Martin Buber Co purchased land as a factory site for 758400

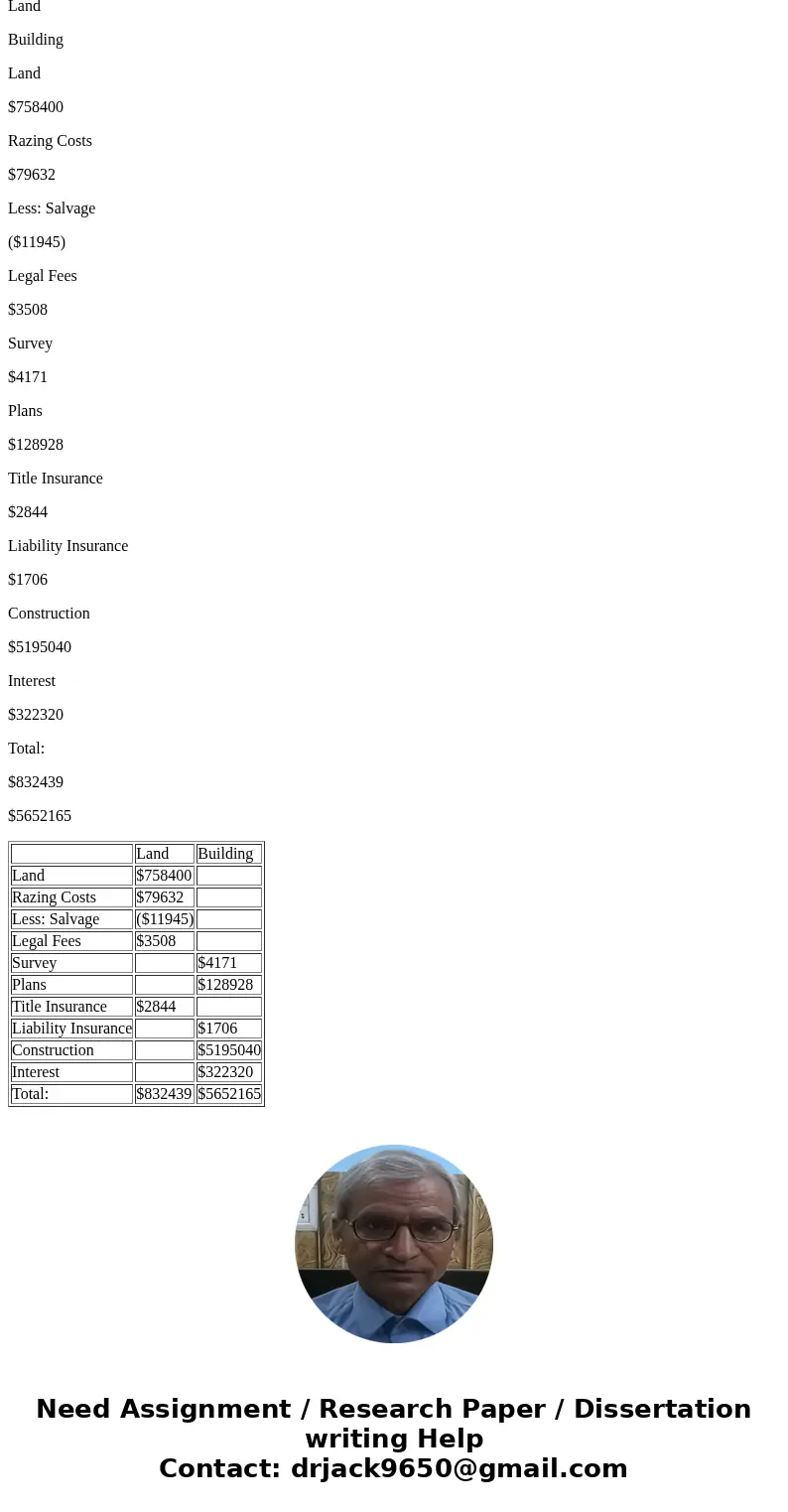

Martin Buber Co. purchased land as a factory site for $758,400. The process of tearing down two old buildings on the site and constructing the factory required 6 months. The company paid $79,632 to raze the old buildings and sold salvaged lumber and brick for $11,945. Legal fees of $3,508 were paid for title investigation and drawing the purchase contract. Martin Buber paid $4,171 to an engineering firm for a land survey, and $128,928 for drawing the factory plans. The land survey had to be made before definitive plans could be drawn. Title insurance on the property cost $2,844, and a liability insurance premium paid during construction was $1,706. The contractor’s charge for construction was $5,195,040. The company paid the contractor in two installments: $2,275,200 at the end of 3 months and $2,919,840 upon completion. Interest costs of $322,320 were incurred to finance the construction. Determine the cost of the land and the cost of the building as they should be recorded on the books of Martin Buberk Co. Assume that the land survey was for the building.

Solution

Determine the cost of the land and the cost of the building as they should be recorded on the books of Martin Buberk Co. Assume that the land survey was for the building.

Land

Building

Land

$758400

Razing Costs

$79632

Less: Salvage

($11945)

Legal Fees

$3508

Survey

$4171

Plans

$128928

Title Insurance

$2844

Liability Insurance

$1706

Construction

$5195040

Interest

$322320

Total:

$832439

$5652165

| Land | Building | |

| Land | $758400 | |

| Razing Costs | $79632 | |

| Less: Salvage | ($11945) | |

| Legal Fees | $3508 | |

| Survey | $4171 | |

| Plans | $128928 | |

| Title Insurance | $2844 | |

| Liability Insurance | $1706 | |

| Construction | $5195040 | |

| Interest | $322320 | |

| Total: | $832439 | $5652165 |

Homework Sourse

Homework Sourse