Fesler Inc acquired all of the outstanding common stock of P

Fesler Inc. acquired all of the outstanding common stock of Pickett Company on January 1, 2017. Annual amortization of $22,000 resulted from this transaction. On the date of the acquisition, Fesler reported retained earnings of $520,000 while Pickett reported a $240,000 balance for retained earnings. Fesler reported net income of $100,000 in 2017 and $68,000 in 2018, and paid dividends of $25,000 in dividends each year. Pickett reported net income of $24,000 in 2017 and $36,000 in 2018, and paid dividends of $10,000 in dividends each year.

If the parent’s net income reflected use of the initial value method, what were the consolidated retained earnings on December 31, 2018?

Solution

Under the equity technique, the parent gathers auxiliary income and amortization expense (related with the securing cost in a buy) in an indistinguishable way from in the consolidation procedure. The equity strategy parallels consolidation. Along these lines, the parent\'s net pay and held income every year will rise to the merged sums

Fesler

Pickett

Retained earnings

520,000

240,000

Annual amortization

(22,000)

2012 net income

100,000

24,000

2013 net income

68,000

36,000

Dividend 2012

(25,000)

(10,000)

Dividend 2013

(25,000)

(10,000)

Net

616,000

280,000

Consolidated

896,000

--------------------------------------------------------------------------------------------------------------------------

Hope that helps.

Feel free to comment if you need further assistance J

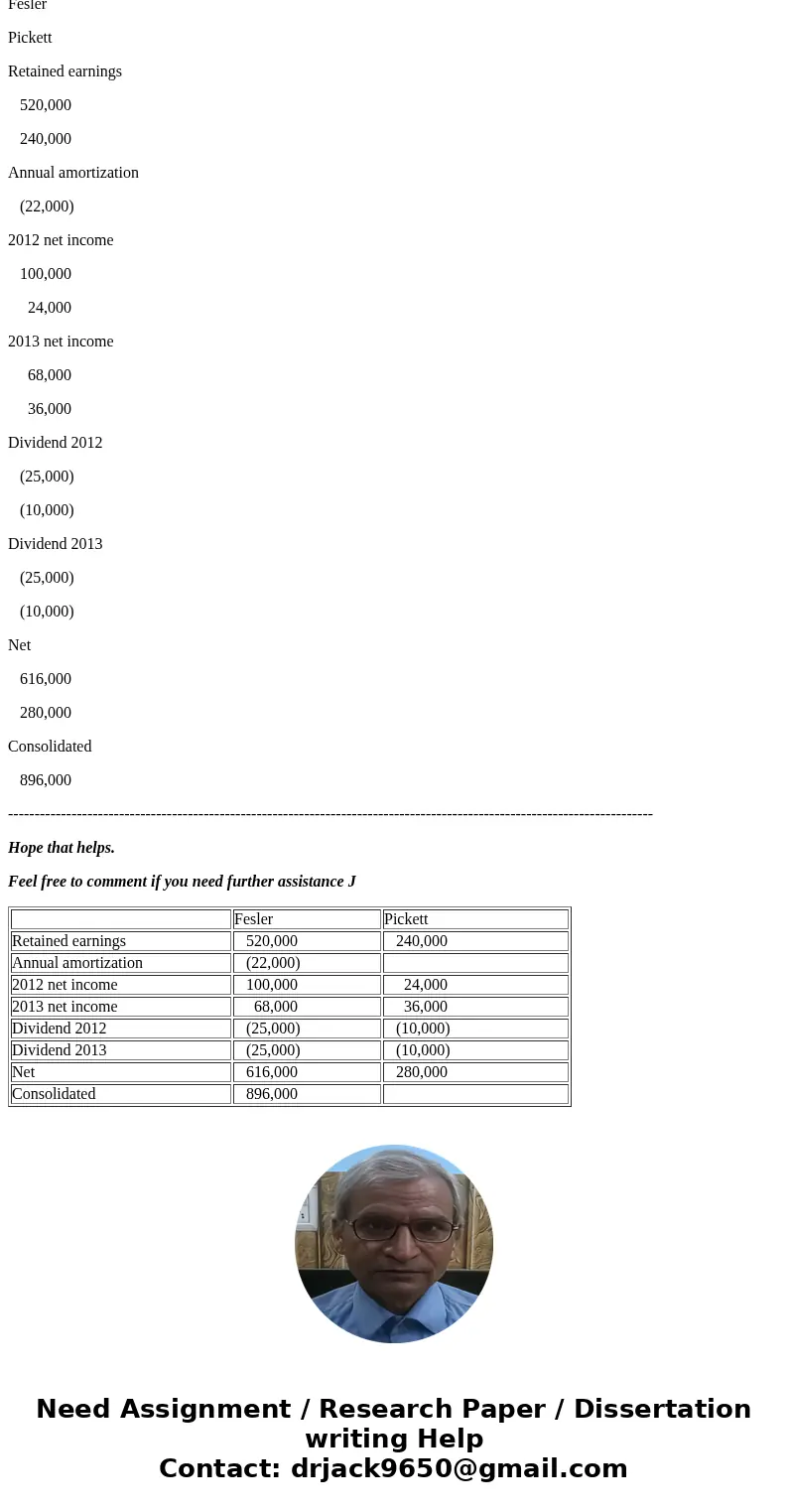

| Fesler | Pickett | |

| Retained earnings | 520,000 | 240,000 |

| Annual amortization | (22,000) | |

| 2012 net income | 100,000 | 24,000 |

| 2013 net income | 68,000 | 36,000 |

| Dividend 2012 | (25,000) | (10,000) |

| Dividend 2013 | (25,000) | (10,000) |

| Net | 616,000 | 280,000 |

| Consolidated | 896,000 |

Homework Sourse

Homework Sourse