Consider the following step up security 1000 par with semian

Consider the following step up security ($1,000 par) with semi-annual coupons (all CFs are at the end of the semi-annual):

Year

1

2

3

Coupon rate

3%

4%

5%

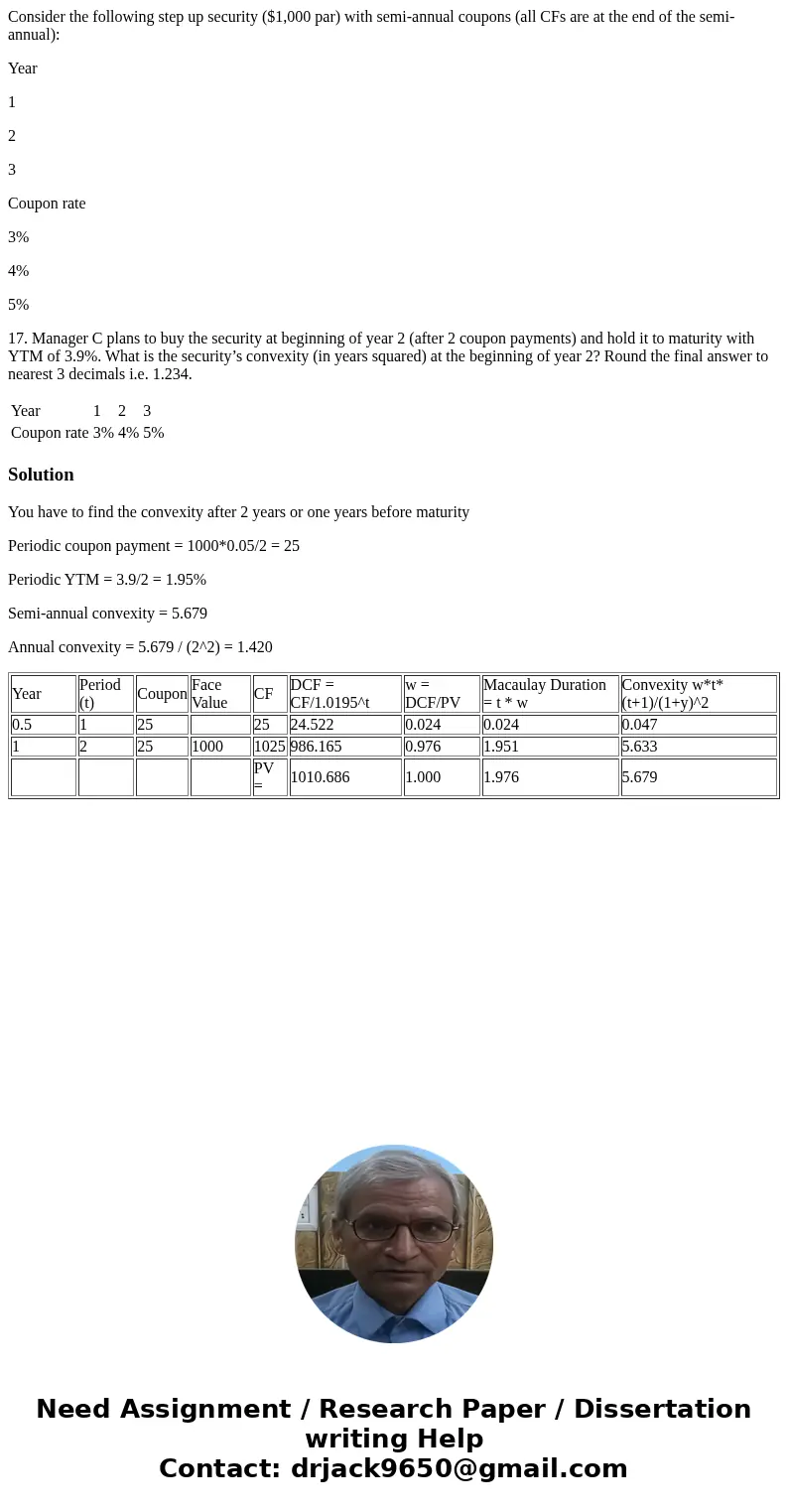

17. Manager C plans to buy the security at beginning of year 2 (after 2 coupon payments) and hold it to maturity with YTM of 3.9%. What is the security’s convexity (in years squared) at the beginning of year 2? Round the final answer to nearest 3 decimals i.e. 1.234.

| Year | 1 | 2 | 3 |

| Coupon rate | 3% | 4% | 5% |

Solution

You have to find the convexity after 2 years or one years before maturity

Periodic coupon payment = 1000*0.05/2 = 25

Periodic YTM = 3.9/2 = 1.95%

Semi-annual convexity = 5.679

Annual convexity = 5.679 / (2^2) = 1.420

| Year | Period (t) | Coupon | Face Value | CF | DCF = CF/1.0195^t | w = DCF/PV | Macaulay Duration = t * w | Convexity w*t*(t+1)/(1+y)^2 |

| 0.5 | 1 | 25 | 25 | 24.522 | 0.024 | 0.024 | 0.047 | |

| 1 | 2 | 25 | 1000 | 1025 | 986.165 | 0.976 | 1.951 | 5.633 |

| PV = | 1010.686 | 1.000 | 1.976 | 5.679 |

Homework Sourse

Homework Sourse