P914 similar to Question Help WACCBook weights and market we

P9-14 (similar to)

Question Help

WACC—Book weights and market weightsWebster Company has compiled the information shown in the following table:

.a.Calculate the weighted average cost of capital using book value weights.

b.Calculate the weighted average cost of capital using market value weights.

c.Compare the answers obtained in parts a and b.

Explain the differences.

| P9-14 (similar to) | Question Help |

Solution

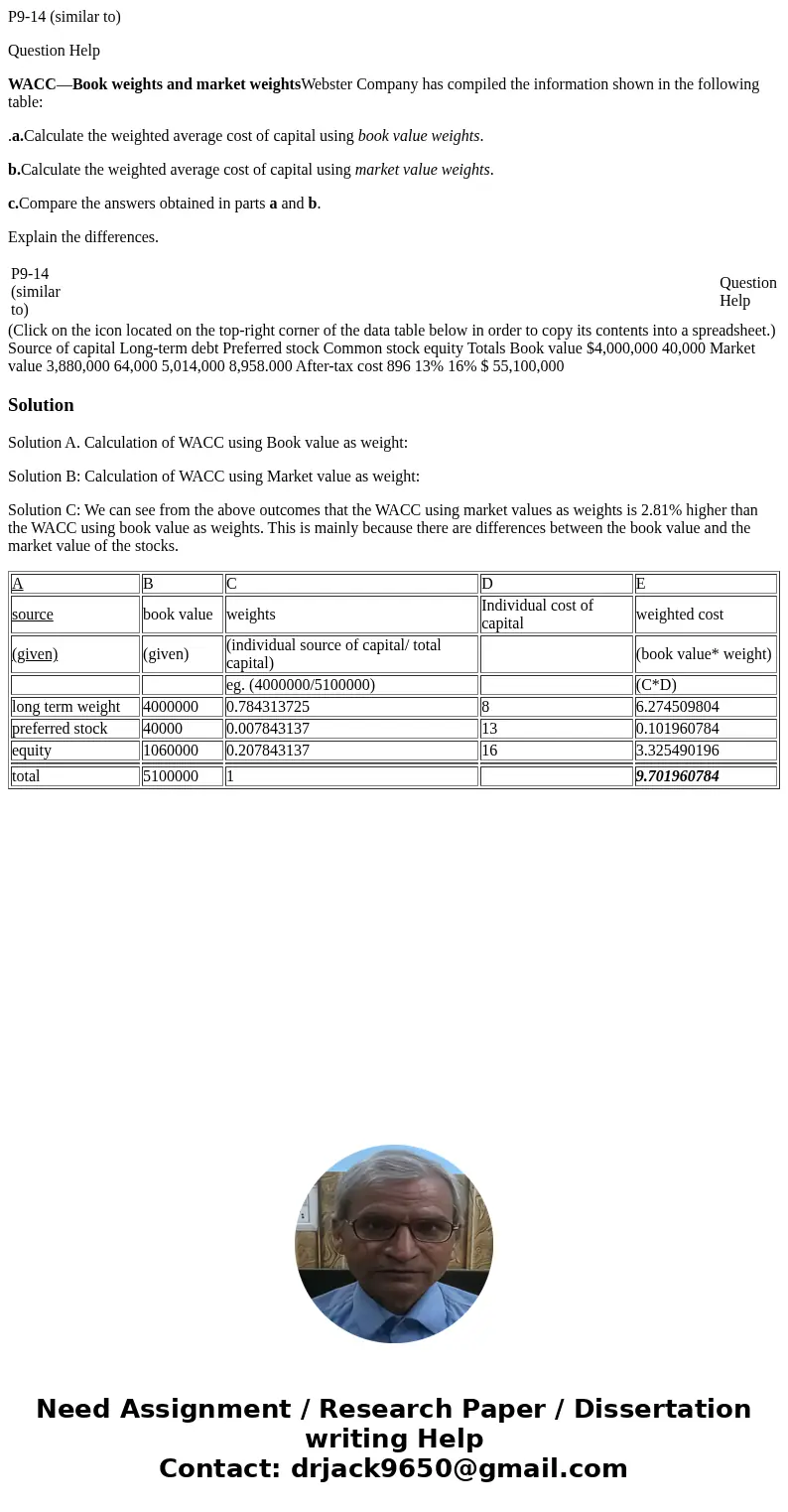

Solution A. Calculation of WACC using Book value as weight:

Solution B: Calculation of WACC using Market value as weight:

Solution C: We can see from the above outcomes that the WACC using market values as weights is 2.81% higher than the WACC using book value as weights. This is mainly because there are differences between the book value and the market value of the stocks.

| A | B | C | D | E |

| source | book value | weights | Individual cost of capital | weighted cost |

| (given) | (given) | (individual source of capital/ total capital) | (book value* weight) | |

| eg. (4000000/5100000) | (C*D) | |||

| long term weight | 4000000 | 0.784313725 | 8 | 6.274509804 |

| preferred stock | 40000 | 0.007843137 | 13 | 0.101960784 |

| equity | 1060000 | 0.207843137 | 16 | 3.325490196 |

| total | 5100000 | 1 | 9.701960784 |

Homework Sourse

Homework Sourse