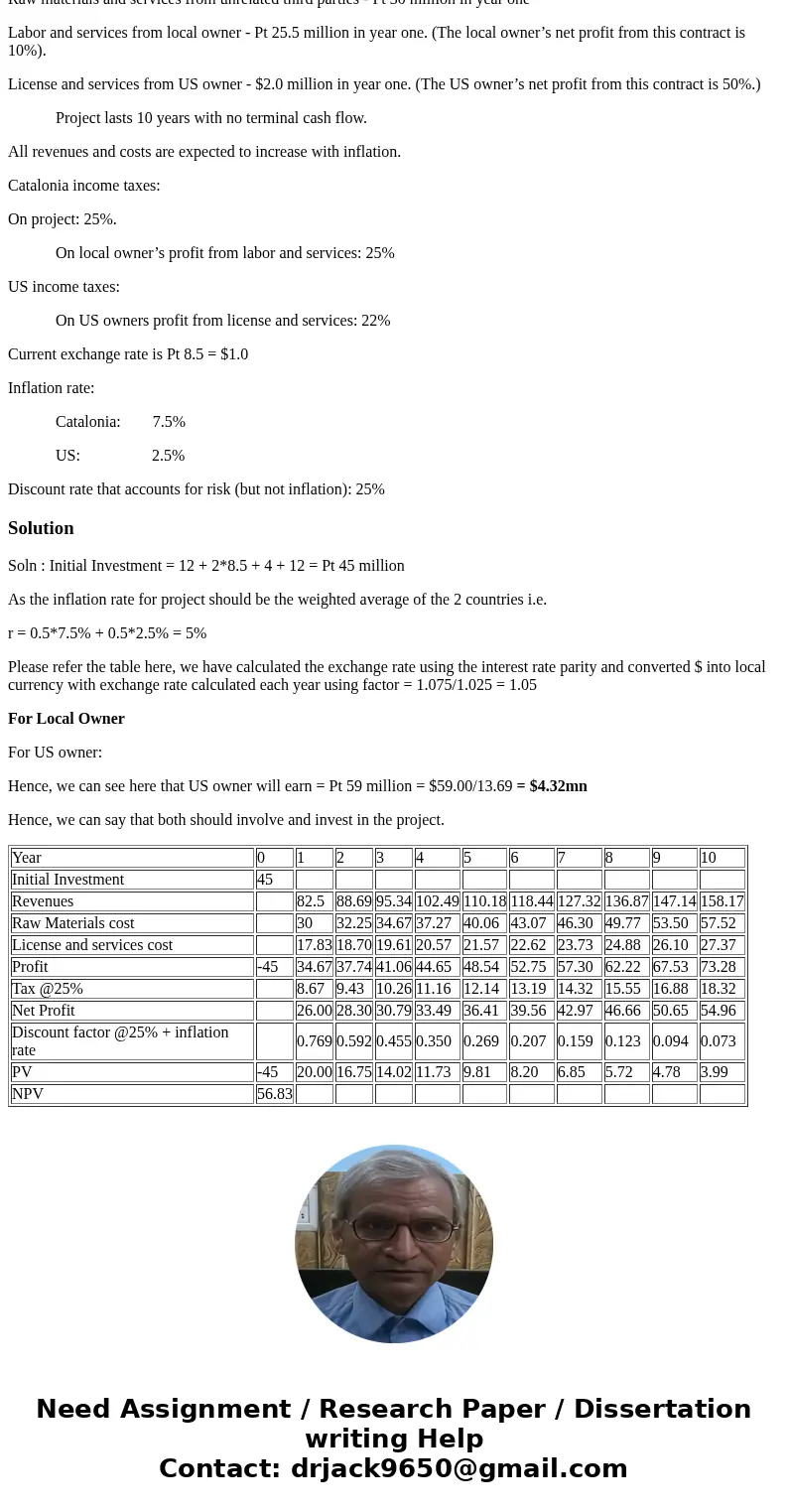

Solution

Soln : Initial Investment = 12 + 2*8.5 + 4 + 12 = Pt 45 million

As the inflation rate for project should be the weighted average of the 2 countries i.e.

r = 0.5*7.5% + 0.5*2.5% = 5%

Please refer the table here, we have calculated the exchange rate using the interest rate parity and converted $ into local currency with exchange rate calculated each year using factor = 1.075/1.025 = 1.05

For Local Owner

For US owner:

Hence, we can see here that US owner will earn = Pt 59 million = $59.00/13.69 = $4.32mn

Hence, we can say that both should involve and invest in the project.

| Year | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Initial Investment | 45 | ||||||||||

| Revenues | 82.5 | 88.69 | 95.34 | 102.49 | 110.18 | 118.44 | 127.32 | 136.87 | 147.14 | 158.17 | |

| Raw Materials cost | 30 | 32.25 | 34.67 | 37.27 | 40.06 | 43.07 | 46.30 | 49.77 | 53.50 | 57.52 | |

| License and services cost | 17.83 | 18.70 | 19.61 | 20.57 | 21.57 | 22.62 | 23.73 | 24.88 | 26.10 | 27.37 | |

| Profit | -45 | 34.67 | 37.74 | 41.06 | 44.65 | 48.54 | 52.75 | 57.30 | 62.22 | 67.53 | 73.28 |

| Tax @25% | 8.67 | 9.43 | 10.26 | 11.16 | 12.14 | 13.19 | 14.32 | 15.55 | 16.88 | 18.32 | |

| Net Profit | 26.00 | 28.30 | 30.79 | 33.49 | 36.41 | 39.56 | 42.97 | 46.66 | 50.65 | 54.96 | |

| Discount factor @25% + inflation rate | 0.769 | 0.592 | 0.455 | 0.350 | 0.269 | 0.207 | 0.159 | 0.123 | 0.094 | 0.073 | |

| PV | -45 | 20.00 | 16.75 | 14.02 | 11.73 | 9.81 | 8.20 | 6.85 | 5.72 | 4.78 | 3.99 |

| NPV | 56.83 |

Homework Sourse

Homework Sourse