63 The Income Statement Problem 613 Loss Carryback and Carry

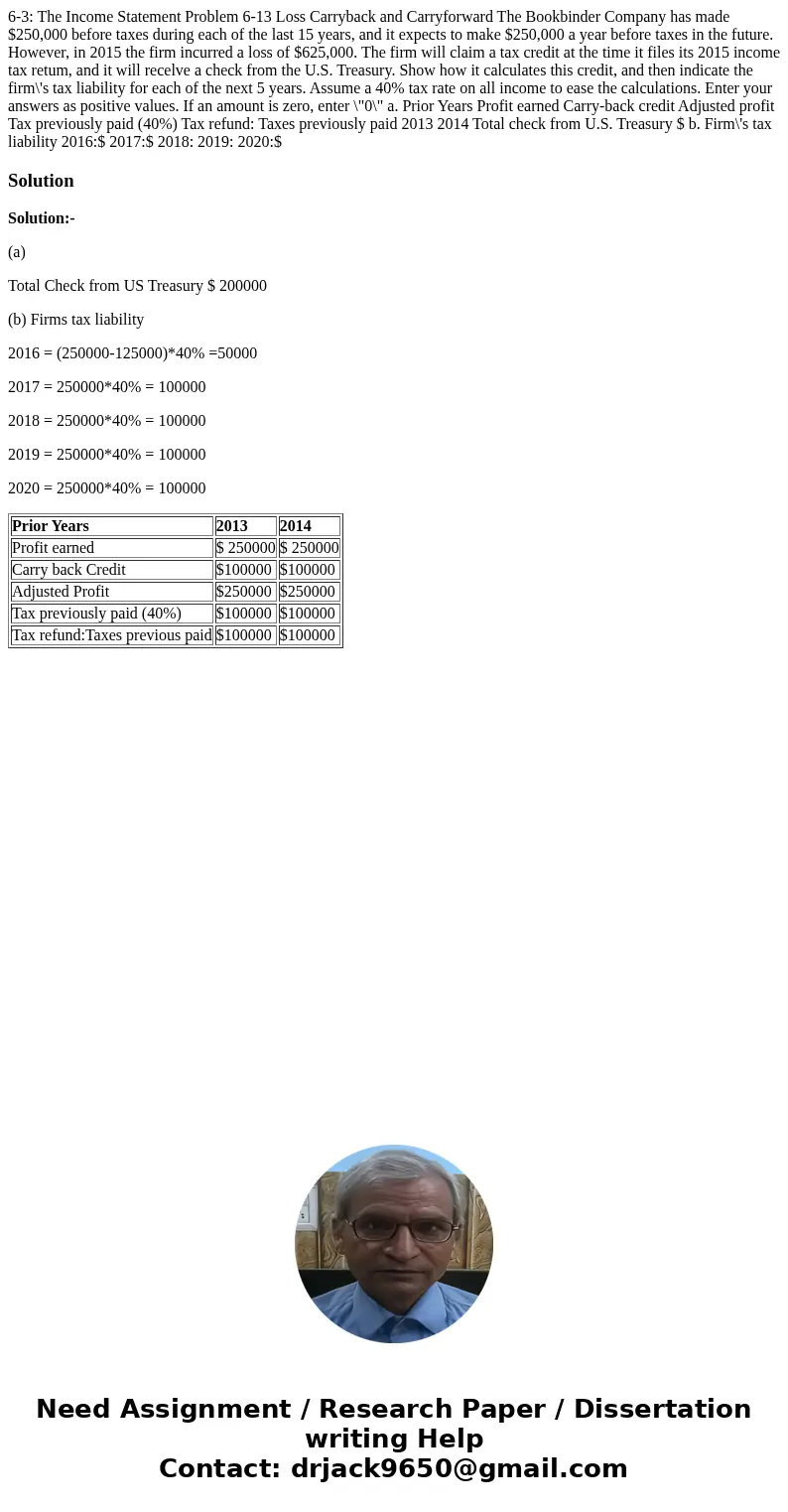

6-3: The Income Statement Problem 6-13 Loss Carryback and Carryforward The Bookbinder Company has made $250,000 before taxes during each of the last 15 years, and it expects to make $250,000 a year before taxes in the future. However, in 2015 the firm incurred a loss of $625,000. The firm will claim a tax credit at the time it files its 2015 income tax retum, and it will recelve a check from the U.S. Treasury. Show how it calculates this credit, and then indicate the firm\'s tax liability for each of the next 5 years. Assume a 40% tax rate on all income to ease the calculations. Enter your answers as positive values. If an amount is zero, enter \"0\" a. Prior Years Profit earned Carry-back credit Adjusted profit Tax previously paid (40%) Tax refund: Taxes previously paid 2013 2014 Total check from U.S. Treasury $ b. Firm\'s tax liability 2016:$ 2017:$ 2018: 2019: 2020:$

Solution

Solution:-

(a)

Total Check from US Treasury $ 200000

(b) Firms tax liability

2016 = (250000-125000)*40% =50000

2017 = 250000*40% = 100000

2018 = 250000*40% = 100000

2019 = 250000*40% = 100000

2020 = 250000*40% = 100000

| Prior Years | 2013 | 2014 |

| Profit earned | $ 250000 | $ 250000 |

| Carry back Credit | $100000 | $100000 |

| Adjusted Profit | $250000 | $250000 |

| Tax previously paid (40%) | $100000 | $100000 |

| Tax refund:Taxes previous paid | $100000 | $100000 |

Homework Sourse

Homework Sourse