John owned 85 of X Corp and 90 of Y Corp John died leaving a

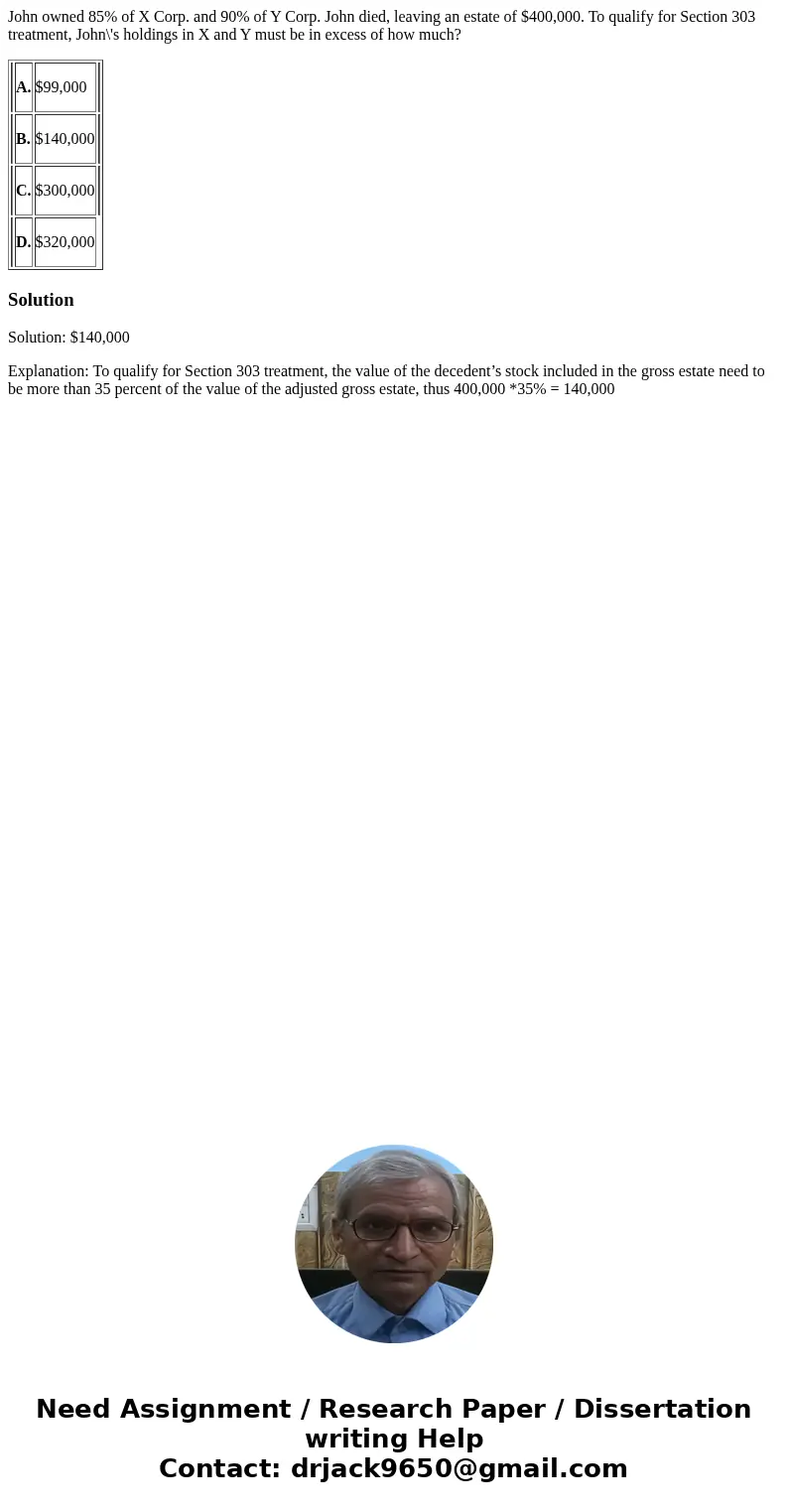

John owned 85% of X Corp. and 90% of Y Corp. John died, leaving an estate of $400,000. To qualify for Section 303 treatment, John\'s holdings in X and Y must be in excess of how much?

| A. | $99,000 | ||

| B. | $140,000 | ||

| C. | $300,000 | ||

| D. | $320,000 |

Solution

Solution: $140,000

Explanation: To qualify for Section 303 treatment, the value of the decedent’s stock included in the gross estate need to be more than 35 percent of the value of the adjusted gross estate, thus 400,000 *35% = 140,000

Homework Sourse

Homework Sourse