Assume that you are in one of the 7 federal tax brackets htt

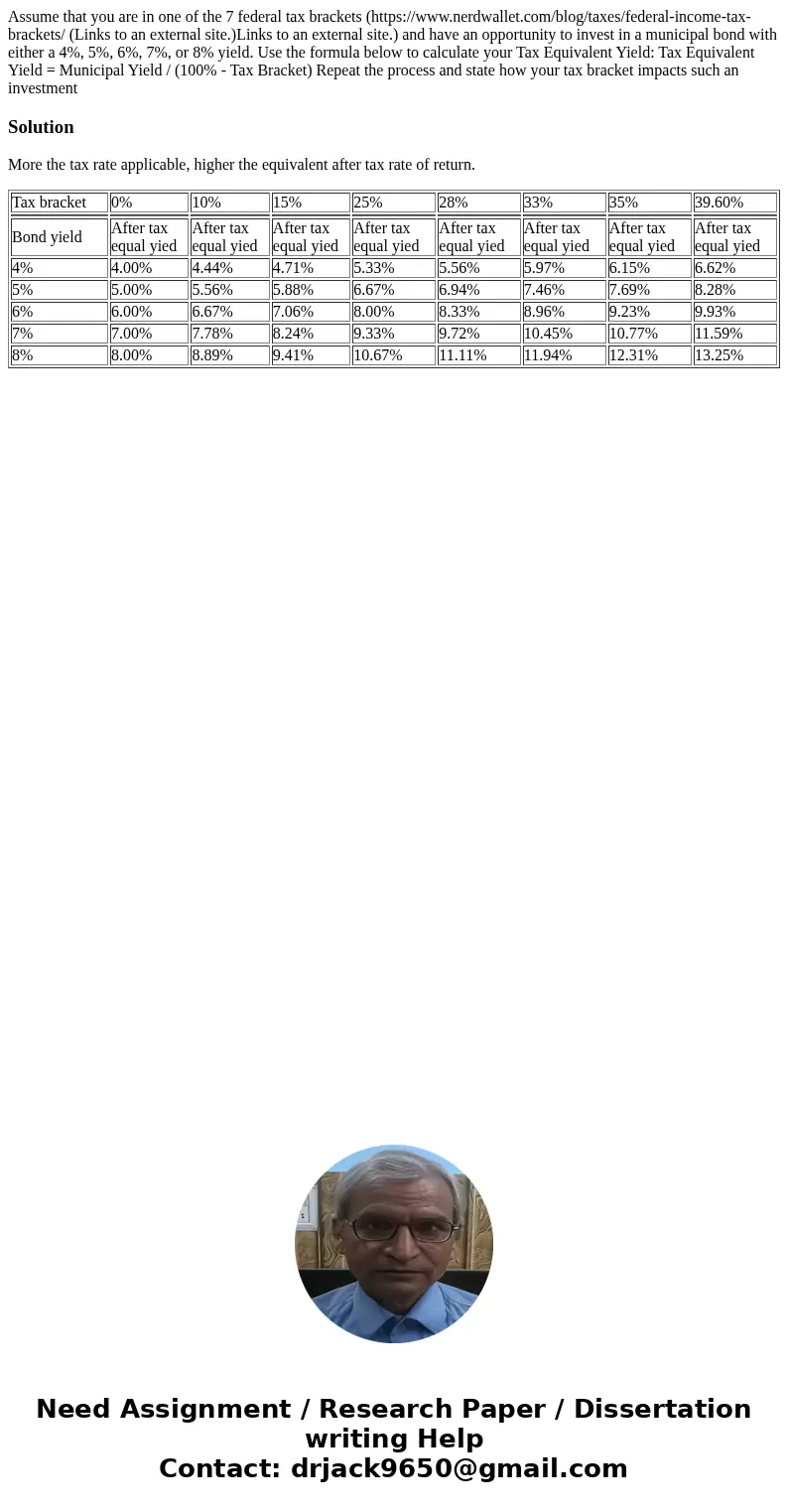

Assume that you are in one of the 7 federal tax brackets (https://www.nerdwallet.com/blog/taxes/federal-income-tax-brackets/ (Links to an external site.)Links to an external site.) and have an opportunity to invest in a municipal bond with either a 4%, 5%, 6%, 7%, or 8% yield. Use the formula below to calculate your Tax Equivalent Yield: Tax Equivalent Yield = Municipal Yield / (100% - Tax Bracket) Repeat the process and state how your tax bracket impacts such an investment

Solution

More the tax rate applicable, higher the equivalent after tax rate of return.

| Tax bracket | 0% | 10% | 15% | 25% | 28% | 33% | 35% | 39.60% |

| Bond yield | After tax equal yied | After tax equal yied | After tax equal yied | After tax equal yied | After tax equal yied | After tax equal yied | After tax equal yied | After tax equal yied |

| 4% | 4.00% | 4.44% | 4.71% | 5.33% | 5.56% | 5.97% | 6.15% | 6.62% |

| 5% | 5.00% | 5.56% | 5.88% | 6.67% | 6.94% | 7.46% | 7.69% | 8.28% |

| 6% | 6.00% | 6.67% | 7.06% | 8.00% | 8.33% | 8.96% | 9.23% | 9.93% |

| 7% | 7.00% | 7.78% | 8.24% | 9.33% | 9.72% | 10.45% | 10.77% | 11.59% |

| 8% | 8.00% | 8.89% | 9.41% | 10.67% | 11.11% | 11.94% | 12.31% | 13.25% |

Homework Sourse

Homework Sourse