125 please see both pictures E124 McGill and Smyth have U re

12-5 please see both pictures

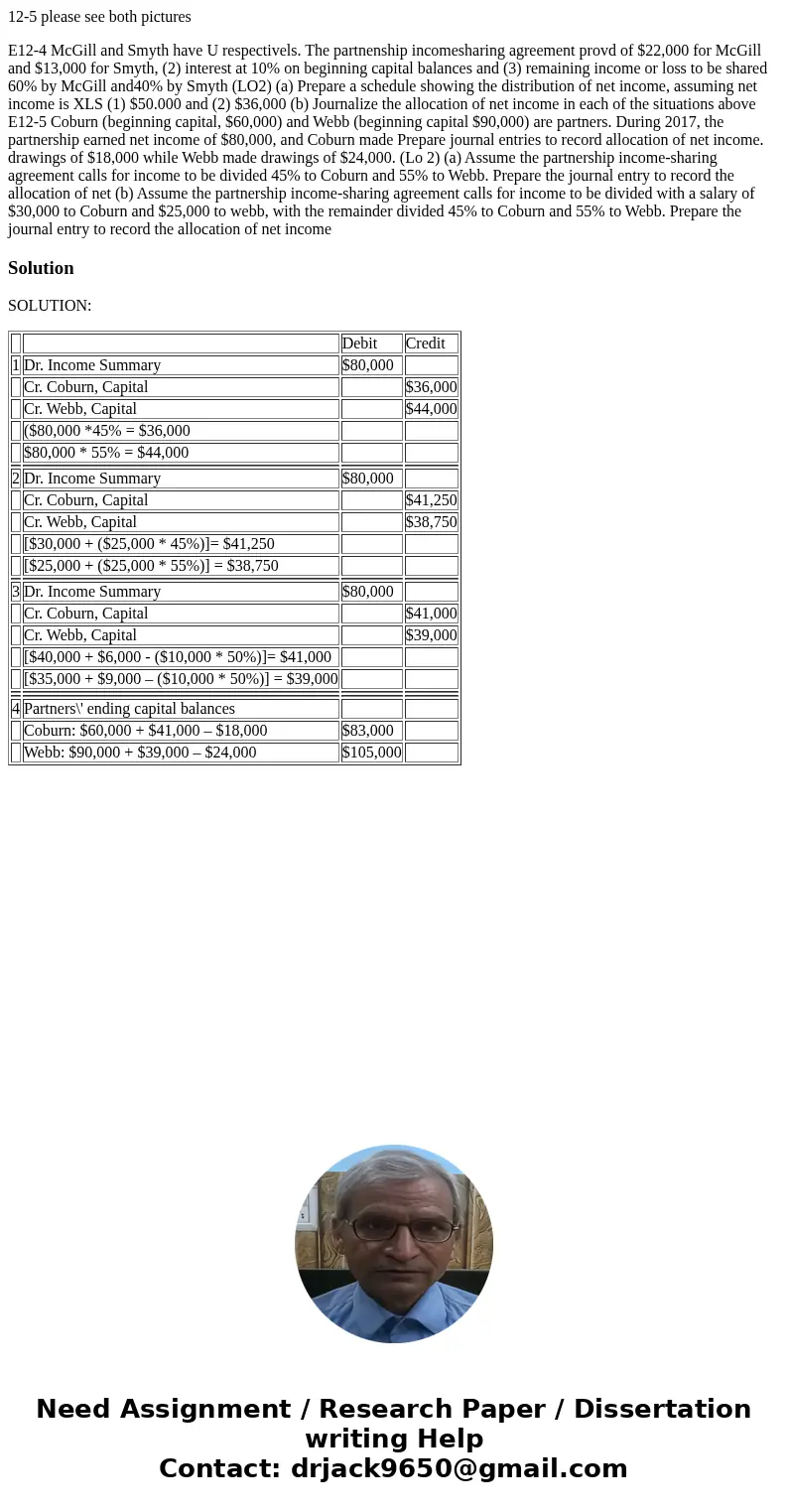

E12-4 McGill and Smyth have U respectivels. The partnenship incomesharing agreement provd of $22,000 for McGill and $13,000 for Smyth, (2) interest at 10% on beginning capital balances and (3) remaining income or loss to be shared 60% by McGill and40% by Smyth (LO2) (a) Prepare a schedule showing the distribution of net income, assuming net income is XLS (1) $50.000 and (2) $36,000 (b) Journalize the allocation of net income in each of the situations above E12-5 Coburn (beginning capital, $60,000) and Webb (beginning capital $90,000) are partners. During 2017, the partnership earned net income of $80,000, and Coburn made Prepare journal entries to record allocation of net income. drawings of $18,000 while Webb made drawings of $24,000. (Lo 2) (a) Assume the partnership income-sharing agreement calls for income to be divided 45% to Coburn and 55% to Webb. Prepare the journal entry to record the allocation of net (b) Assume the partnership income-sharing agreement calls for income to be divided with a salary of $30,000 to Coburn and $25,000 to webb, with the remainder divided 45% to Coburn and 55% to Webb. Prepare the journal entry to record the allocation of net incomeSolution

SOLUTION:

| Debit | Credit | ||

| 1 | Dr. Income Summary | $80,000 | |

| Cr. Coburn, Capital | $36,000 | ||

| Cr. Webb, Capital | $44,000 | ||

| ($80,000 *45% = $36,000 | |||

| $80,000 * 55% = $44,000 | |||

| 2 | Dr. Income Summary | $80,000 | |

| Cr. Coburn, Capital | $41,250 | ||

| Cr. Webb, Capital | $38,750 | ||

| [$30,000 + ($25,000 * 45%)]= $41,250 | |||

| [$25,000 + ($25,000 * 55%)] = $38,750 | |||

| 3 | Dr. Income Summary | $80,000 | |

| Cr. Coburn, Capital | $41,000 | ||

| Cr. Webb, Capital | $39,000 | ||

| [$40,000 + $6,000 - ($10,000 * 50%)]= $41,000 | |||

| [$35,000 + $9,000 – ($10,000 * 50%)] = $39,000 | |||

| 4 | Partners\' ending capital balances | ||

| Coburn: $60,000 + $41,000 – $18,000 | $83,000 | ||

| Webb: $90,000 + $39,000 – $24,000 | $105,000 |

Homework Sourse

Homework Sourse