Consider the cash flow for an investment project with MARR

\"Consider the cash flow for an investment project with MARR = 17.4%. Determine the annual equivalent worth for the project. The cash flow for years 0 through 4 in dollars is as follows:

-4,100

1,600

1,700

1,300

540\"

Solution

Year

Cash Flow

PV Factor Formula

PV Factor @ 17.4%

PV

0

$ (4,100.00)

1/(1+0.174)^0

1

$ (4,100.00)

1

$ 1,600.00

1/(1+0.174)^1

0.851788756

$ 1,362.86

2

$ 1,700.00

1/(1+0.174)^2

0.725544086

$ 1,233.42

3

$ 1,300.00

1/(1+0.174)^3

0.618010294

$ 803.41

4

$ 540.00

1/(1+0.174)^4

0.52641422

$ 284.26

NPV

$ (416.04)

Equivalent annual worth = NPV/Ar,t

Ar,t = [1 – 1/(1+r)t]/r

r = Rate of interest = 17.4 % or 0.174

t = No. of periods = 4

Ar,t = [1 – 1/(1+0.174)4]/0.174

= [1 – 1/ (1.174)4]/0.174

= [1 – (1/ 1.899644732)]/0.174

= (1 – 0.52641422)/0.174

= 0.47358578/0.174

= 2.721757356

Equivalent annual worth = $ (416.04)/ 2.721757356 = $ (152.86)

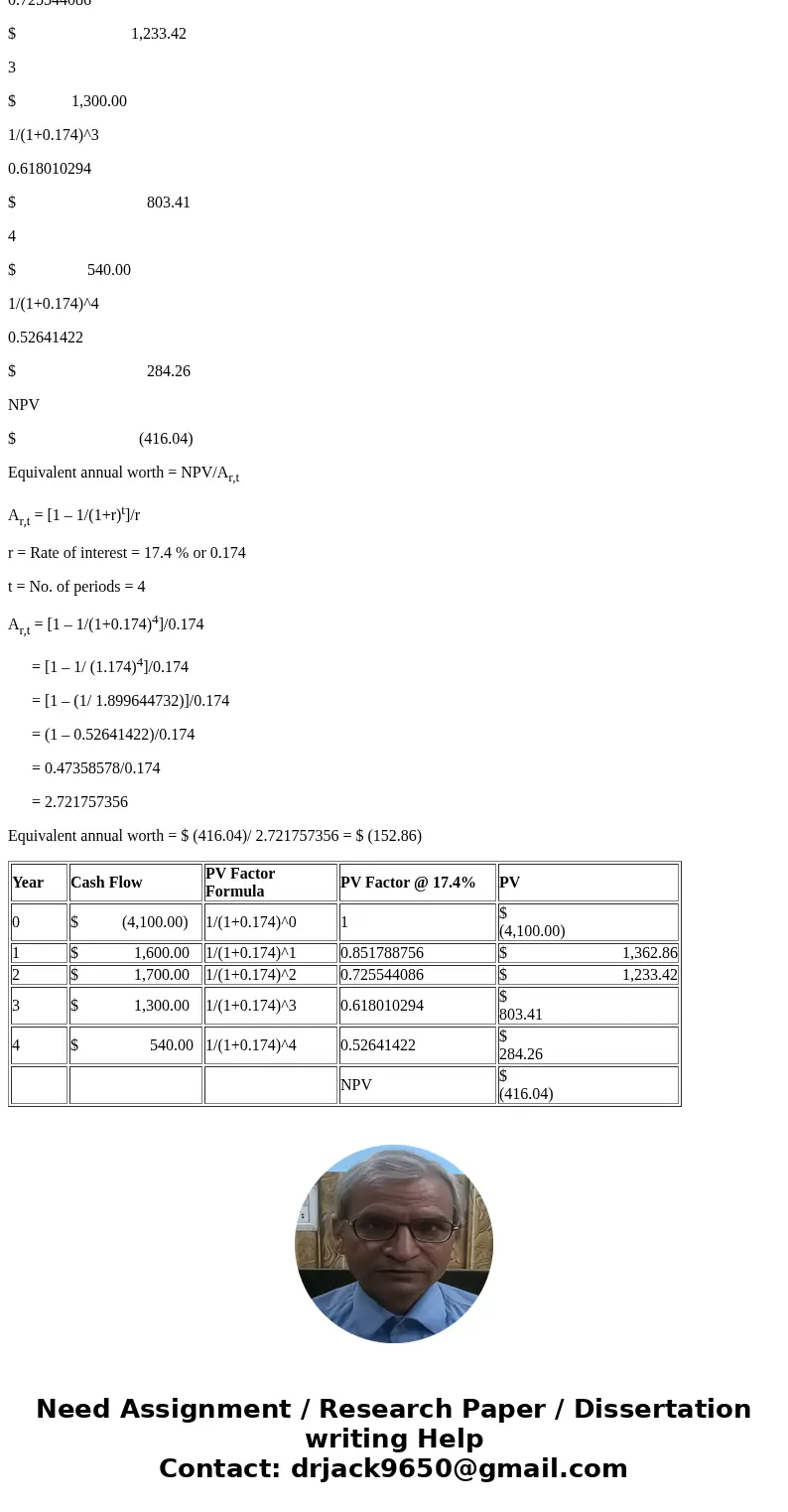

| Year | Cash Flow | PV Factor Formula | PV Factor @ 17.4% | PV |

| 0 | $ (4,100.00) | 1/(1+0.174)^0 | 1 | $ (4,100.00) |

| 1 | $ 1,600.00 | 1/(1+0.174)^1 | 0.851788756 | $ 1,362.86 |

| 2 | $ 1,700.00 | 1/(1+0.174)^2 | 0.725544086 | $ 1,233.42 |

| 3 | $ 1,300.00 | 1/(1+0.174)^3 | 0.618010294 | $ 803.41 |

| 4 | $ 540.00 | 1/(1+0.174)^4 | 0.52641422 | $ 284.26 |

| NPV | $ (416.04) |

Homework Sourse

Homework Sourse