26 osvier Corporation has an actovitybased costing system wi

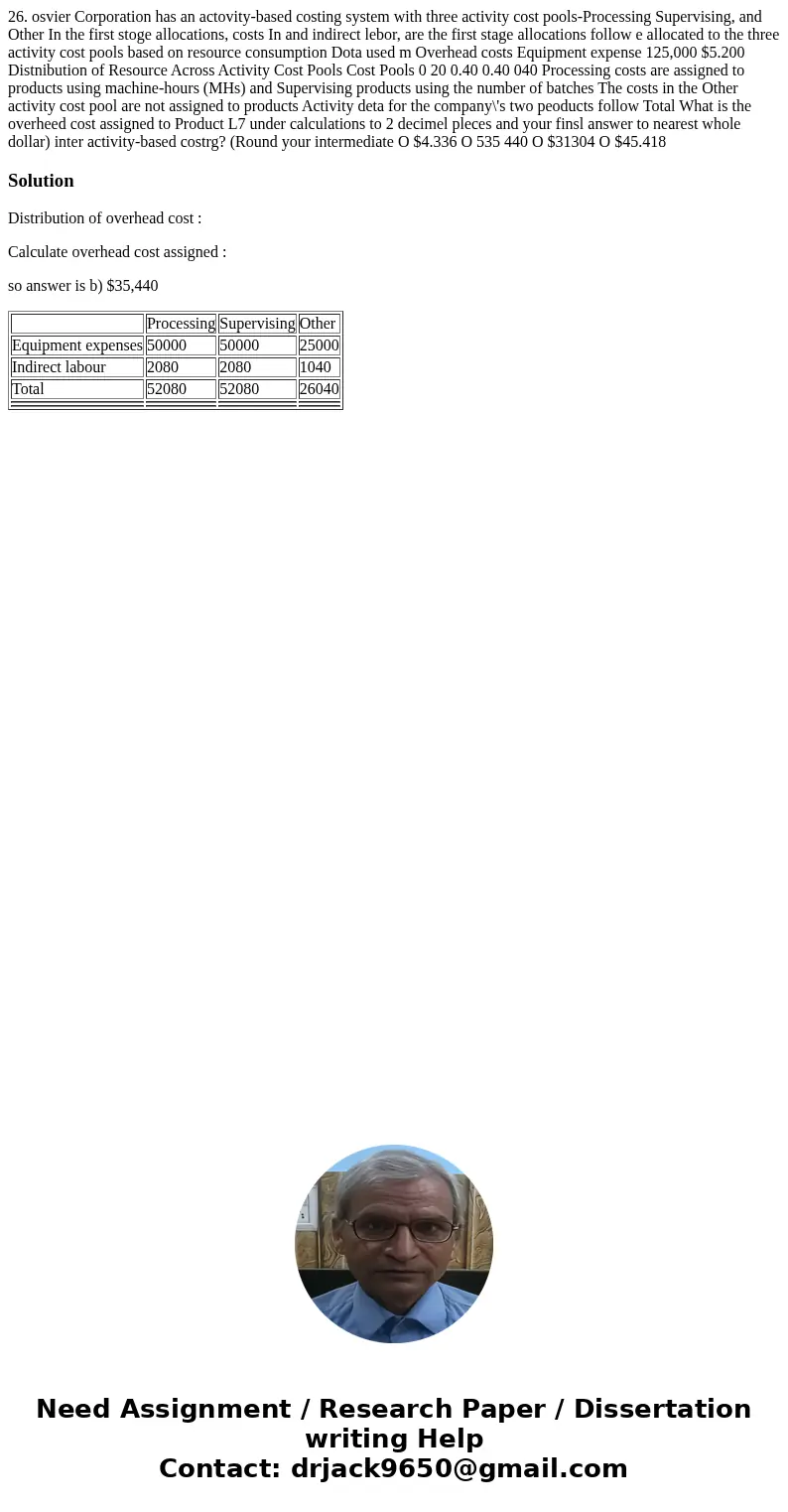

26. osvier Corporation has an actovity-based costing system with three activity cost pools-Processing Supervising, and Other In the first stoge allocations, costs In and indirect lebor, are the first stage allocations follow e allocated to the three activity cost pools based on resource consumption Dota used m Overhead costs Equipment expense 125,000 $5.200 Distnibution of Resource Across Activity Cost Pools Cost Pools 0 20 0.40 0.40 040 Processing costs are assigned to products using machine-hours (MHs) and Supervising products using the number of batches The costs in the Other activity cost pool are not assigned to products Activity deta for the company\'s two peoducts follow Total What is the overheed cost assigned to Product L7 under calculations to 2 decimel pleces and your finsl answer to nearest whole dollar) inter activity-based costrg? (Round your intermediate O $4.336 O 535 440 O $31304 O $45.418

Solution

Distribution of overhead cost :

Calculate overhead cost assigned :

so answer is b) $35,440

| Processing | Supervising | Other | |

| Equipment expenses | 50000 | 50000 | 25000 |

| Indirect labour | 2080 | 2080 | 1040 |

| Total | 52080 | 52080 | 26040 |

Homework Sourse

Homework Sourse