Nancy Tercek started a delivery service Sheffield Corp on Ju

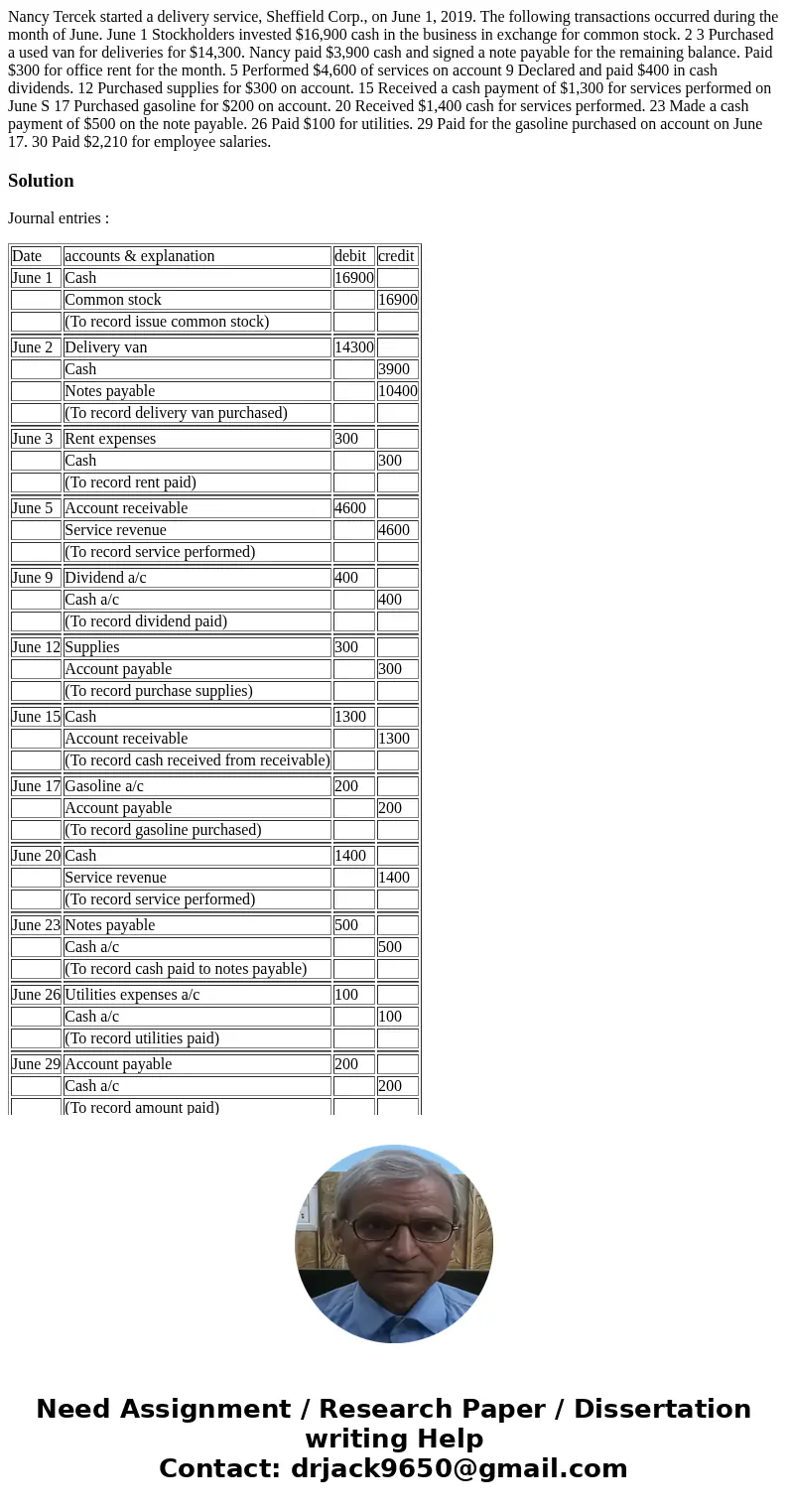

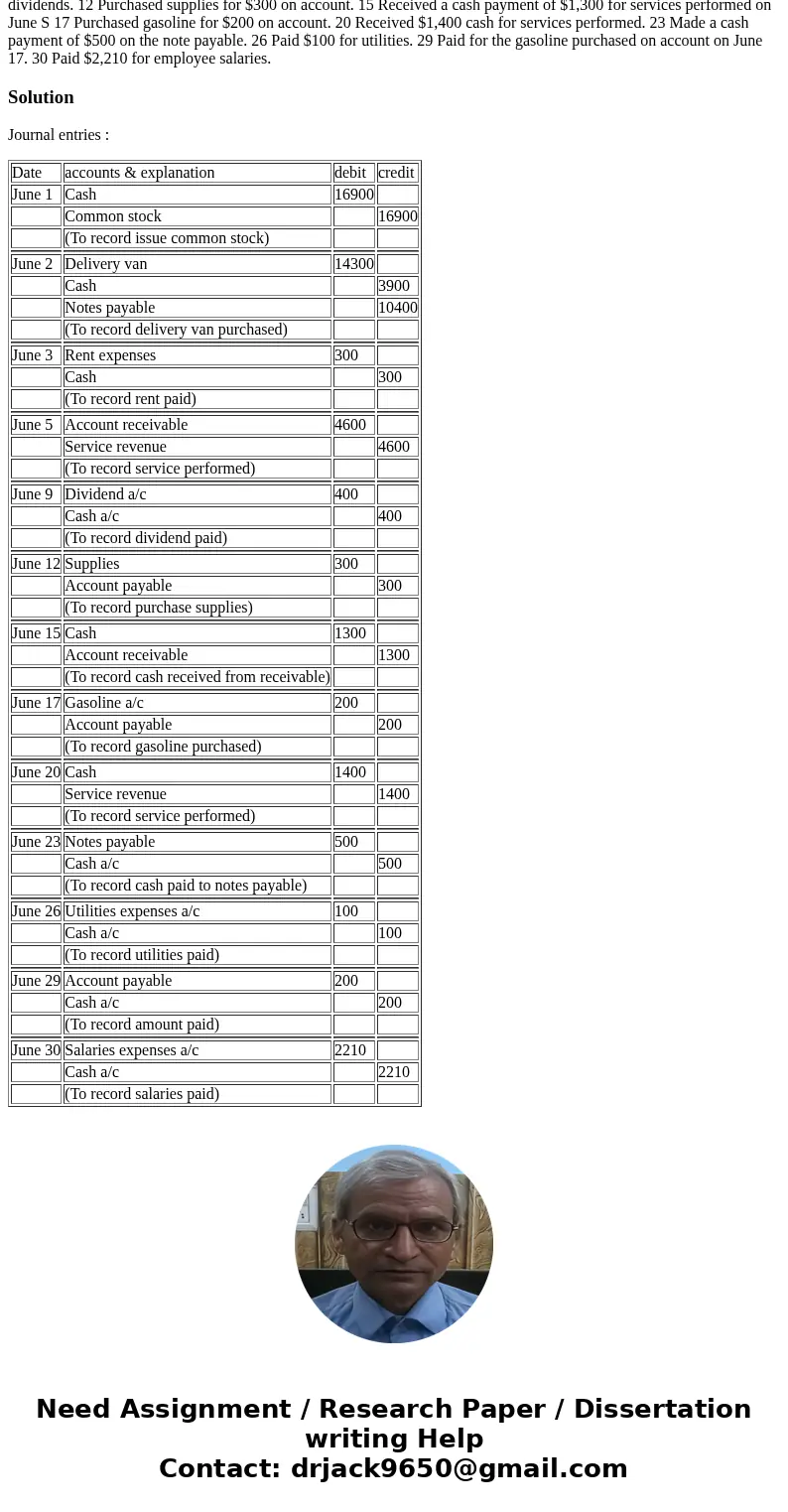

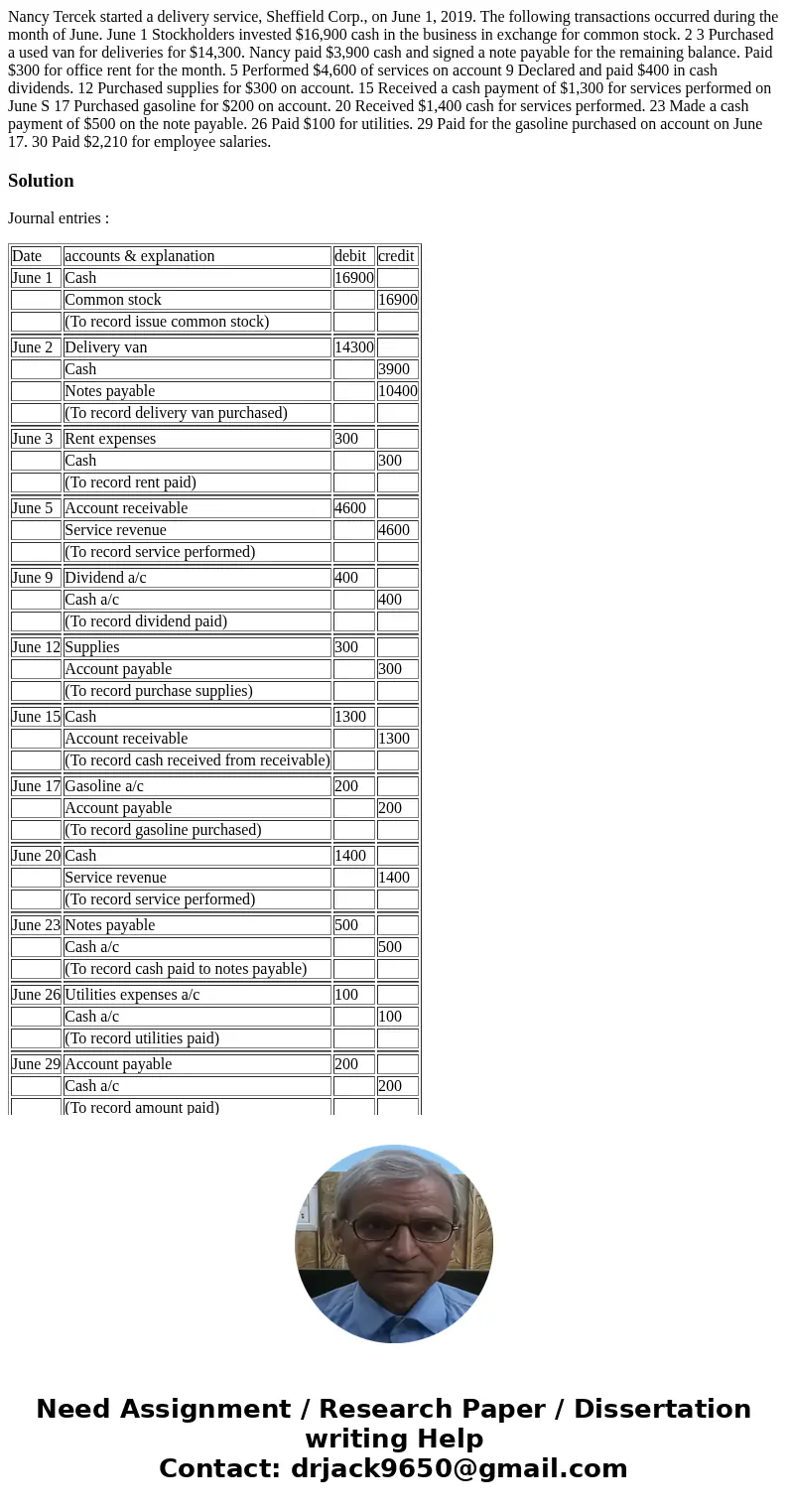

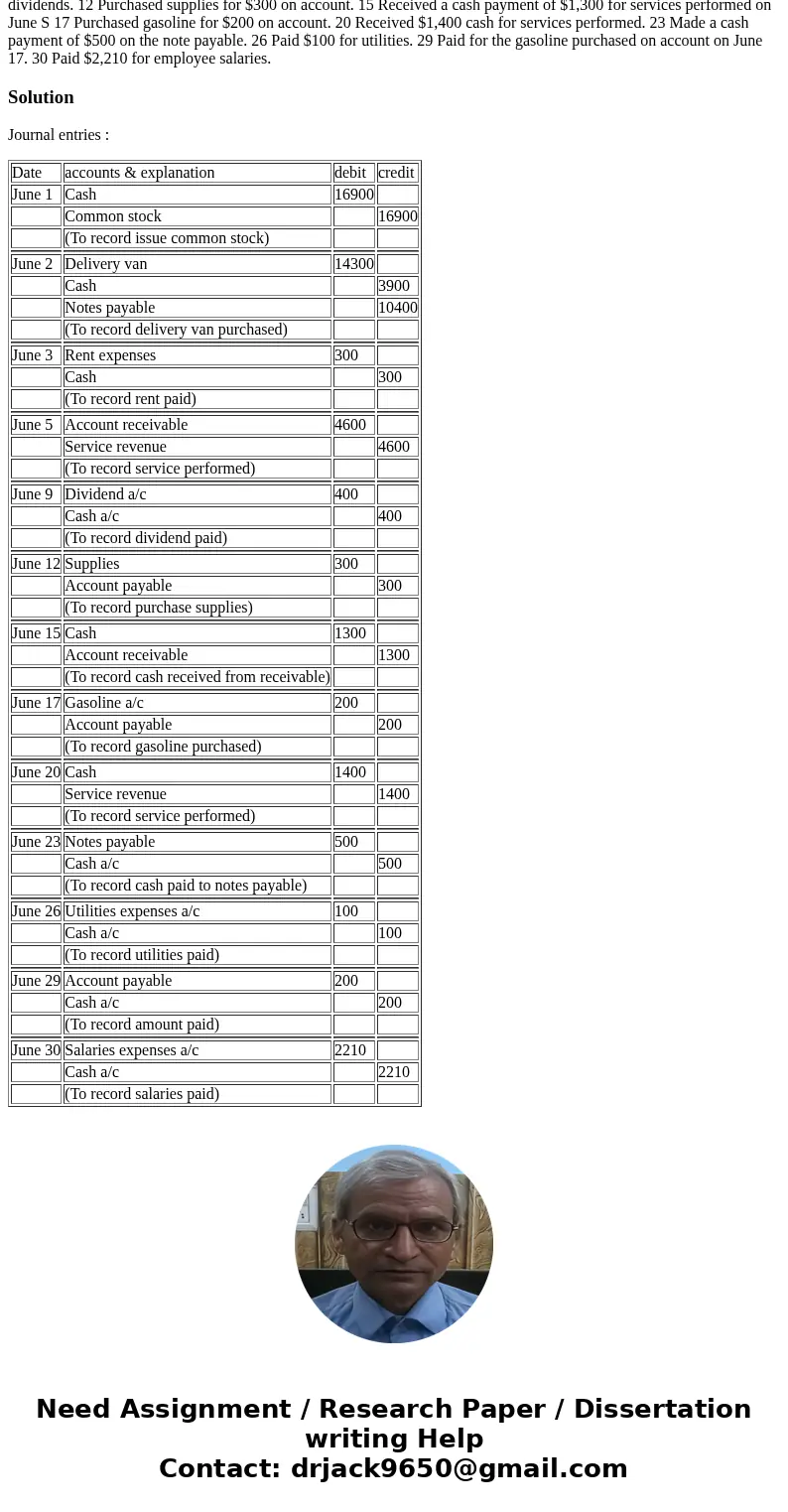

Nancy Tercek started a delivery service, Sheffield Corp., on June 1, 2019. The following transactions occurred during the month of June. June 1 Stockholders invested $16,900 cash in the business in exchange for common stock. 2 3 Purchased a used van for deliveries for $14,300. Nancy paid $3,900 cash and signed a note payable for the remaining balance. Paid $300 for office rent for the month. 5 Performed $4,600 of services on account 9 Declared and paid $400 in cash dividends. 12 Purchased supplies for $300 on account. 15 Received a cash payment of $1,300 for services performed on June S 17 Purchased gasoline for $200 on account. 20 Received $1,400 cash for services performed. 23 Made a cash payment of $500 on the note payable. 26 Paid $100 for utilities. 29 Paid for the gasoline purchased on account on June 17. 30 Paid $2,210 for employee salaries.

Solution

Journal entries :

| Date | accounts & explanation | debit | credit |

| June 1 | Cash | 16900 | |

| Common stock | 16900 | ||

| (To record issue common stock) | |||

| June 2 | Delivery van | 14300 | |

| Cash | 3900 | ||

| Notes payable | 10400 | ||

| (To record delivery van purchased) | |||

| June 3 | Rent expenses | 300 | |

| Cash | 300 | ||

| (To record rent paid) | |||

| June 5 | Account receivable | 4600 | |

| Service revenue | 4600 | ||

| (To record service performed) | |||

| June 9 | Dividend a/c | 400 | |

| Cash a/c | 400 | ||

| (To record dividend paid) | |||

| June 12 | Supplies | 300 | |

| Account payable | 300 | ||

| (To record purchase supplies) | |||

| June 15 | Cash | 1300 | |

| Account receivable | 1300 | ||

| (To record cash received from receivable) | |||

| June 17 | Gasoline a/c | 200 | |

| Account payable | 200 | ||

| (To record gasoline purchased) | |||

| June 20 | Cash | 1400 | |

| Service revenue | 1400 | ||

| (To record service performed) | |||

| June 23 | Notes payable | 500 | |

| Cash a/c | 500 | ||

| (To record cash paid to notes payable) | |||

| June 26 | Utilities expenses a/c | 100 | |

| Cash a/c | 100 | ||

| (To record utilities paid) | |||

| June 29 | Account payable | 200 | |

| Cash a/c | 200 | ||

| (To record amount paid) | |||

| June 30 | Salaries expenses a/c | 2210 | |

| Cash a/c | 2210 | ||

| (To record salaries paid) |

Homework Sourse

Homework Sourse