Pk 311 Presented below is information related to Susan Mayer

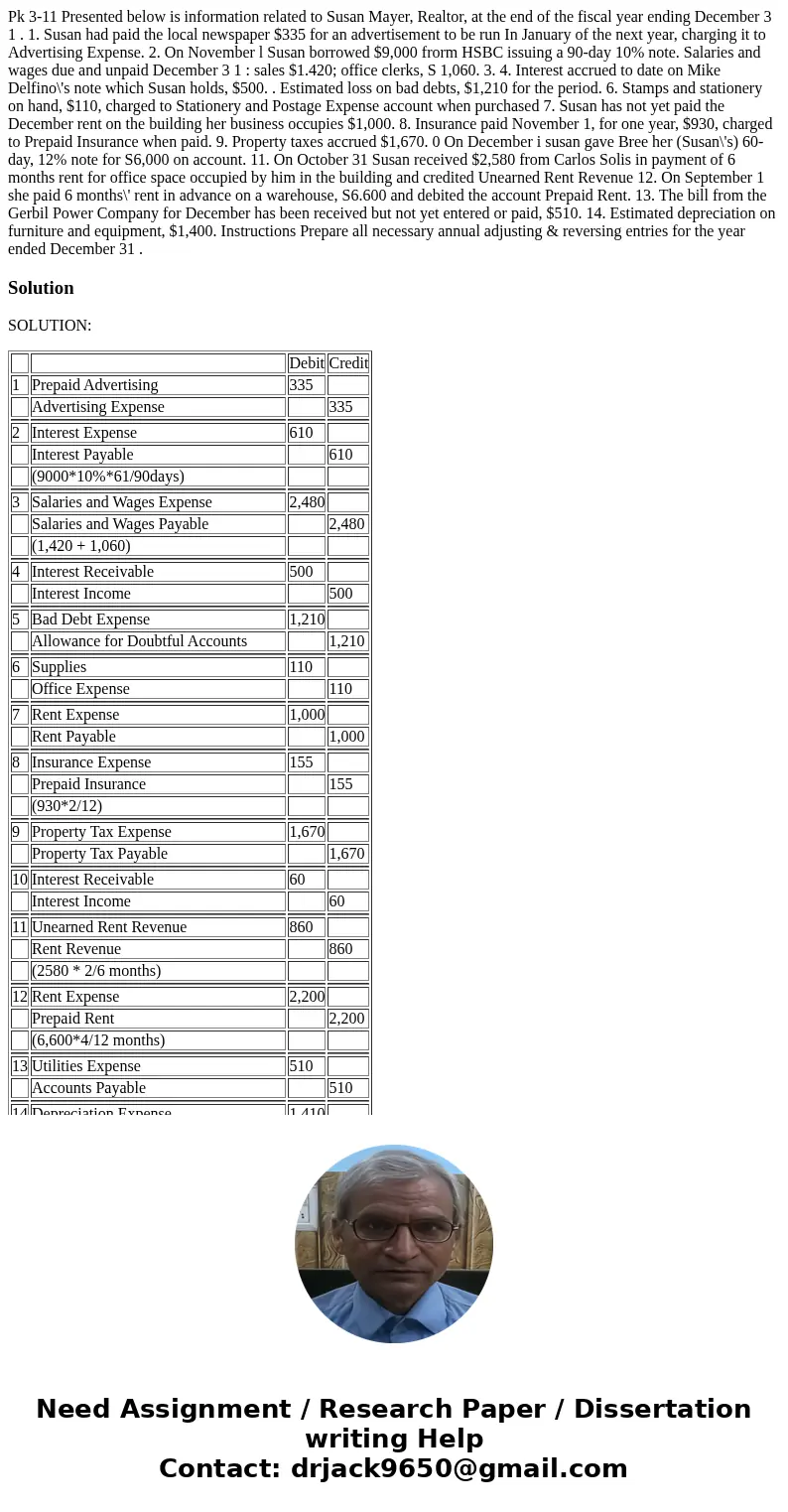

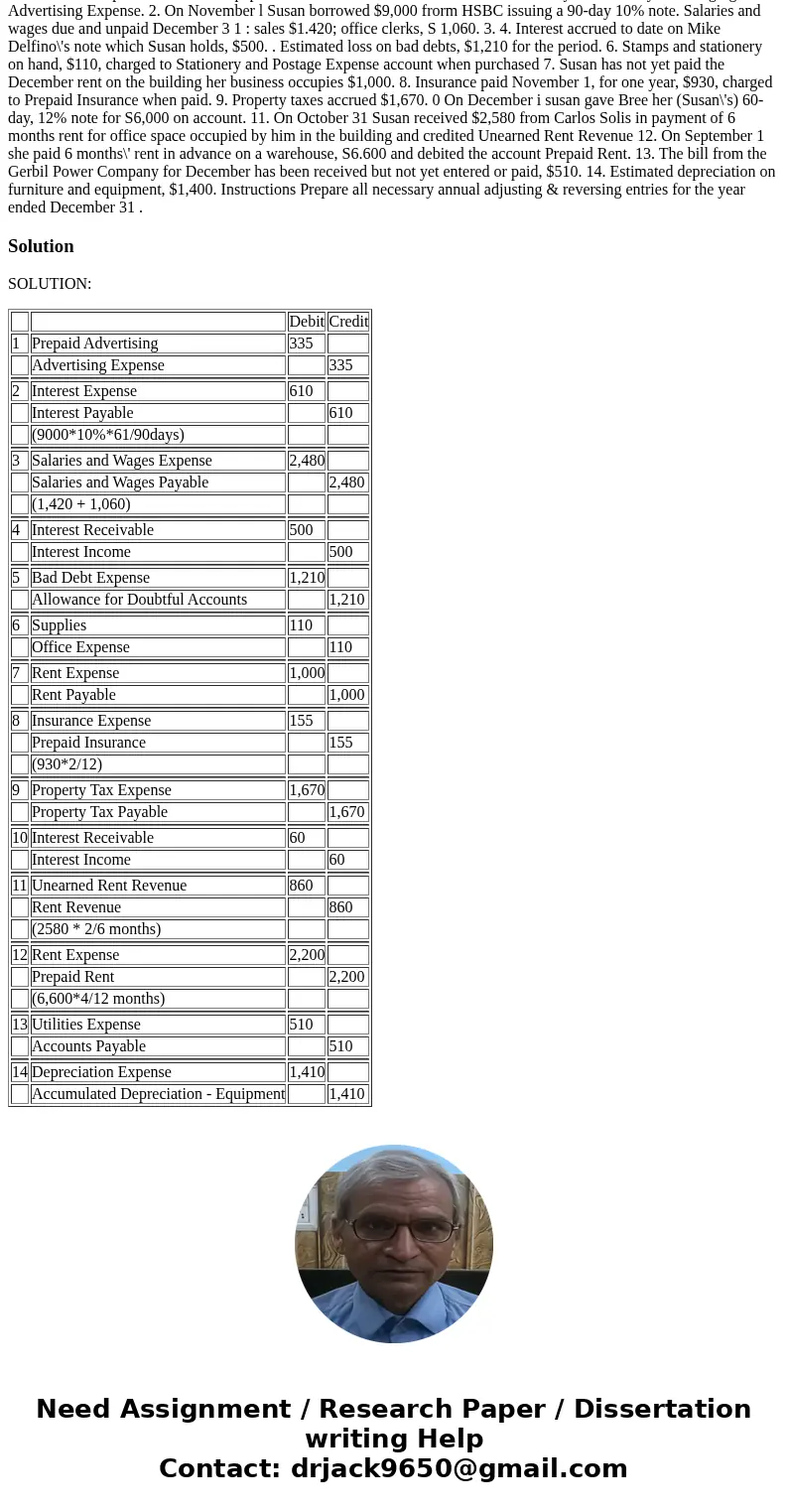

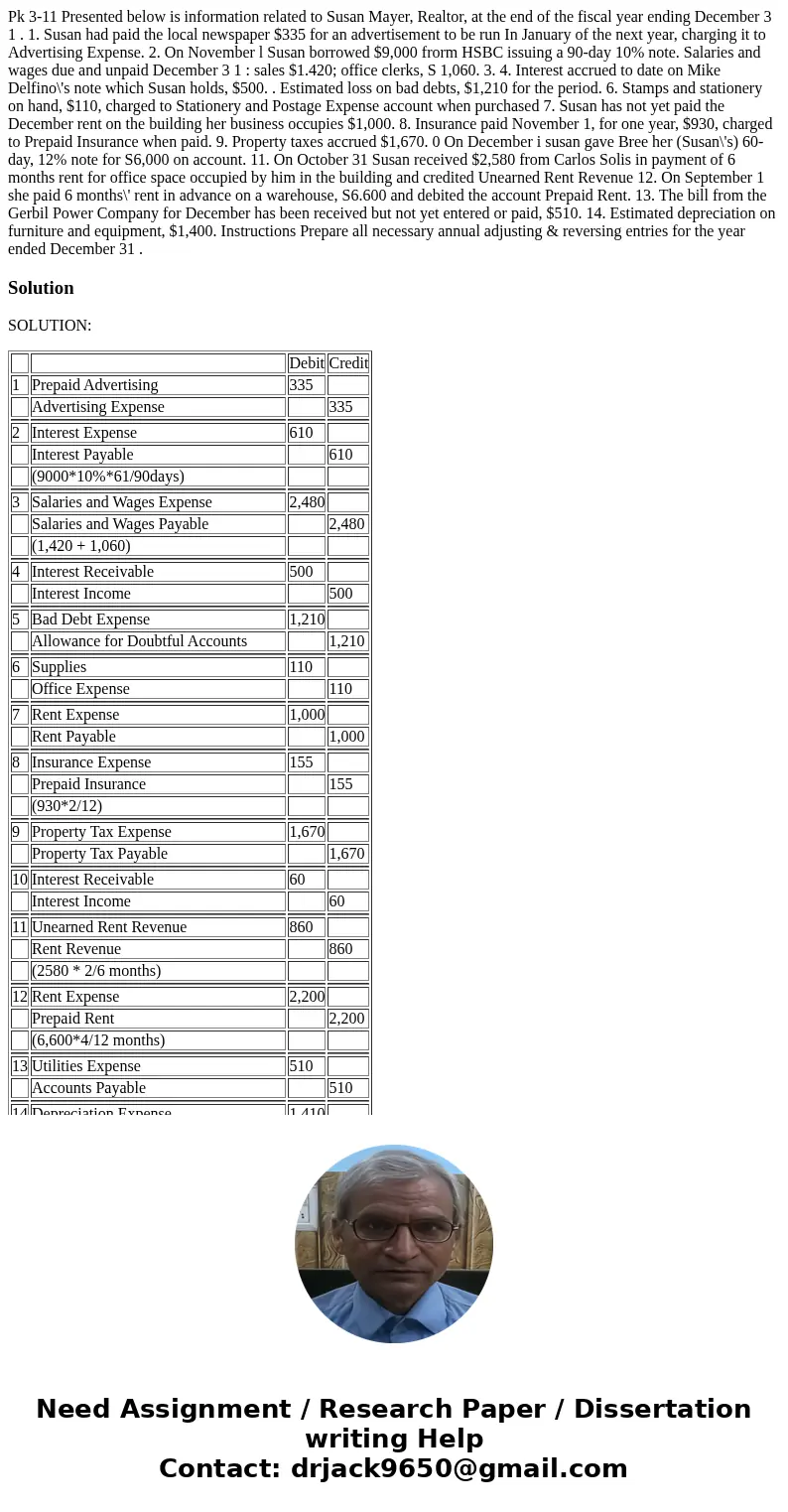

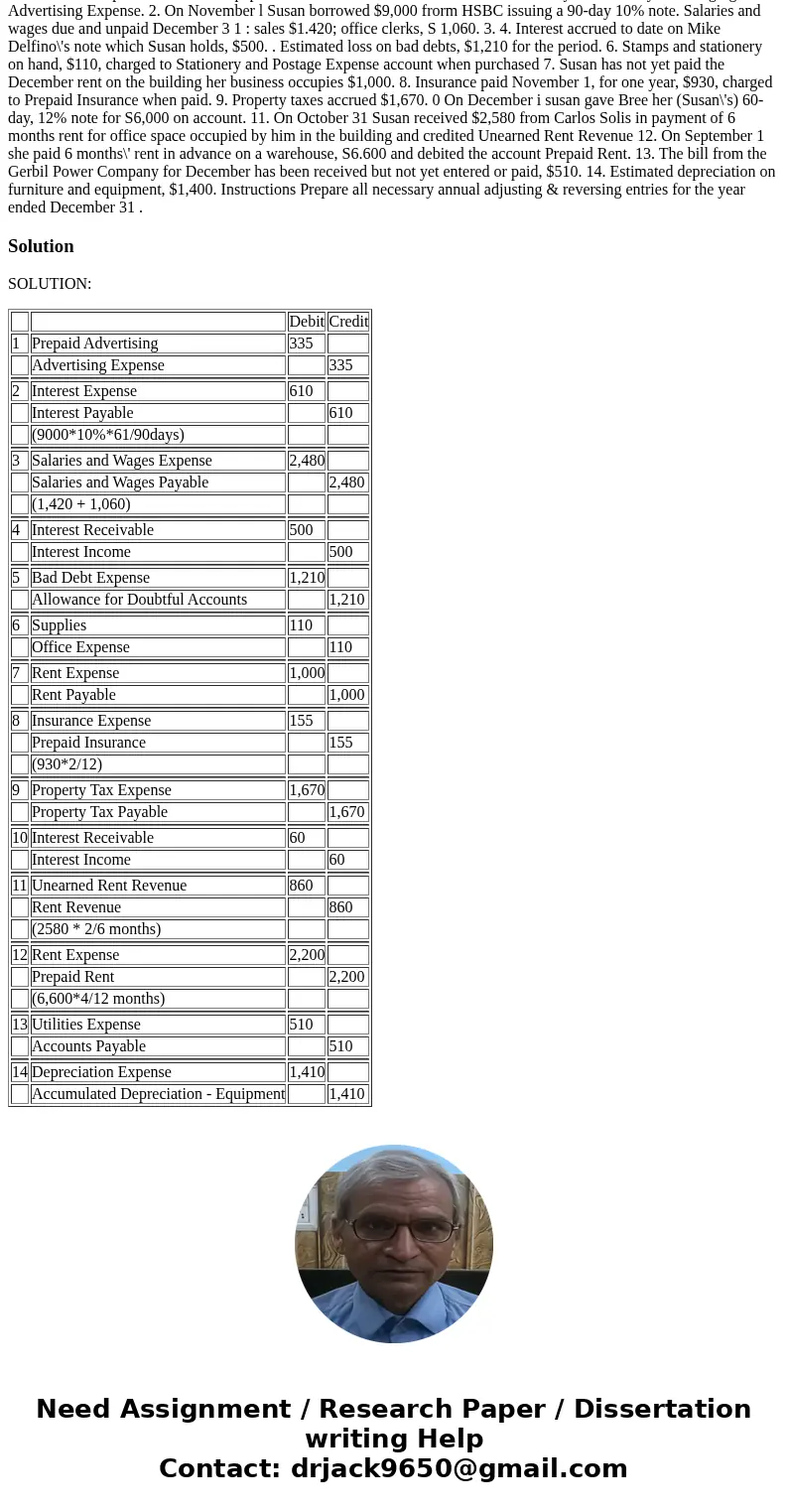

Pk 3-11 Presented below is information related to Susan Mayer, Realtor, at the end of the fiscal year ending December 3 1 . 1. Susan had paid the local newspaper $335 for an advertisement to be run In January of the next year, charging it to Advertising Expense. 2. On November l Susan borrowed $9,000 frorm HSBC issuing a 90-day 10% note. Salaries and wages due and unpaid December 3 1 : sales $1.420; office clerks, S 1,060. 3. 4. Interest accrued to date on Mike Delfino\'s note which Susan holds, $500. . Estimated loss on bad debts, $1,210 for the period. 6. Stamps and stationery on hand, $110, charged to Stationery and Postage Expense account when purchased 7. Susan has not yet paid the December rent on the building her business occupies $1,000. 8. Insurance paid November 1, for one year, $930, charged to Prepaid Insurance when paid. 9. Property taxes accrued $1,670. 0 On December i susan gave Bree her (Susan\'s) 60-day, 12% note for S6,000 on account. 11. On October 31 Susan received $2,580 from Carlos Solis in payment of 6 months rent for office space occupied by him in the building and credited Unearned Rent Revenue 12. On September 1 she paid 6 months\' rent in advance on a warehouse, S6.600 and debited the account Prepaid Rent. 13. The bill from the Gerbil Power Company for December has been received but not yet entered or paid, $510. 14. Estimated depreciation on furniture and equipment, $1,400. Instructions Prepare all necessary annual adjusting & reversing entries for the year ended December 31 .

Solution

SOLUTION:

| Debit | Credit | ||

| 1 | Prepaid Advertising | 335 | |

| Advertising Expense | 335 | ||

| 2 | Interest Expense | 610 | |

| Interest Payable | 610 | ||

| (9000*10%*61/90days) | |||

| 3 | Salaries and Wages Expense | 2,480 | |

| Salaries and Wages Payable | 2,480 | ||

| (1,420 + 1,060) | |||

| 4 | Interest Receivable | 500 | |

| Interest Income | 500 | ||

| 5 | Bad Debt Expense | 1,210 | |

| Allowance for Doubtful Accounts | 1,210 | ||

| 6 | Supplies | 110 | |

| Office Expense | 110 | ||

| 7 | Rent Expense | 1,000 | |

| Rent Payable | 1,000 | ||

| 8 | Insurance Expense | 155 | |

| Prepaid Insurance | 155 | ||

| (930*2/12) | |||

| 9 | Property Tax Expense | 1,670 | |

| Property Tax Payable | 1,670 | ||

| 10 | Interest Receivable | 60 | |

| Interest Income | 60 | ||

| 11 | Unearned Rent Revenue | 860 | |

| Rent Revenue | 860 | ||

| (2580 * 2/6 months) | |||

| 12 | Rent Expense | 2,200 | |

| Prepaid Rent | 2,200 | ||

| (6,600*4/12 months) | |||

| 13 | Utilities Expense | 510 | |

| Accounts Payable | 510 | ||

| 14 | Depreciation Expense | 1,410 | |

| Accumulated Depreciation - Equipment | 1,410 |

Homework Sourse

Homework Sourse