Your firm is considering a proposed project which lasts thre

Your firm is considering a proposed project, which lasts three years and has an initial investment of $200,000. The after-tax operating cash flows (OCFs) are estimated at $60,000 for year one, $120,000 for year two, and $135,000 for year three. The firm has a target debt/equity ratio of 1.2. The firm\'s cost of equity is 14 percent and its cost of debt is 9 percent. The tax rate is 34 percent. Please answer the following:

Calculate the profitability index. Should the firm accept the project?

Calculate the payback method. Should the firm accept the project?

Solution

Debt/ equity =1.2/1

Debt =

We= weight of Equity=1

Ke= Cost of Equity =14% or 0.14

Wd= weight of Debt=1.2

Kd= Cost of Debt =9% or 0.09

T= tax rate =34% or 0.34

WACC= We x Ke +Wd x Kd(1-t)

= 1/ 2.2 x 0.14 +1.2/2.2 x 0.09 x (1-0.34)

=0.454545 x 0.14 + 0.545455 x 0.09 x 0.66

=0.063636 +0.0324

=0.096036

=9.60%

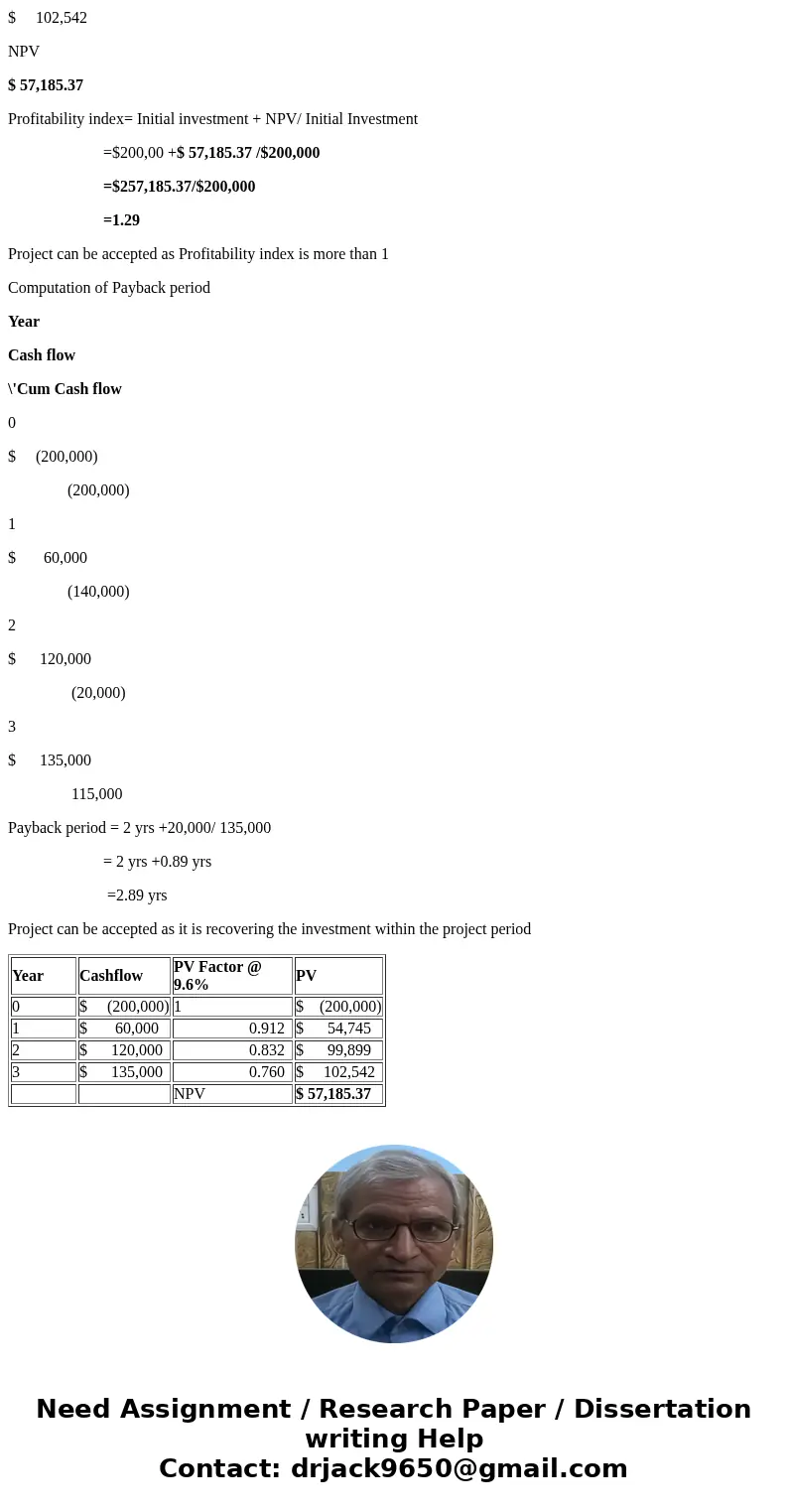

Year

Cashflow

PV Factor @ 9.6%

PV

0

$ (200,000)

1

$ (200,000)

1

$ 60,000

0.912

$ 54,745

2

$ 120,000

0.832

$ 99,899

3

$ 135,000

0.760

$ 102,542

NPV

$ 57,185.37

Profitability index= Initial investment + NPV/ Initial Investment

=$200,00 +$ 57,185.37 /$200,000

=$257,185.37/$200,000

=1.29

Project can be accepted as Profitability index is more than 1

Computation of Payback period

Year

Cash flow

\'Cum Cash flow

0

$ (200,000)

(200,000)

1

$ 60,000

(140,000)

2

$ 120,000

(20,000)

3

$ 135,000

115,000

Payback period = 2 yrs +20,000/ 135,000

= 2 yrs +0.89 yrs

=2.89 yrs

Project can be accepted as it is recovering the investment within the project period

| Year | Cashflow | PV Factor @ 9.6% | PV |

| 0 | $ (200,000) | 1 | $ (200,000) |

| 1 | $ 60,000 | 0.912 | $ 54,745 |

| 2 | $ 120,000 | 0.832 | $ 99,899 |

| 3 | $ 135,000 | 0.760 | $ 102,542 |

| NPV | $ 57,185.37 |

Homework Sourse

Homework Sourse