The cost of a home is financed with a 130000 40year fixedrat

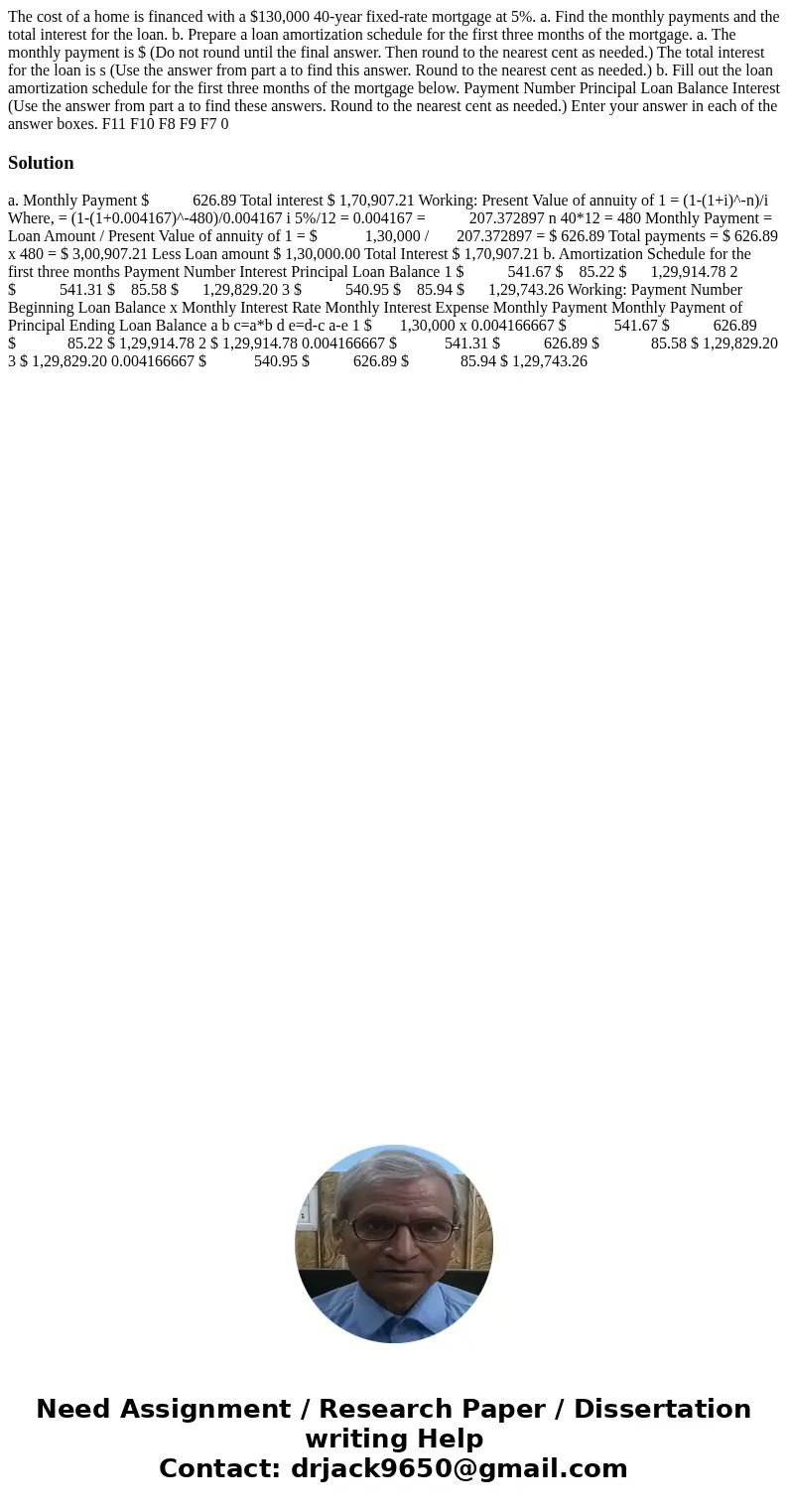

The cost of a home is financed with a $130,000 40-year fixed-rate mortgage at 5%. a. Find the monthly payments and the total interest for the loan. b. Prepare a loan amortization schedule for the first three months of the mortgage. a. The monthly payment is $ (Do not round until the final answer. Then round to the nearest cent as needed.) The total interest for the loan is s (Use the answer from part a to find this answer. Round to the nearest cent as needed.) b. Fill out the loan amortization schedule for the first three months of the mortgage below. Payment Number Principal Loan Balance Interest (Use the answer from part a to find these answers. Round to the nearest cent as needed.) Enter your answer in each of the answer boxes. F11 F10 F8 F9 F7 0

Solution

a. Monthly Payment $ 626.89 Total interest $ 1,70,907.21 Working: Present Value of annuity of 1 = (1-(1+i)^-n)/i Where, = (1-(1+0.004167)^-480)/0.004167 i 5%/12 = 0.004167 = 207.372897 n 40*12 = 480 Monthly Payment = Loan Amount / Present Value of annuity of 1 = $ 1,30,000 / 207.372897 = $ 626.89 Total payments = $ 626.89 x 480 = $ 3,00,907.21 Less Loan amount $ 1,30,000.00 Total Interest $ 1,70,907.21 b. Amortization Schedule for the first three months Payment Number Interest Principal Loan Balance 1 $ 541.67 $ 85.22 $ 1,29,914.78 2 $ 541.31 $ 85.58 $ 1,29,829.20 3 $ 540.95 $ 85.94 $ 1,29,743.26 Working: Payment Number Beginning Loan Balance x Monthly Interest Rate Monthly Interest Expense Monthly Payment Monthly Payment of Principal Ending Loan Balance a b c=a*b d e=d-c a-e 1 $ 1,30,000 x 0.004166667 $ 541.67 $ 626.89 $ 85.22 $ 1,29,914.78 2 $ 1,29,914.78 0.004166667 $ 541.31 $ 626.89 $ 85.58 $ 1,29,829.20 3 $ 1,29,829.20 0.004166667 $ 540.95 $ 626.89 $ 85.94 $ 1,29,743.26

Homework Sourse

Homework Sourse