Show all formulas and steps using engineering economics A co

Show all formulas and steps using engineering economics. A company spends $1,000,000 on equipment with a 10 year service life to start a manufacturing facility. The expenses are $100,000 per year, and the revenue from selling the products are $450,000 per year. The depreciation method that the company uses to depreciate their equipment is MACRS 5 year schedule. For this problem, assume a flat income tax of 34%.

a). Determine the Taxable Income, Income Tax, and After Tax Cash Flows (ATCFs) for the life of the project (10 years)

b). Determine the non-discounted payback period

c). Determine the discounted payback period if interest rate = 5%

d). Determine the IRR of the ATCF after 10 years

Solution

Answer:

A company spends on equipment with a 10 year service life is: $1,000,000

The expenses per year: $100,000

The revenue from selling the products per year: $450,000

The company uses to depreciate their equipment is MACRS 5 year schedule.

Income tax of 34%

What is MACRS?

MACRS stands for modified accelerated cost recovery system. It is the current system allowed in the United States to calculate tax deductions on account of depreciation for depreciable assets.

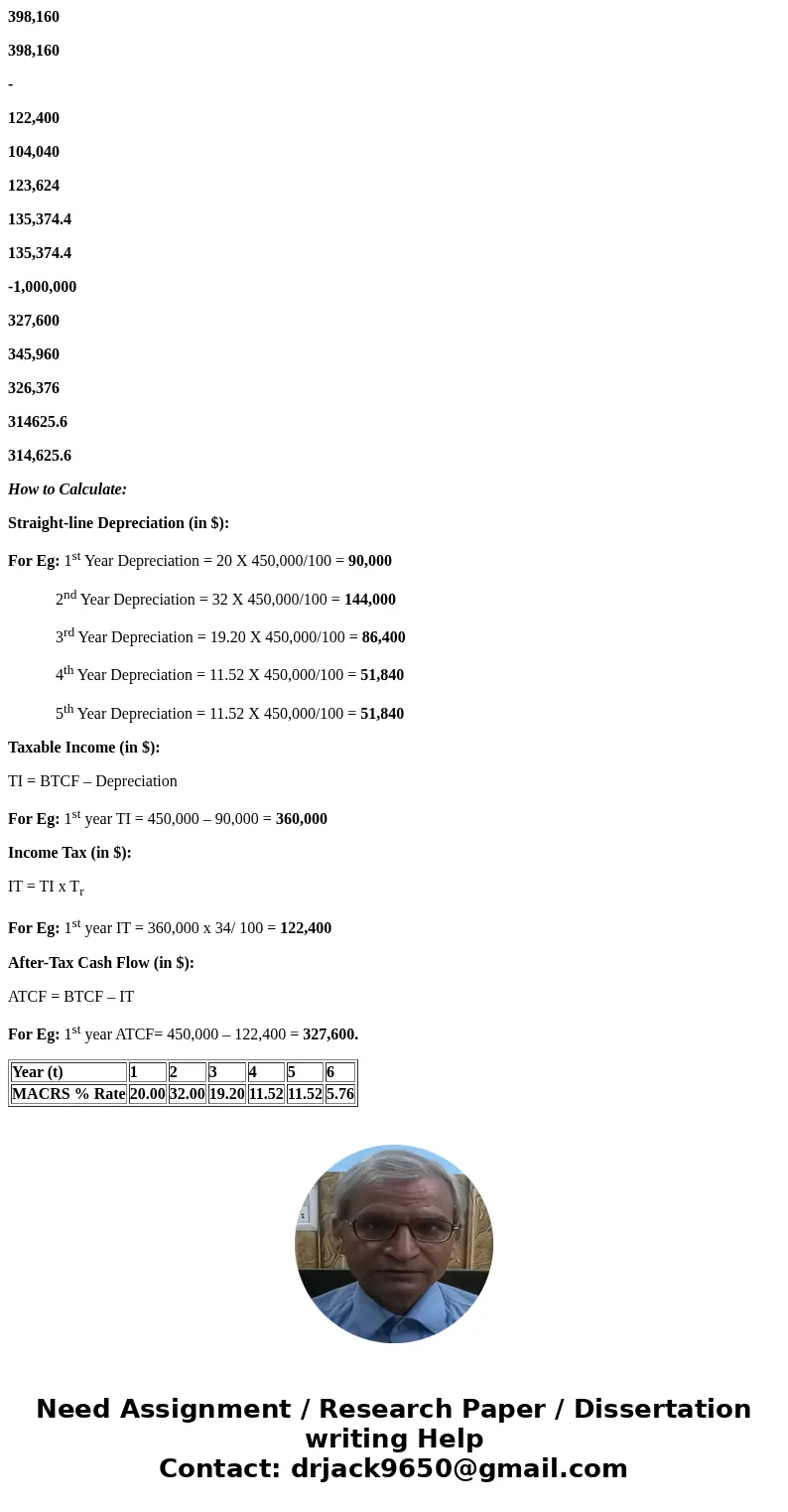

Depreciation by MACRS for 5 year schedule:

Year (t)

1

2

3

4

5

6

MACRS % Rate

20.00

32.00

19.20

11.52

11.52

5.76

Taxable Income can be expressed as

TI = R - C - D - OE

Where: TI = Taxable Income

R = Revenues

C = Operating Costs of projects or goods sold

D = Depreciation of assets

OE = Operating Expenses

Income Taxes can be calculated as:

IT = TI x Tr

Where: IT = Income Taxes

Tr = Tax rate

After-Tax Cash Flow can be measured as:

ATCF = BTCF - Tax Cash flow

Where: ATCF = After-Tax Cash Flow

BTCF = Before-Tax Cash Flow

Payback:

Payback is defined as the length of time it takes the net cash revenue / cash cost savings of a project to payback the initial investment.

Payback = initial investment / net cash inflow

Discounted Payback:

The discounted payback is defined as the length of time it takes the discounted net cash revenue/cost savings of a project to payback the initial investment.

Internal rate of Return (IRR):

A primary measure of an investments worth is based on yield and known as the internal rate of return (IRR). The internal rate of return can be defined as the break-even interest rate which equates the Net Present Worth (Net Present Value) of a projects cash flow in and out.

PW(irr) = PWcash_in - PWcash_out

Where: PW = Present Worth

irr = internal rate of return

Determine the Taxable Income, Income Tax, and After Tax Cash Flows: (for 5years)

Year (T)

BTCF

(in $)

Depreciation

(in $)

Taxable Income (in $)

Income Tax

(in $)

ATCF

(in $)

0

1

2

3

4

5

-1,000,000

450,000

450,000

450,000

450,000

450,000

-

90,000

144,000

86,400

51,840

51,840

-

360,000

306,000

363,600

398,160

398,160

-

122,400

104,040

123,624

135,374.4

135,374.4

-1,000,000

327,600

345,960

326,376

314625.6

314,625.6

How to Calculate:

Straight-line Depreciation (in $):

For Eg: 1st Year Depreciation = 20 X 450,000/100 = 90,000

2nd Year Depreciation = 32 X 450,000/100 = 144,000

3rd Year Depreciation = 19.20 X 450,000/100 = 86,400

4th Year Depreciation = 11.52 X 450,000/100 = 51,840

5th Year Depreciation = 11.52 X 450,000/100 = 51,840

Taxable Income (in $):

TI = BTCF – Depreciation

For Eg: 1st year TI = 450,000 – 90,000 = 360,000

Income Tax (in $):

IT = TI x Tr

For Eg: 1st year IT = 360,000 x 34/ 100 = 122,400

After-Tax Cash Flow (in $):

ATCF = BTCF – IT

For Eg: 1st year ATCF= 450,000 – 122,400 = 327,600.

| Year (t) | 1 | 2 | 3 | 4 | 5 | 6 |

| MACRS % Rate | 20.00 | 32.00 | 19.20 | 11.52 | 11.52 | 5.76 |

Homework Sourse

Homework Sourse