lems Seved Help Save Exit Submit Check my work Castle Inc ha

Solution

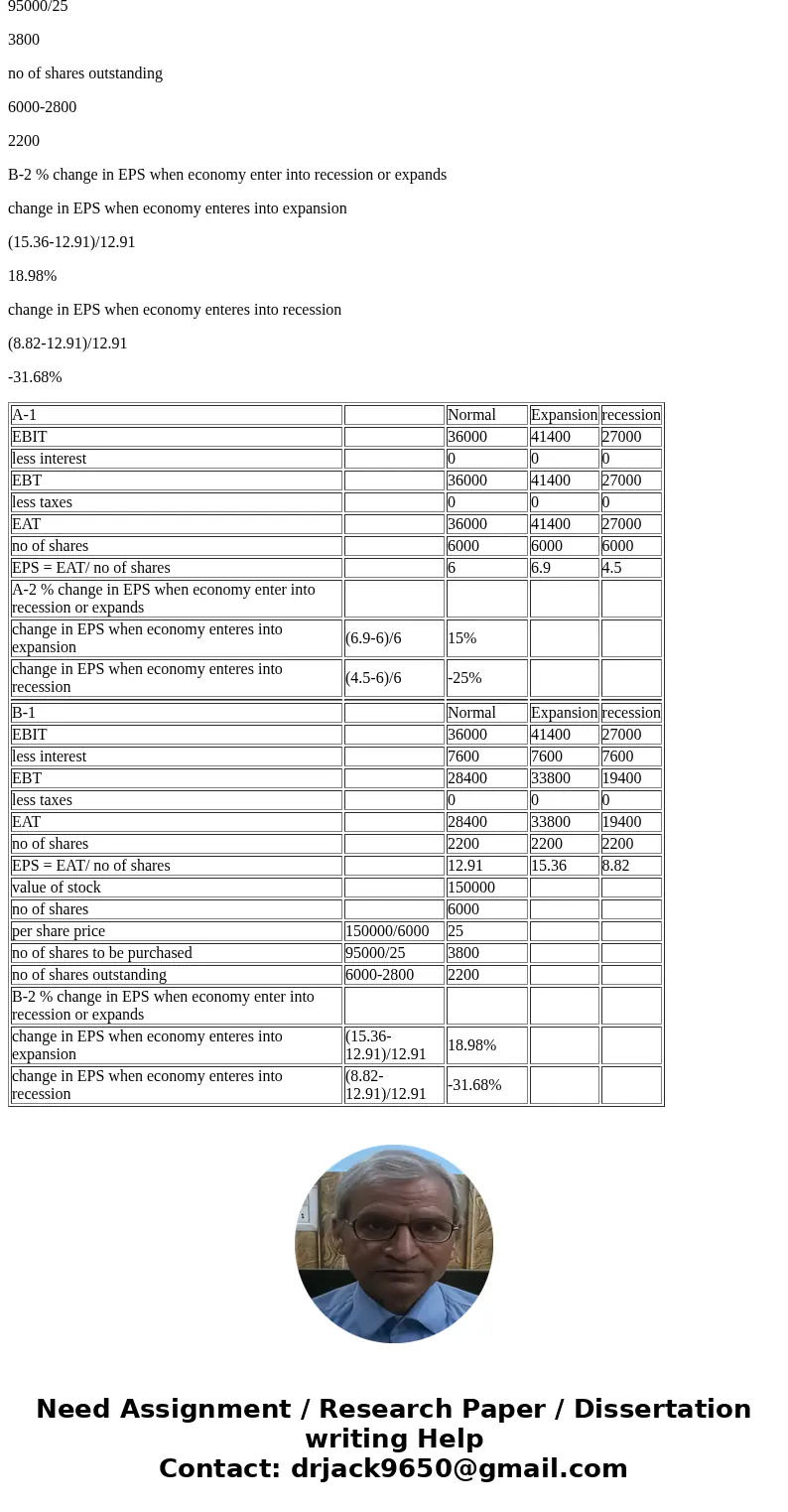

A-1

Normal

Expansion

recession

EBIT

36000

41400

27000

less interest

0

0

0

EBT

36000

41400

27000

less taxes

0

0

0

EAT

36000

41400

27000

no of shares

6000

6000

6000

EPS = EAT/ no of shares

6

6.9

4.5

A-2 % change in EPS when economy enter into recession or expands

change in EPS when economy enteres into expansion

(6.9-6)/6

15%

change in EPS when economy enteres into recession

(4.5-6)/6

-25%

B-1

Normal

Expansion

recession

EBIT

36000

41400

27000

less interest

7600

7600

7600

EBT

28400

33800

19400

less taxes

0

0

0

EAT

28400

33800

19400

no of shares

2200

2200

2200

EPS = EAT/ no of shares

12.91

15.36

8.82

value of stock

150000

no of shares

6000

per share price

150000/6000

25

no of shares to be purchased

95000/25

3800

no of shares outstanding

6000-2800

2200

B-2 % change in EPS when economy enter into recession or expands

change in EPS when economy enteres into expansion

(15.36-12.91)/12.91

18.98%

change in EPS when economy enteres into recession

(8.82-12.91)/12.91

-31.68%

| A-1 | Normal | Expansion | recession | |

| EBIT | 36000 | 41400 | 27000 | |

| less interest | 0 | 0 | 0 | |

| EBT | 36000 | 41400 | 27000 | |

| less taxes | 0 | 0 | 0 | |

| EAT | 36000 | 41400 | 27000 | |

| no of shares | 6000 | 6000 | 6000 | |

| EPS = EAT/ no of shares | 6 | 6.9 | 4.5 | |

| A-2 % change in EPS when economy enter into recession or expands | ||||

| change in EPS when economy enteres into expansion | (6.9-6)/6 | 15% | ||

| change in EPS when economy enteres into recession | (4.5-6)/6 | -25% | ||

| B-1 | Normal | Expansion | recession | |

| EBIT | 36000 | 41400 | 27000 | |

| less interest | 7600 | 7600 | 7600 | |

| EBT | 28400 | 33800 | 19400 | |

| less taxes | 0 | 0 | 0 | |

| EAT | 28400 | 33800 | 19400 | |

| no of shares | 2200 | 2200 | 2200 | |

| EPS = EAT/ no of shares | 12.91 | 15.36 | 8.82 | |

| value of stock | 150000 | |||

| no of shares | 6000 | |||

| per share price | 150000/6000 | 25 | ||

| no of shares to be purchased | 95000/25 | 3800 | ||

| no of shares outstanding | 6000-2800 | 2200 | ||

| B-2 % change in EPS when economy enter into recession or expands | ||||

| change in EPS when economy enteres into expansion | (15.36-12.91)/12.91 | 18.98% | ||

| change in EPS when economy enteres into recession | (8.82-12.91)/12.91 | -31.68% |

Homework Sourse

Homework Sourse