Dirt Bikes Mountain Racing Bikes Bikes Sales Variable manufa

Solution

Answer:

1

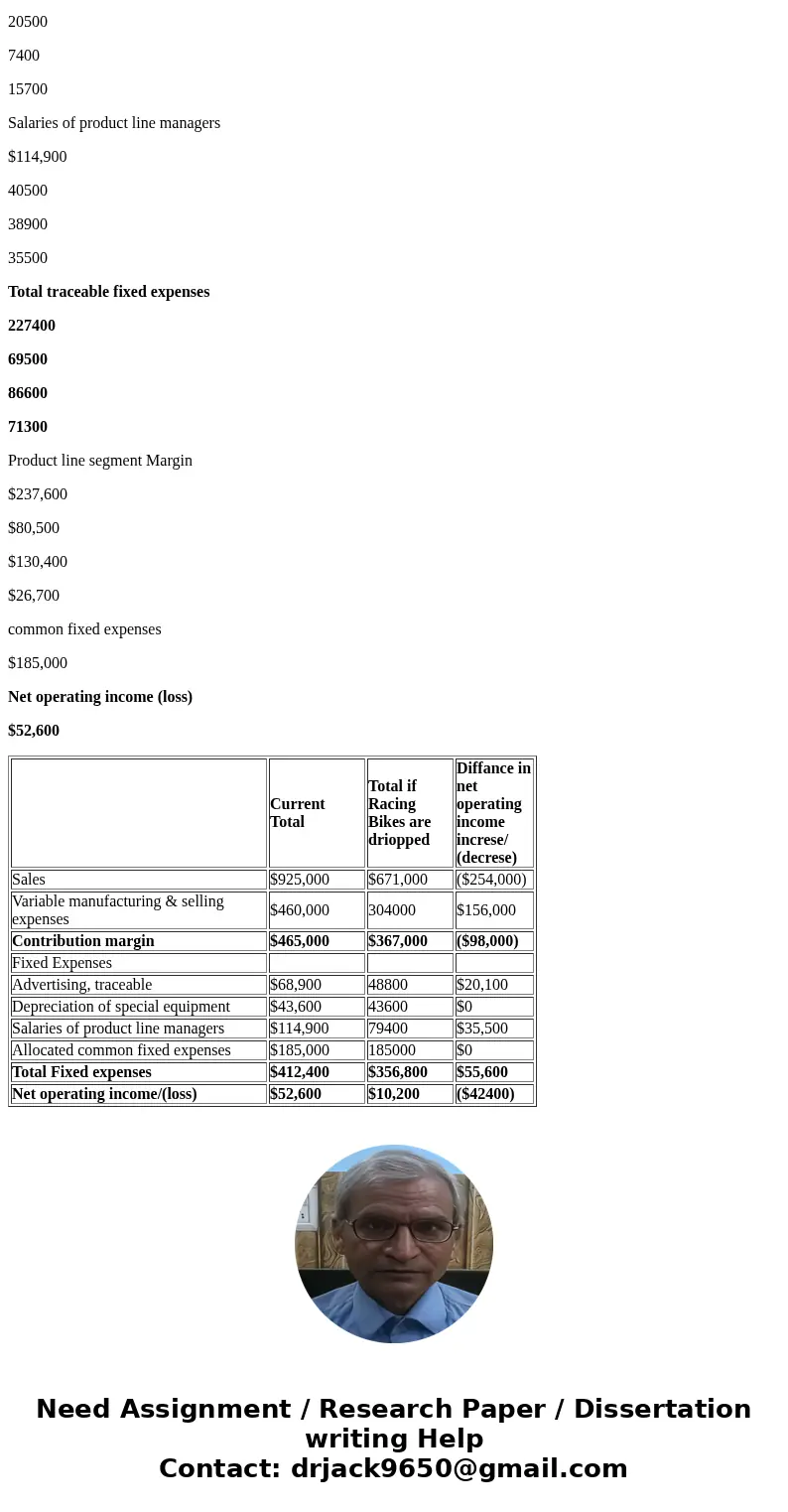

We can calculate the Financial advantage/(disadvantage) per quarter of discontinuing Racing bikes as under

Current

Total

Total if Racing Bikes are driopped

Diffance in

net operating income

increse/ (decrese)

Sales

$925,000

$671,000

($254,000)

Variable manufacturing & selling expenses

$460,000

304000

$156,000

Contribution margin

$465,000

$367,000

($98,000)

Fixed Expenses

Advertising, traceable

$68,900

48800

$20,100

Depreciation of special equipment

$43,600

43600

$0

Salaries of product line managers

$114,900

79400

$35,500

Allocated common fixed expenses

$185,000

185000

$0

Total Fixed expenses

$412,400

$356,800

$55,600

Net operating income/(loss)

$52,600

$10,200

($42400)

As we can see from the above calculation that, company has Financial disadvantage per quarter of discontinuing Racing bikes by $42,400

_________________________________________________________________

2

No,

Explanation to the answer:

company should not discontinue the production and sell of racing bikes because becuase dropping racing bike reduce the net operating income because of the higher fixed expenses allocation cost

____________________________________________________________________

3

Segmented Income Statement

Total

Dirt Bikes

Mountain Bikes

Racing Bikes

Sales

$925,000

$262,000

$409,000

$254,000

Variable manufacturing & selling expenses

$460,000

112000

192000

156000

Contribution margin (loss)

$465,000

$150,000

$217,000

$98,000

Traceable fixed expenses:

Advertising

$68,900

8500

40300

20100

Depreciation of special equipment

$43,600

20500

7400

15700

Salaries of product line managers

$114,900

40500

38900

35500

Total traceable fixed expenses

227400

69500

86600

71300

Product line segment Margin

$237,600

$80,500

$130,400

$26,700

common fixed expenses

$185,000

Net operating income (loss)

$52,600

| Current | Total if Racing Bikes are driopped | Diffance in | |

| Sales | $925,000 | $671,000 | ($254,000) |

| Variable manufacturing & selling expenses | $460,000 | 304000 | $156,000 |

| Contribution margin | $465,000 | $367,000 | ($98,000) |

| Fixed Expenses | |||

| Advertising, traceable | $68,900 | 48800 | $20,100 |

| Depreciation of special equipment | $43,600 | 43600 | $0 |

| Salaries of product line managers | $114,900 | 79400 | $35,500 |

| Allocated common fixed expenses | $185,000 | 185000 | $0 |

| Total Fixed expenses | $412,400 | $356,800 | $55,600 |

| Net operating income/(loss) | $52,600 | $10,200 | ($42400) |

Homework Sourse

Homework Sourse