21 3000 Dividends Per Share Lightfoot Inc a software develop

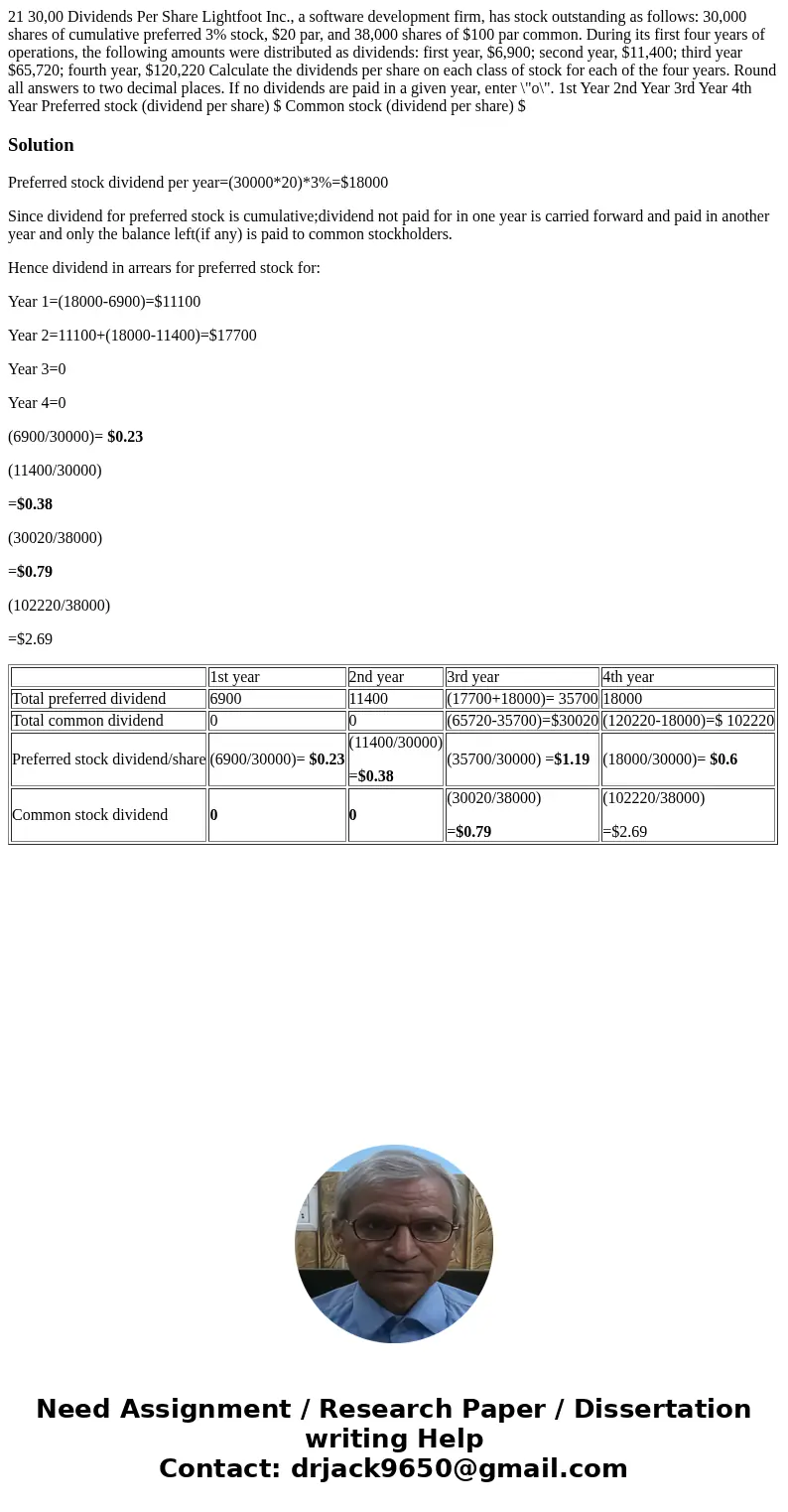

21 30,00 Dividends Per Share Lightfoot Inc., a software development firm, has stock outstanding as follows: 30,000 shares of cumulative preferred 3% stock, $20 par, and 38,000 shares of $100 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $6,900; second year, $11,400; third year $65,720; fourth year, $120,220 Calculate the dividends per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in a given year, enter \"o\". 1st Year 2nd Year 3rd Year 4th Year Preferred stock (dividend per share) $ Common stock (dividend per share) $

Solution

Preferred stock dividend per year=(30000*20)*3%=$18000

Since dividend for preferred stock is cumulative;dividend not paid for in one year is carried forward and paid in another year and only the balance left(if any) is paid to common stockholders.

Hence dividend in arrears for preferred stock for:

Year 1=(18000-6900)=$11100

Year 2=11100+(18000-11400)=$17700

Year 3=0

Year 4=0

(6900/30000)= $0.23

(11400/30000)

=$0.38

(30020/38000)

=$0.79

(102220/38000)

=$2.69

| 1st year | 2nd year | 3rd year | 4th year | |

| Total preferred dividend | 6900 | 11400 | (17700+18000)= 35700 | 18000 |

| Total common dividend | 0 | 0 | (65720-35700)=$30020 | (120220-18000)=$ 102220 |

| Preferred stock dividend/share | (6900/30000)= $0.23 | (11400/30000) =$0.38 | (35700/30000) =$1.19 | (18000/30000)= $0.6 |

| Common stock dividend | 0 | 0 | (30020/38000) =$0.79 | (102220/38000) =$2.69 |

Homework Sourse

Homework Sourse