Question2 5 pts If MARR7 which alternative should be selecte

Solution

Both projects can be accepted as IRR of both the projects is greater than MARR and NPV of both Projects is positive.

Hence option “Either Alt. A or B” is correct answer.

Explanation:

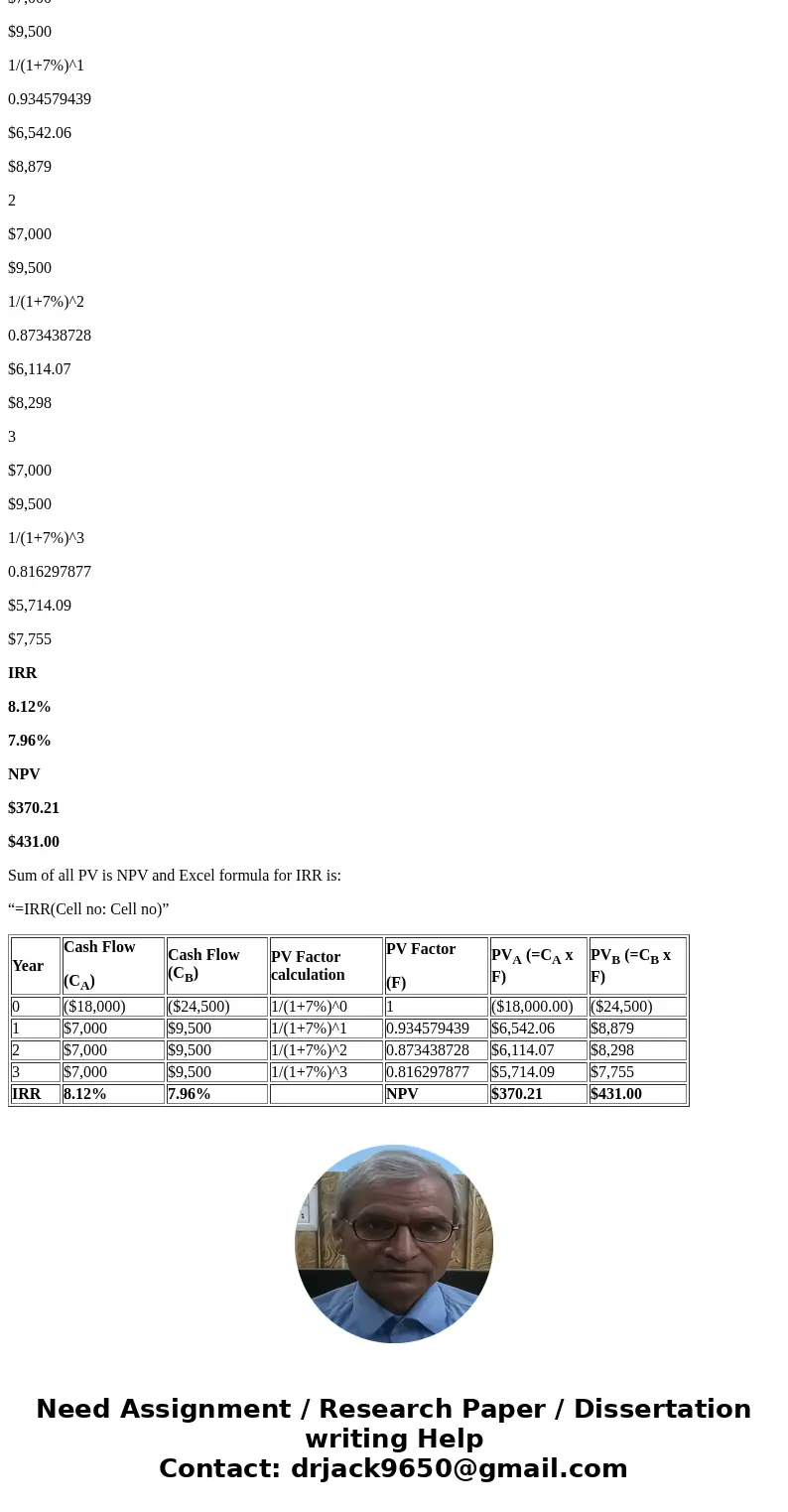

Computation of IRR and NPV of both the projects:

Year

Cash Flow

(CA)

Cash Flow (CB)

PV Factor calculation

PV Factor

(F)

PVA (=CA x F)

PVB (=CB x F)

0

($18,000)

($24,500)

1/(1+7%)^0

1

($18,000.00)

($24,500)

1

$7,000

$9,500

1/(1+7%)^1

0.934579439

$6,542.06

$8,879

2

$7,000

$9,500

1/(1+7%)^2

0.873438728

$6,114.07

$8,298

3

$7,000

$9,500

1/(1+7%)^3

0.816297877

$5,714.09

$7,755

IRR

8.12%

7.96%

NPV

$370.21

$431.00

Sum of all PV is NPV and Excel formula for IRR is:

“=IRR(Cell no: Cell no)”

| Year | Cash Flow (CA) | Cash Flow (CB) | PV Factor calculation | PV Factor (F) | PVA (=CA x F) | PVB (=CB x F) |

| 0 | ($18,000) | ($24,500) | 1/(1+7%)^0 | 1 | ($18,000.00) | ($24,500) |

| 1 | $7,000 | $9,500 | 1/(1+7%)^1 | 0.934579439 | $6,542.06 | $8,879 |

| 2 | $7,000 | $9,500 | 1/(1+7%)^2 | 0.873438728 | $6,114.07 | $8,298 |

| 3 | $7,000 | $9,500 | 1/(1+7%)^3 | 0.816297877 | $5,714.09 | $7,755 |

| IRR | 8.12% | 7.96% | NPV | $370.21 | $431.00 |

Homework Sourse

Homework Sourse