Please do not answer the question partially I have already d

*********Please do not answer the question partially. I have already done step #1, now just needing to complete all of the other steps (2-10) an explantion included would be nice as well, I would appriciate it! :) *If you can not help completely or entirely; to the furthest extent please do not leave an answer*******

Question 1

Required: #1. Prepare journal entries to record the December transactions in the General Journal Tab in the excel template file \"Accounting Cycle Excel Template.xlsx\". Use the following accounts as appropriate: Cash, Accounts Receivable, Supplies, Prepaid Insurance, Equipment, Accumulated Depreciation, Accounts Payable, Wages Payable, Common Stock, Retained Earnings, Dividends, Service Revenue, Depreciation Expense, Wages Expense, Supplies Expense, Rent Expense, and Insurance Expense.

1-Dec Began business by depositing $6000 in a bank account in the name of the company in exchange for

600 shares of $10 per share common stock.

1-Dec Paid the rent for the current month, $500 .

1-Dec Paid the premium on a one-year insurance policy, $480 .

1-Dec Purchased Equipment for $3600 cash.

5-Dec Purchased office supplies from XYZ Company on account, $300 .

15-Dec Provided services to customers for $5400 cash.

16-Dec Provided service to customers ABC Inc. on account, $2500 .

21-Dec Received $1500 cash from ABC Inc., customer on account.

23-Dec Paid $170 to XYZ company for supplies purchased on account on December 5 .

28-Dec Paid wages for the period December 1 through December 28, $4200 .

30-Dec Declared and paid dividend to stockholders $200 .

#2. Post all of the December transactions from the “General Journal” tab to the T-accounts under the “T-Accounts” tab in the excel template file \"Accounting Cycle Excel Template.xlsx\". Assume there are no beginning balances in any of the accounts.

#3. Compute the balance for each T-account after all of the entries have been posted. These are the unadjusted balance as of December 31.

#4. Prepare the unadjusted trial balance under the “Unadjusted Trial Balance” tab in the excel template file \"Accounting Cycle Excel Template.xlsx\" .

Provide the total of the credit column from the Unadjusted Trial Balance ______

#5. Record the following four transactions as adjusting entries under the “General Journal” tab.

31-Dec One month’s insurance has been used by the company $40.

31-Dec The remaining inventory of unused office supplies is $90.

31-Dec The estimated depreciation on equipment is $60.

31-Dec Wages incurred from December 29 to December 31 but not yet paid or recorded total $450.

#6. Post all of the adjusting entries to the T-accounts under the “T-Accounts” tab. Compute the balance for each T-account after all of the adjusting entries have been posted. These are the adjusted balance as of December 31.

#7. Prepare the adjusted trial balance under the “Adjusted Trial Balance” tab as of December 31 in the excel template file \"Accounting Cycle Excel Template.xlsx\" .

Provide the following accounts balances from the Adjusted Trial Balance:

Cash ______

Accounts Receivable ______

Supplies ______

Prepaid Insurance ______

Equipment ______

Accumulated Depreciation ______

Accounts Payable ______

Wages Payable ______

Common Stock ______

Retained Earnings ______

#8. Prepare Income Statement, Statement of Stockholder’s Equity, and Classified Balance Sheet under the “Financial Statements” tab for the month ended December 31, 20XX in the excel template file \"Accounting Cycle Excel Template.xlsx\".

Provide the following amount from the Income Statement:

Service Revenue ______

Depreciation Expense ______

Wages Expense ______

Supplies Expense ______

Rent Expense ______

Insurance Expense ______

Net Income ______

Provide the following account balance from the Statement of Stockholders\' Equity:

Dividends ______

Provide the following account balances from the Balance Sheet:

Current Assets ______

Long-Term Assets ______

Total Liabilities ______

Total Stockholder’s Equity ______

Cash ______

#9. Record the closing entries under the “General Journal” tab.

#10. Post all of the closing entries to the T-accounts under the “T-Accounts” tab. Compute the balance for each T-account after all of the closing entries have been posted.

Provide the ending balance of Cash at December 31 from the T-account ______

Provide the balance of the Retained Earnings T-account after closing entries have been posted. _____

Does the ending balance of the Retained Earnings T-account agree with the balance of Retained Earnings on the Balance Sheet? ______

Check Point: Total Assets $ 8,820.00

Solution

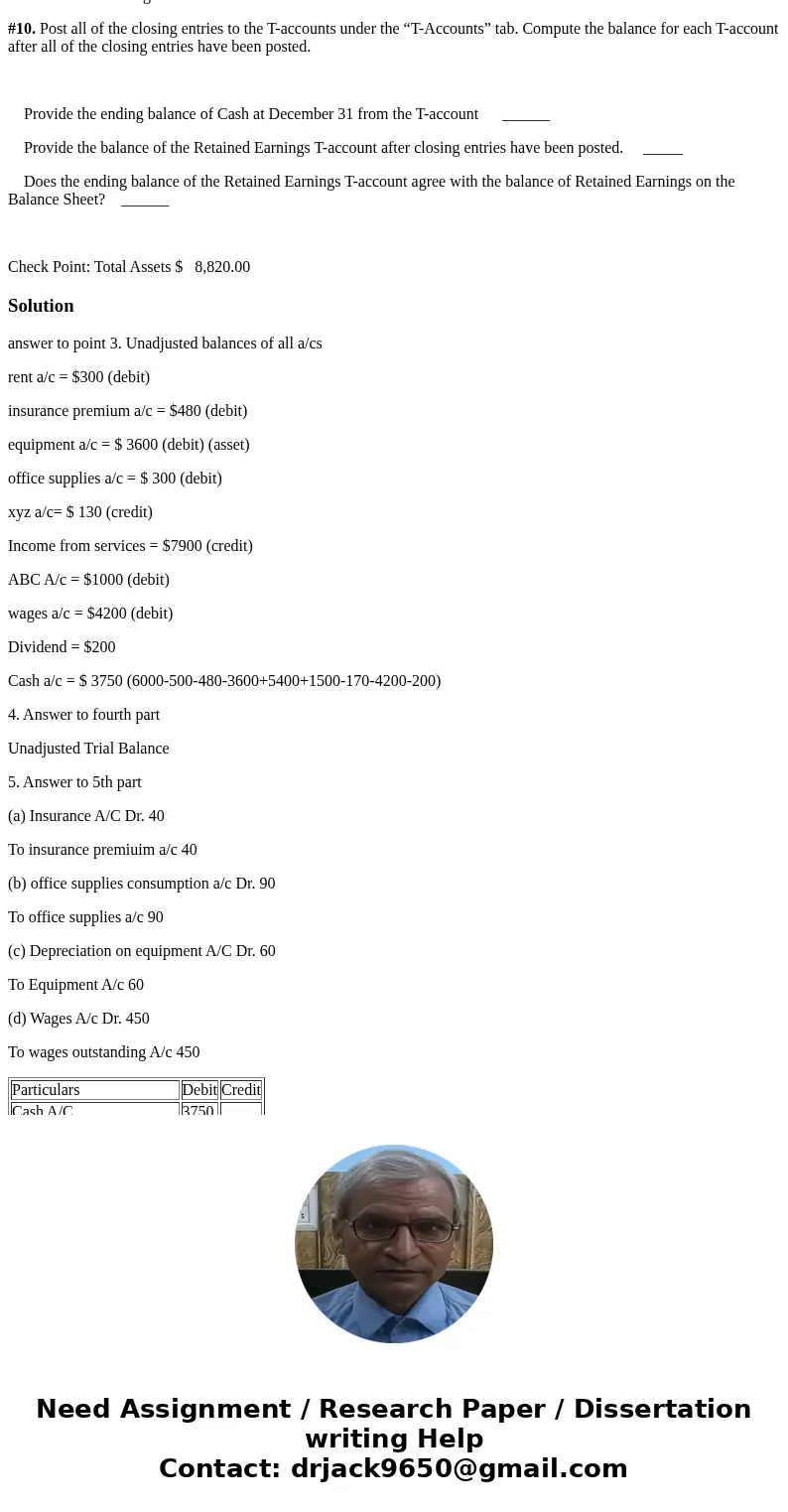

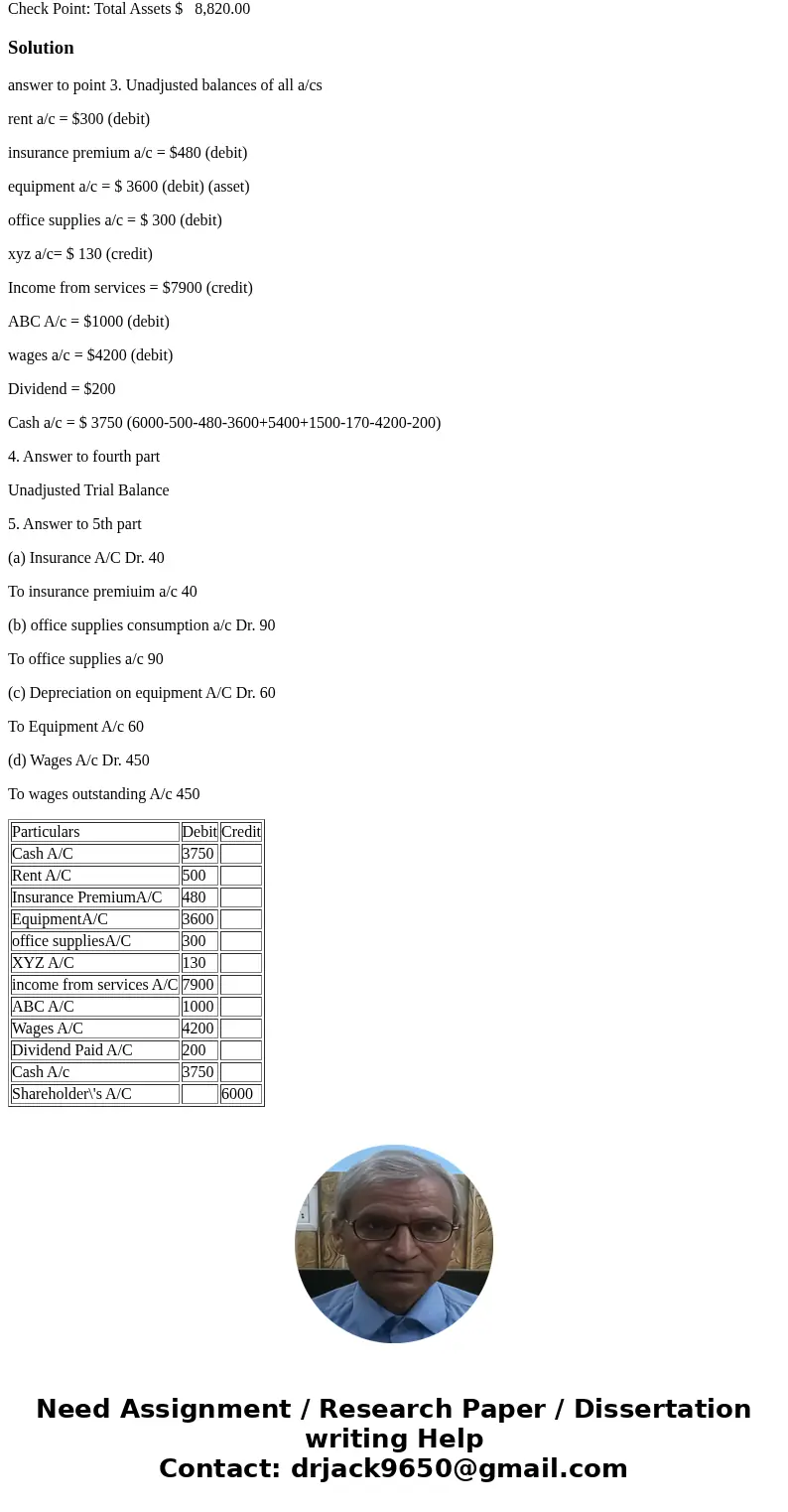

answer to point 3. Unadjusted balances of all a/cs

rent a/c = $300 (debit)

insurance premium a/c = $480 (debit)

equipment a/c = $ 3600 (debit) (asset)

office supplies a/c = $ 300 (debit)

xyz a/c= $ 130 (credit)

Income from services = $7900 (credit)

ABC A/c = $1000 (debit)

wages a/c = $4200 (debit)

Dividend = $200

Cash a/c = $ 3750 (6000-500-480-3600+5400+1500-170-4200-200)

4. Answer to fourth part

Unadjusted Trial Balance

5. Answer to 5th part

(a) Insurance A/C Dr. 40

To insurance premiuim a/c 40

(b) office supplies consumption a/c Dr. 90

To office supplies a/c 90

(c) Depreciation on equipment A/C Dr. 60

To Equipment A/c 60

(d) Wages A/c Dr. 450

To wages outstanding A/c 450

| Particulars | Debit | Credit |

| Cash A/C | 3750 | |

| Rent A/C | 500 | |

| Insurance PremiumA/C | 480 | |

| EquipmentA/C | 3600 | |

| office suppliesA/C | 300 | |

| XYZ A/C | 130 | |

| income from services A/C | 7900 | |

| ABC A/C | 1000 | |

| Wages A/C | 4200 | |

| Dividend Paid A/C | 200 | |

| Cash A/c | 3750 | |

| Shareholder\'s A/C | 6000 |

Homework Sourse

Homework Sourse