Mortgage Extra Credit Problem 15 points Due Last day of clas

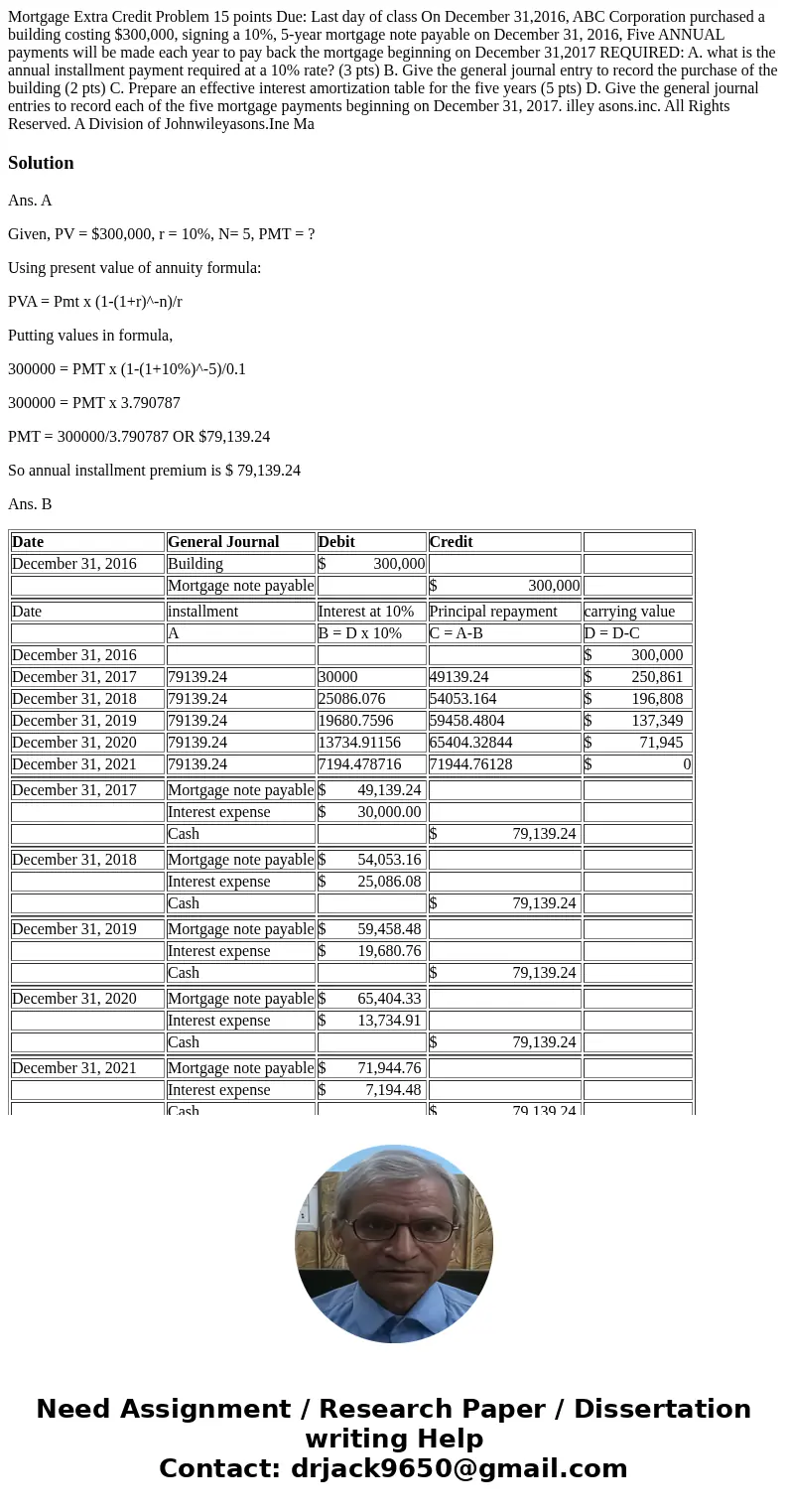

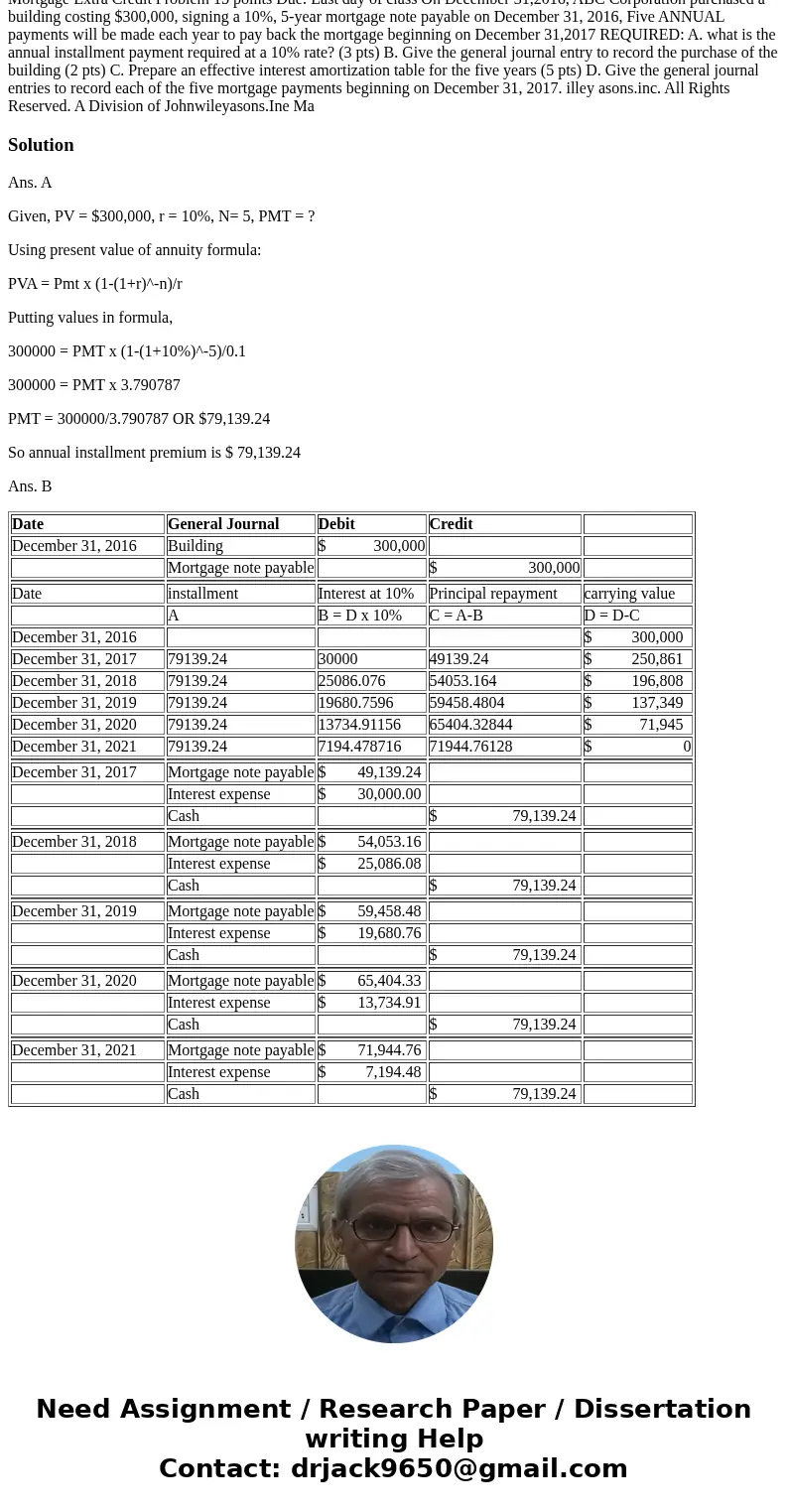

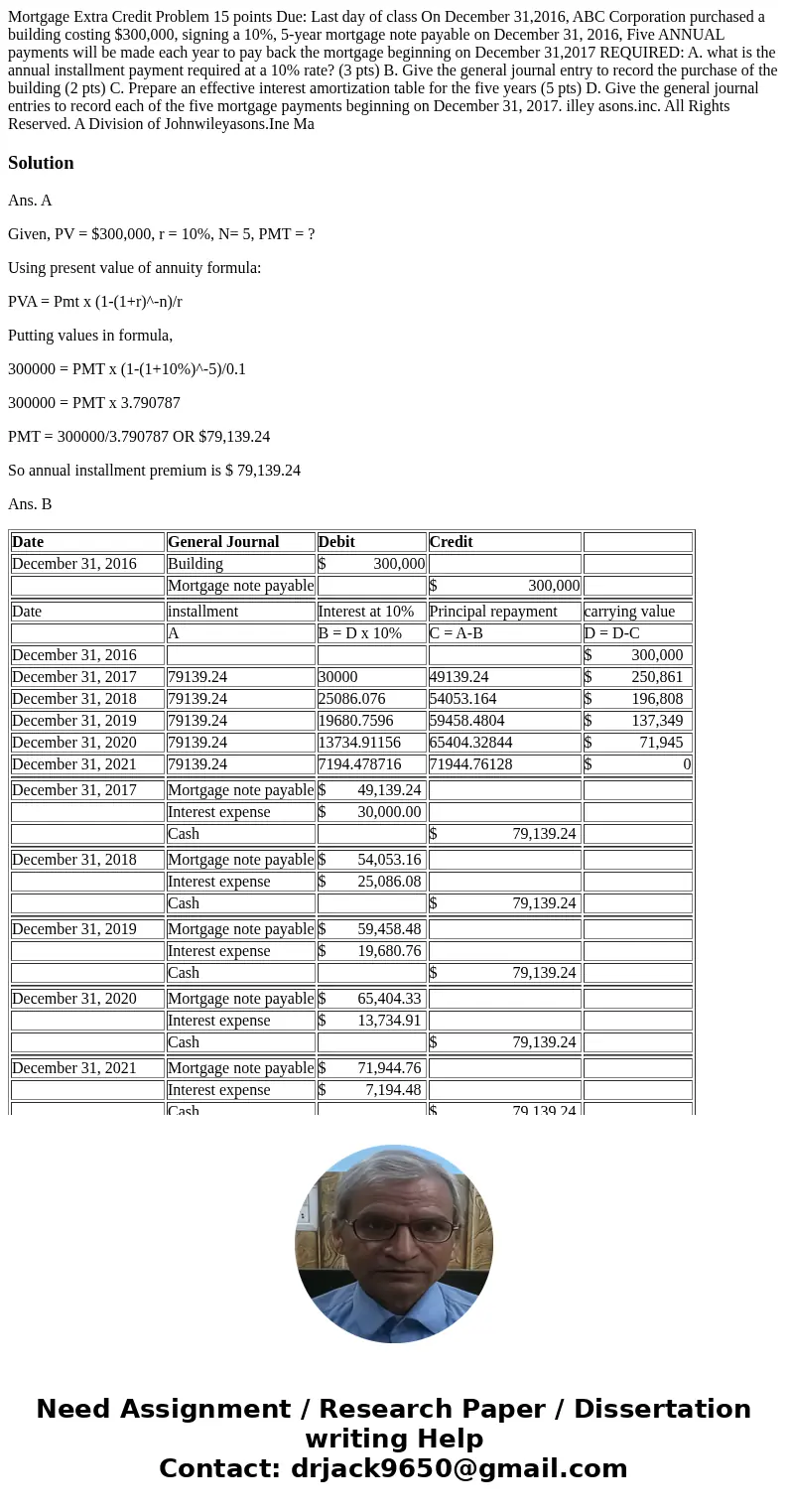

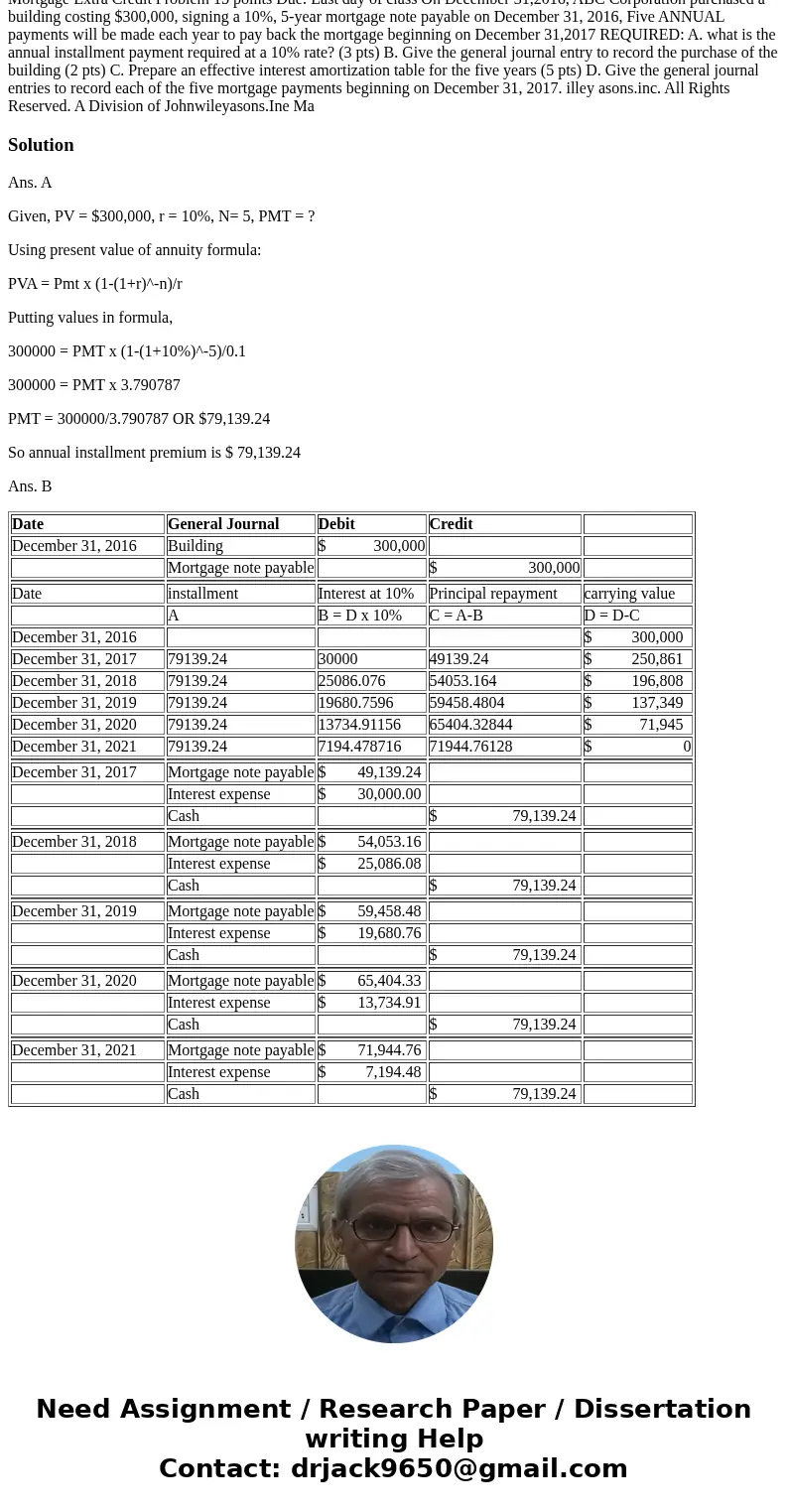

Mortgage Extra Credit Problem 15 points Due: Last day of class On December 31,2016, ABC Corporation purchased a building costing $300,000, signing a 10%, 5-year mortgage note payable on December 31, 2016, Five ANNUAL payments will be made each year to pay back the mortgage beginning on December 31,2017 REQUIRED: A. what is the annual installment payment required at a 10% rate? (3 pts) B. Give the general journal entry to record the purchase of the building (2 pts) C. Prepare an effective interest amortization table for the five years (5 pts) D. Give the general journal entries to record each of the five mortgage payments beginning on December 31, 2017. illey asons.inc. All Rights Reserved. A Division of Johnwileyasons.Ine Ma

Solution

Ans. A

Given, PV = $300,000, r = 10%, N= 5, PMT = ?

Using present value of annuity formula:

PVA = Pmt x (1-(1+r)^-n)/r

Putting values in formula,

300000 = PMT x (1-(1+10%)^-5)/0.1

300000 = PMT x 3.790787

PMT = 300000/3.790787 OR $79,139.24

So annual installment premium is $ 79,139.24

Ans. B

| Date | General Journal | Debit | Credit | |

| December 31, 2016 | Building | $ 300,000 | ||

| Mortgage note payable | $ 300,000 | |||

| Date | installment | Interest at 10% | Principal repayment | carrying value |

| A | B = D x 10% | C = A-B | D = D-C | |

| December 31, 2016 | $ 300,000 | |||

| December 31, 2017 | 79139.24 | 30000 | 49139.24 | $ 250,861 |

| December 31, 2018 | 79139.24 | 25086.076 | 54053.164 | $ 196,808 |

| December 31, 2019 | 79139.24 | 19680.7596 | 59458.4804 | $ 137,349 |

| December 31, 2020 | 79139.24 | 13734.91156 | 65404.32844 | $ 71,945 |

| December 31, 2021 | 79139.24 | 7194.478716 | 71944.76128 | $ 0 |

| December 31, 2017 | Mortgage note payable | $ 49,139.24 | ||

| Interest expense | $ 30,000.00 | |||

| Cash | $ 79,139.24 | |||

| December 31, 2018 | Mortgage note payable | $ 54,053.16 | ||

| Interest expense | $ 25,086.08 | |||

| Cash | $ 79,139.24 | |||

| December 31, 2019 | Mortgage note payable | $ 59,458.48 | ||

| Interest expense | $ 19,680.76 | |||

| Cash | $ 79,139.24 | |||

| December 31, 2020 | Mortgage note payable | $ 65,404.33 | ||

| Interest expense | $ 13,734.91 | |||

| Cash | $ 79,139.24 | |||

| December 31, 2021 | Mortgage note payable | $ 71,944.76 | ||

| Interest expense | $ 7,194.48 | |||

| Cash | $ 79,139.24 |

Homework Sourse

Homework Sourse