Problem 201A ott Company uses a job order cost system and ap

Solution

1. Journal Entries.

S. no

Particulars

Debit

Credit

1

Raw Materials Inventory

TO Accounts Payable

(Being inventory purchased)

106,200

106,200

2

Salaries & Wages Expense

To Labor Payable

TO Payroll Taxes Payable

82,600

63,720

18,880

3

Manufacturing Overheads (20,060+23,600)

Depreciation Expense

Other Manufacturing Costs

TO Cash

TO Accumulated Depreciation

43,660

14,160

18,880

62,540

14,160

2. Journal Entries for assignment

S. no

Particulars

Debit

Credit

1

Work in Progress

TO Raw Materials Inventory

(11,800 + 46,020 + 35,400)

93,220

93,220

2

Work in progress

TO Salaries & Wages

59,000

59,000

3

Work in progress

TO Manufacturing Overheads

76,700

76,700

3. Journal Entry for completed job sheets

Job 50 & 51 are completed during the month. Therefore the costs of 50 & 51 will be journalized.

S. no

Particulars

Debit

Credit

1

Finished Goods Inventory

TO Work in progress

(81,420 + 110,920)

192,340

192,340

4. Journal entry for sale of job sheet

S. no

Particulars

Debit

Credit

1

Accounts Receivable

TO Sale of job 49

143,960

143,960

2

Accounts Receivable

TO Sale of job 50

186,440

186,440

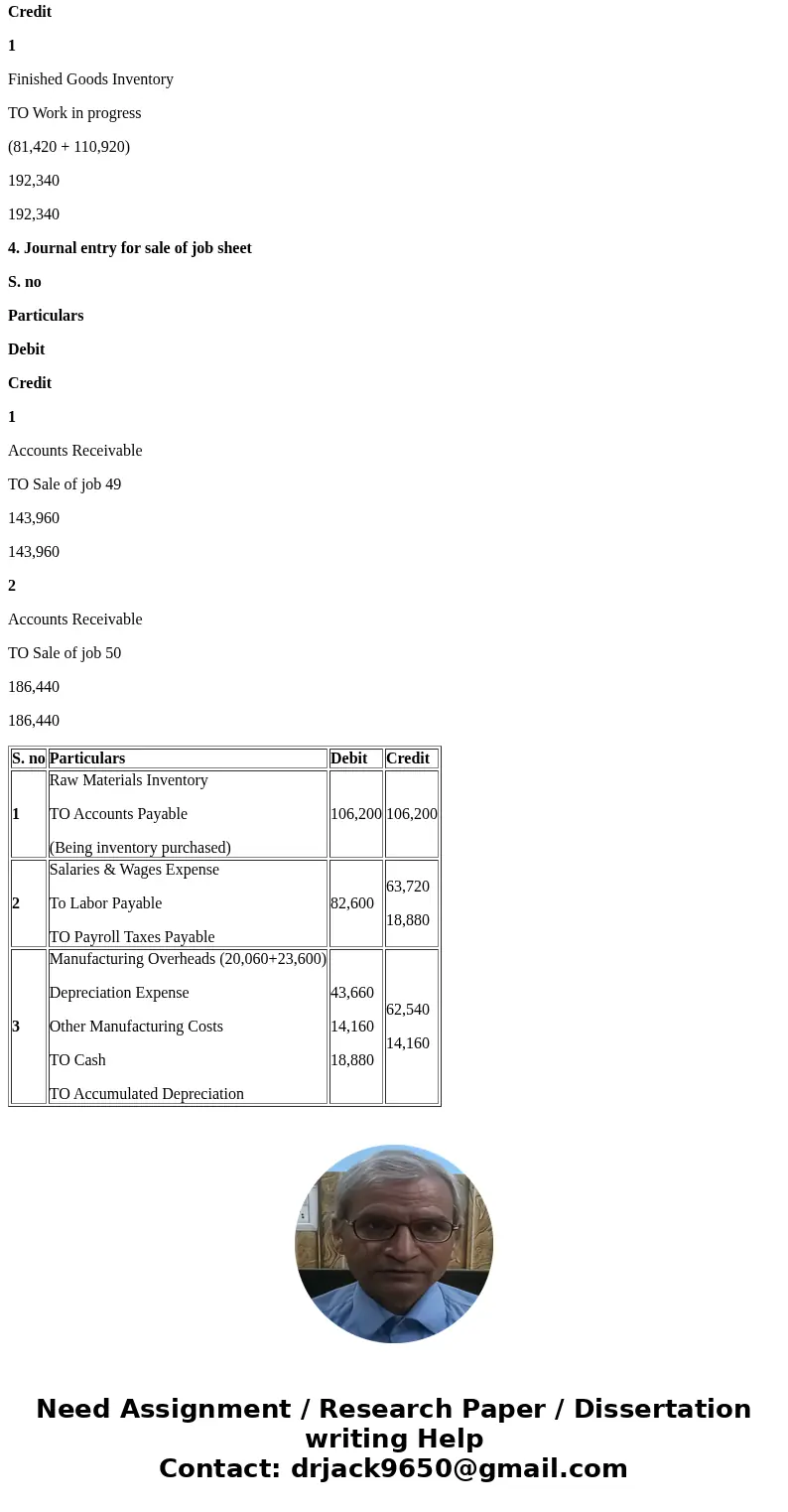

| S. no | Particulars | Debit | Credit |

| 1 | Raw Materials Inventory TO Accounts Payable (Being inventory purchased) | 106,200 | 106,200 |

| 2 | Salaries & Wages Expense To Labor Payable TO Payroll Taxes Payable | 82,600 | 63,720 18,880 |

| 3 | Manufacturing Overheads (20,060+23,600) Depreciation Expense Other Manufacturing Costs TO Cash TO Accumulated Depreciation | 43,660 14,160 18,880 | 62,540 14,160 |

Homework Sourse

Homework Sourse