Question 2 Considering the following data for a project begu

Solution

1. Calculation of Revenue to be recognized in both years.

2017:

Percentage of Completion = Total costs incurred in 2017 / estimated cost of construction

Total cost incurred in 2017 = 200,000

Total Estimated costs = 200,000 + 700,000 = 900,000

Percentage of Completion in 2017 = 200,000 / 900,000 = 22.2%

Revenue to be booked in 2017 = Total contract price x percentage of completion

= 1,500,000 x 22.2% = $333,000

2018:

Percentage of completion = (200,000 + 200,000) / (200,000 + 200,000 + 400,000)

= 50%

Total Revenue to be booked = 1,500,000 x 50% = $750,000

Revenue already booked in 2017 = $333,000

Revenue to be booked in 2018 = 750,000 - 333,000 = $417,000

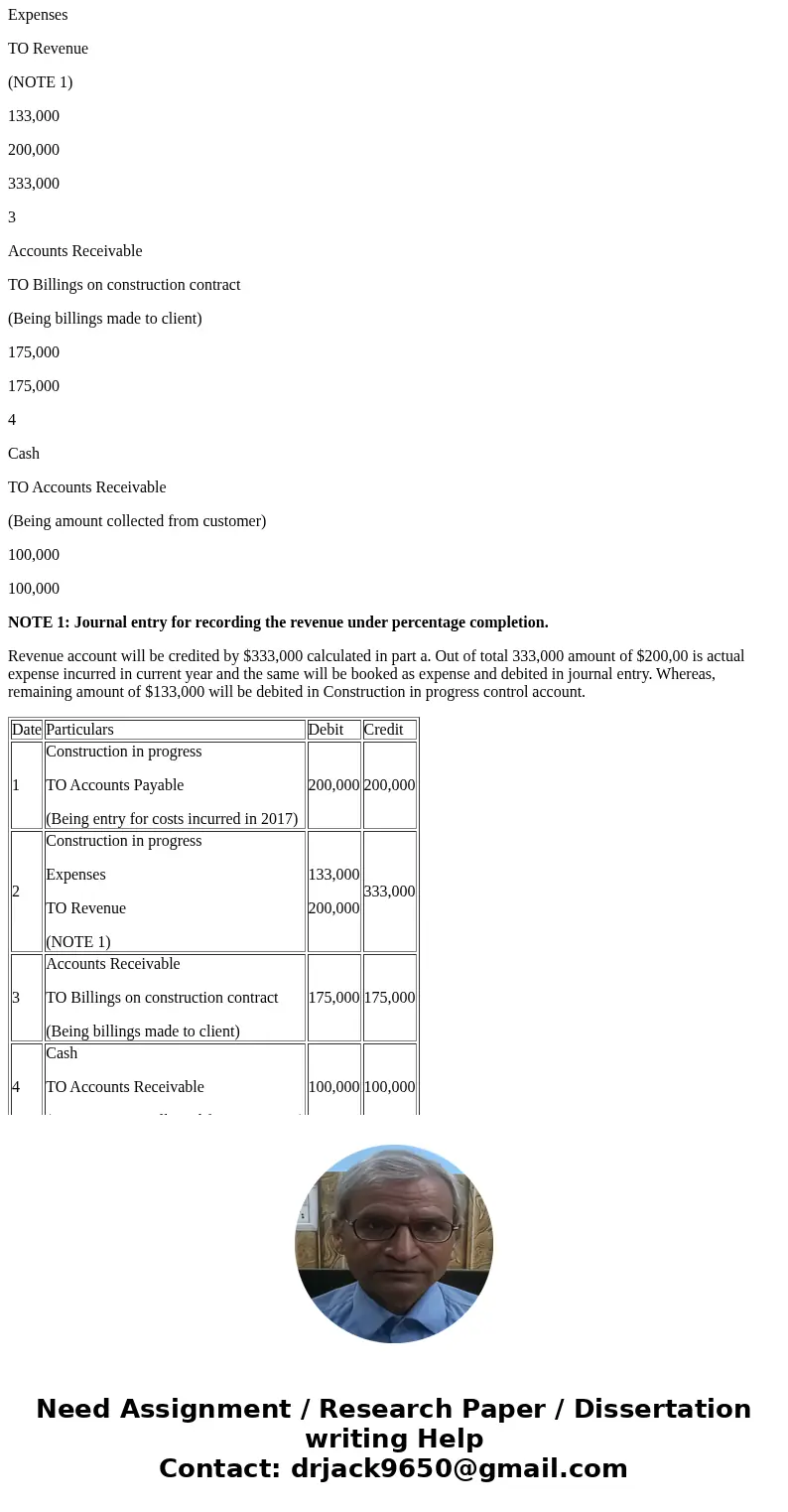

C. Journal Entries for 2017

Date

Particulars

Debit

Credit

1

Construction in progress

TO Accounts Payable

(Being entry for costs incurred in 2017)

200,000

200,000

2

Construction in progress

Expenses

TO Revenue

(NOTE 1)

133,000

200,000

333,000

3

Accounts Receivable

TO Billings on construction contract

(Being billings made to client)

175,000

175,000

4

Cash

TO Accounts Receivable

(Being amount collected from customer)

100,000

100,000

NOTE 1: Journal entry for recording the revenue under percentage completion.

Revenue account will be credited by $333,000 calculated in part a. Out of total 333,000 amount of $200,00 is actual expense incurred in current year and the same will be booked as expense and debited in journal entry. Whereas, remaining amount of $133,000 will be debited in Construction in progress control account.

| Date | Particulars | Debit | Credit |

| 1 | Construction in progress TO Accounts Payable (Being entry for costs incurred in 2017) | 200,000 | 200,000 |

| 2 | Construction in progress Expenses TO Revenue (NOTE 1) | 133,000 200,000 | 333,000 |

| 3 | Accounts Receivable TO Billings on construction contract (Being billings made to client) | 175,000 | 175,000 |

| 4 | Cash TO Accounts Receivable (Being amount collected from customer) | 100,000 | 100,000 |

Homework Sourse

Homework Sourse