CALCULATOR MESSAGE MY INSTRUCTOR FULLSCREEN PRINTER VERSI

CALCULATOR MESSAGE MY INSTRUCTOR | | FULLSCREEN | PRINTER VERSION BACK Exercise 2-3 Suppose the following items were taken from the December 31, 2017, assets section of the Vaughn Manufacturing b sheet. (All dollars are in millions.) Inventory Notes receivable-due after December 31, 2018 Notes receivable-due before December 31, 2018 Accumulated depreciation-buildings $16,010 Patents $11,220 20,910 8,300 5,630 1,630 5,020 Buildings 365 Cash 13,340 Accounts receivable Debt investments (short-term) e the assets section of a classified balance sheet. (List the current assets in order uidity.) Vaughn Manufacturing Partial Balance Sheet Assets Current Assets 8.300 Cash 5.630 Accounts Receivable Version 4.24 Sons.Ins All Rights Reserved. A Division of /shared/ t/tes t/aglist.ur nd \"asnmt2 150480 #N 10040 SAMSUNG

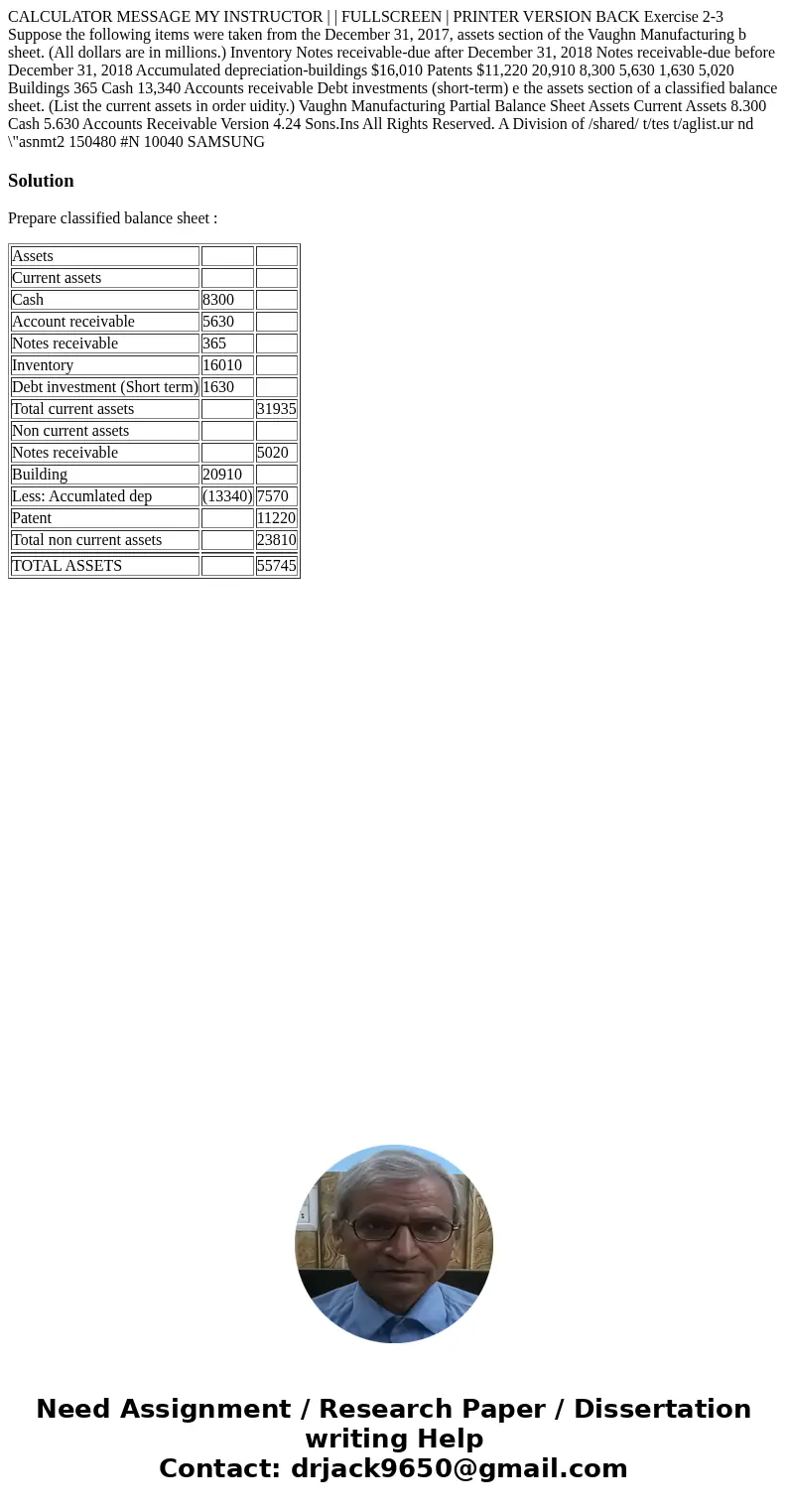

Solution

Prepare classified balance sheet :

| Assets | ||

| Current assets | ||

| Cash | 8300 | |

| Account receivable | 5630 | |

| Notes receivable | 365 | |

| Inventory | 16010 | |

| Debt investment (Short term) | 1630 | |

| Total current assets | 31935 | |

| Non current assets | ||

| Notes receivable | 5020 | |

| Building | 20910 | |

| Less: Accumlated dep | (13340) | 7570 |

| Patent | 11220 | |

| Total non current assets | 23810 | |

| TOTAL ASSETS | 55745 |

Homework Sourse

Homework Sourse