2 Explain why the income statement is not a good representat

Solution

Net cash flows are different than Income statement.

Net cash flows are pure net cash of an entity. The Income statement is not necessary a pure cash element.

The present value is applied on money or cash directly hence it gives understandable or comprehensive result which can be related to time value of money concept.

Income statement has few non-cash items like depreciation, intangible assets written off etc. which finally results in lower tax. Lower tax means lesser cash outflow. As non-cash items deflate the Income statement hence it will result in lower present value. Whereas in case of Net Cash flows we will experience higher PV because net cash flows ignore non-cash items.

Hence, income statement is not good representation of cash flow.

------------------

Average tax rate

Slab

Allocation of Income = I

Rate = R

Tax = I x R

0-50000

50000

15%

7500

50001-75000

75000

25%

18750

75001-100000

93700

34%

31858

Total

218,700

58,108

Average tax rate = Total tax / Total taxable income

Average tax rate = 58108/218700

Average tax rate = 26.57%

(We don’t have additional income information to calculate marginal tax rate, we will assume raise of income to $225000)

Now, let’s assume that taxable income raised to 225,000 then let’s calculate the marginal tax:

Slab

Allocation of Income = I

Rate = R

Tax

0-50000

50000

15%

7500

50001-75000

75000

25%

18750

75001-100000

100000

34%

34000

Total income

225000

60250

Marginal tax rate = Change in tax /Change in income

Marginal tax rate = 34.00%

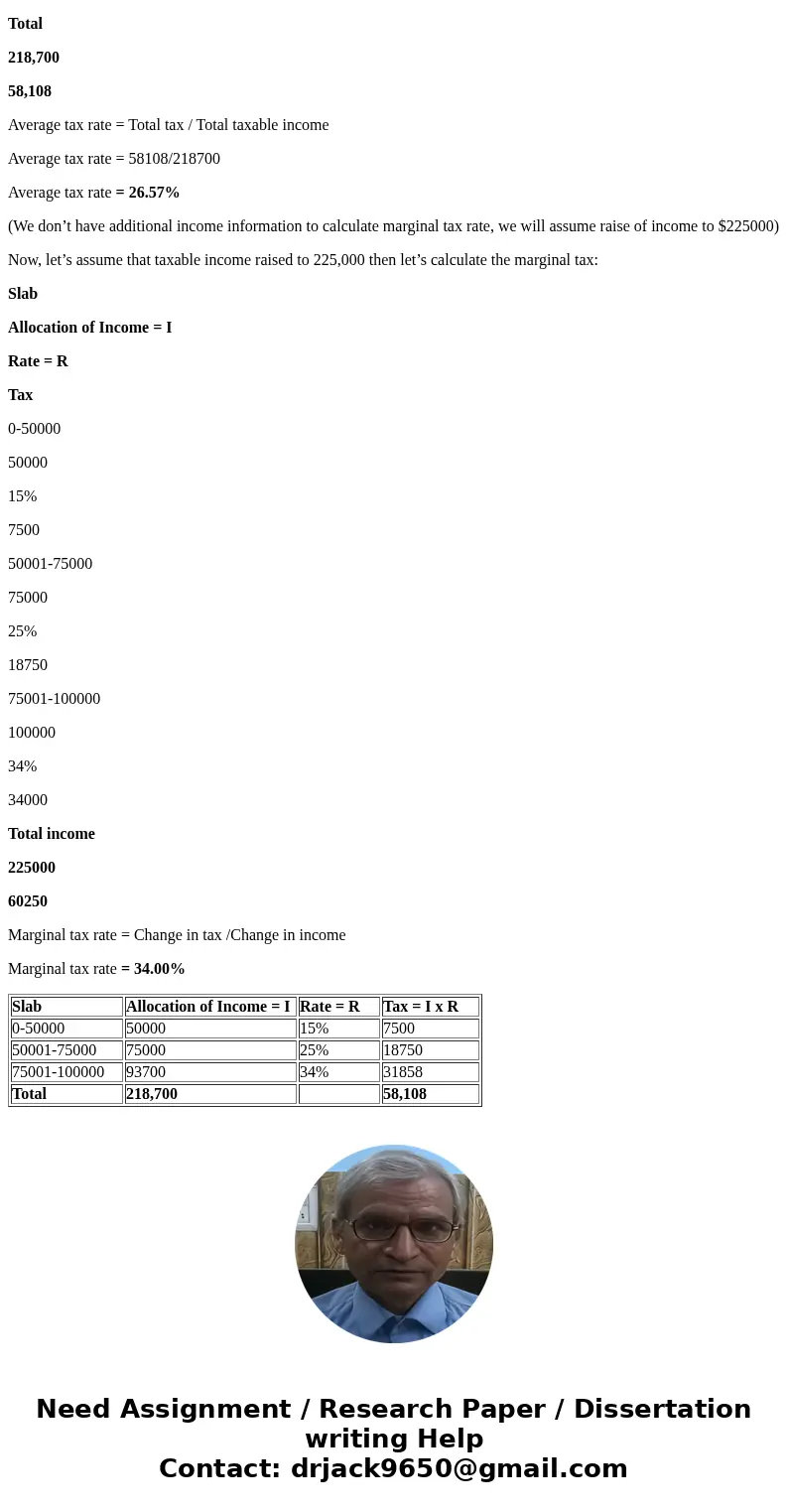

| Slab | Allocation of Income = I | Rate = R | Tax = I x R |

| 0-50000 | 50000 | 15% | 7500 |

| 50001-75000 | 75000 | 25% | 18750 |

| 75001-100000 | 93700 | 34% | 31858 |

| Total | 218,700 | 58,108 |

Homework Sourse

Homework Sourse