C D eztomheducationcomhrntpx0488880083 14120981514919958390

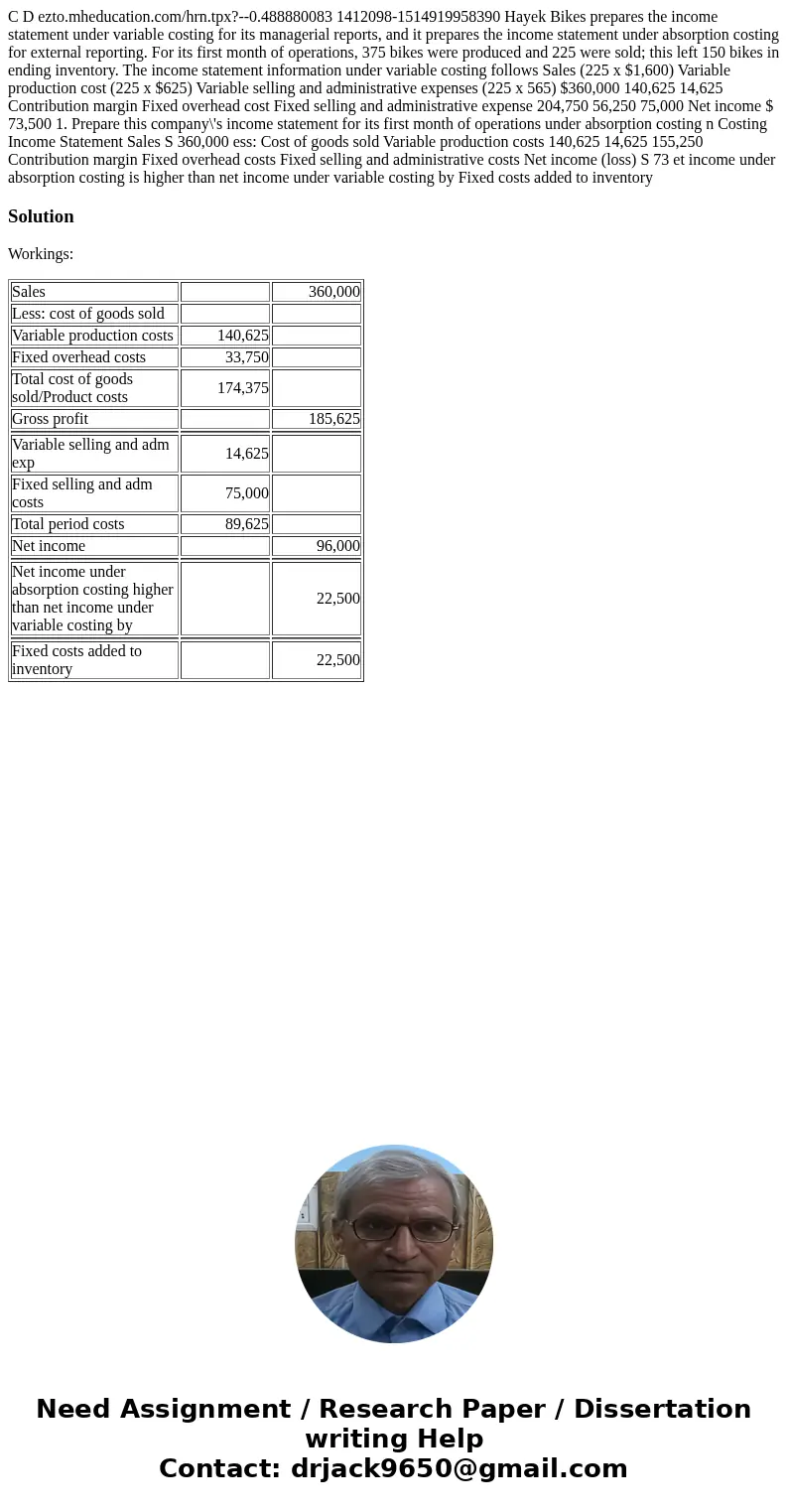

C D ezto.mheducation.com/hrn.tpx?--0.488880083 1412098-1514919958390 Hayek Bikes prepares the income statement under variable costing for its managerial reports, and it prepares the income statement under absorption costing for external reporting. For its first month of operations, 375 bikes were produced and 225 were sold; this left 150 bikes in ending inventory. The income statement information under variable costing follows Sales (225 x $1,600) Variable production cost (225 x $625) Variable selling and administrative expenses (225 x 565) $360,000 140,625 14,625 Contribution margin Fixed overhead cost Fixed selling and administrative expense 204,750 56,250 75,000 Net income $ 73,500 1. Prepare this company\'s income statement for its first month of operations under absorption costing n Costing Income Statement Sales S 360,000 ess: Cost of goods sold Variable production costs 140,625 14,625 155,250 Contribution margin Fixed overhead costs Fixed selling and administrative costs Net income (loss) S 73 et income under absorption costing is higher than net income under variable costing by Fixed costs added to inventory

Solution

Workings:

| Sales | 360,000 | |

| Less: cost of goods sold | ||

| Variable production costs | 140,625 | |

| Fixed overhead costs | 33,750 | |

| Total cost of goods sold/Product costs | 174,375 | |

| Gross profit | 185,625 | |

| Variable selling and adm exp | 14,625 | |

| Fixed selling and adm costs | 75,000 | |

| Total period costs | 89,625 | |

| Net income | 96,000 | |

| Net income under absorption costing higher than net income under variable costing by | 22,500 | |

| Fixed costs added to inventory | 22,500 |

Homework Sourse

Homework Sourse