Question 4 Assume that you hold a diversifhed 90000 portfoli

Question 4 Assume that you hold a diversifhed $90,000 portfolio with a beta of 1.20, and that you are in the process of buying 1,000 shares of a high-tech stock at $10 a sha with a beta of 1.70, and adding it to this portfolio. Also assume that risk-free rate is 2%, and that the expected rate of return on the market is 82%. Based on the CAPM, what would be the expected rate of return for your portolio after the purchase of this stock? CAPM, what would be the expected rate of return for your portfolio after the purchase of this stock? Your answer should be between 7.45 and 16.30, rounded to 2 decimal places, with no special characters.

Solution

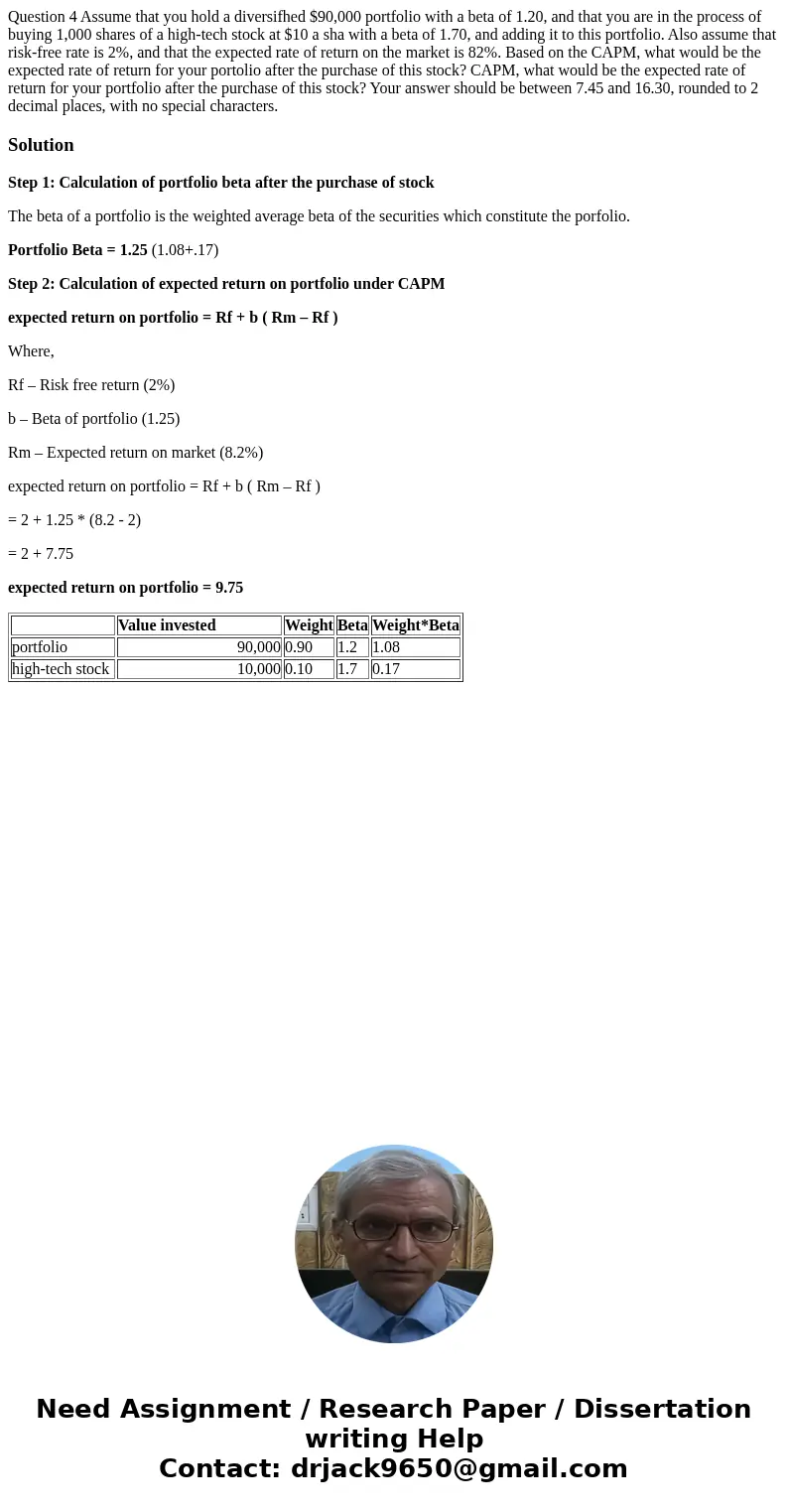

Step 1: Calculation of portfolio beta after the purchase of stock

The beta of a portfolio is the weighted average beta of the securities which constitute the porfolio.

Portfolio Beta = 1.25 (1.08+.17)

Step 2: Calculation of expected return on portfolio under CAPM

expected return on portfolio = Rf + b ( Rm – Rf )

Where,

Rf – Risk free return (2%)

b – Beta of portfolio (1.25)

Rm – Expected return on market (8.2%)

expected return on portfolio = Rf + b ( Rm – Rf )

= 2 + 1.25 * (8.2 - 2)

= 2 + 7.75

expected return on portfolio = 9.75

| Value invested | Weight | Beta | Weight*Beta | |

| portfolio | 90,000 | 0.90 | 1.2 | 1.08 |

| high-tech stock | 10,000 | 0.10 | 1.7 | 0.17 |

Homework Sourse

Homework Sourse